Starknet experienced a mainnet outage lasting 2 hours 44 minutes after its sequencer failed to recognize Cairo0 code, halting block production and requiring a reorg from block 1960612; users must resubmit transactions created between 02:23–04:36 UTC. (Starknet outage)

-

Sequencer failure caused a 2h44m Starknet outage, impacting block production and transaction processing.

-

Starknet has been restored to full operation; a reorg from block 1960612 requires resubmission of affected transactions.

-

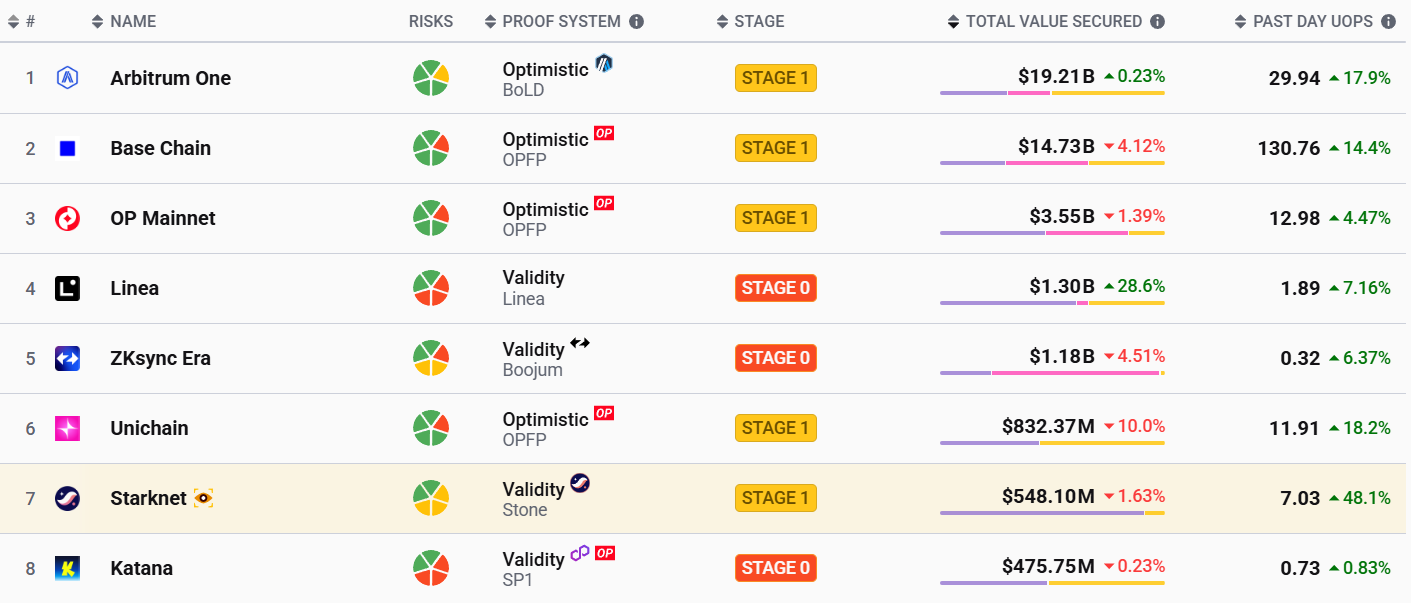

Starknet is the seventh-largest Ethereum L2 with ~$548M TVL (L2beat.com); this is the second major outage in two months.

Starknet outage: mainnet halted for 2h44m after sequencer failed to read Cairo0; resubmit transactions from block 1960612. Read next steps.

Starknet suffered a near three-hour mainnet outage, leading to slow block production due to sequencer issues.

Ethereum scaling solution Starknet suffered another mainnet outage, causing investor concerns over the reliability of the blockchain network.

The Starknet layer-2 (L2) blockchain suffered an outage on Tuesday, affecting the mainnet for two hours and 44 minutes, leading to slow block creation and stagnating transactions on the network.

The outage was caused by the network’s sequencer, which functions as a traffic controller ordering transactions for inclusion in blocks.

During Tuesday’s outage, the Starknet sequencer was unable to recognize the “Cairo0 code,” according to status.starknet.io.

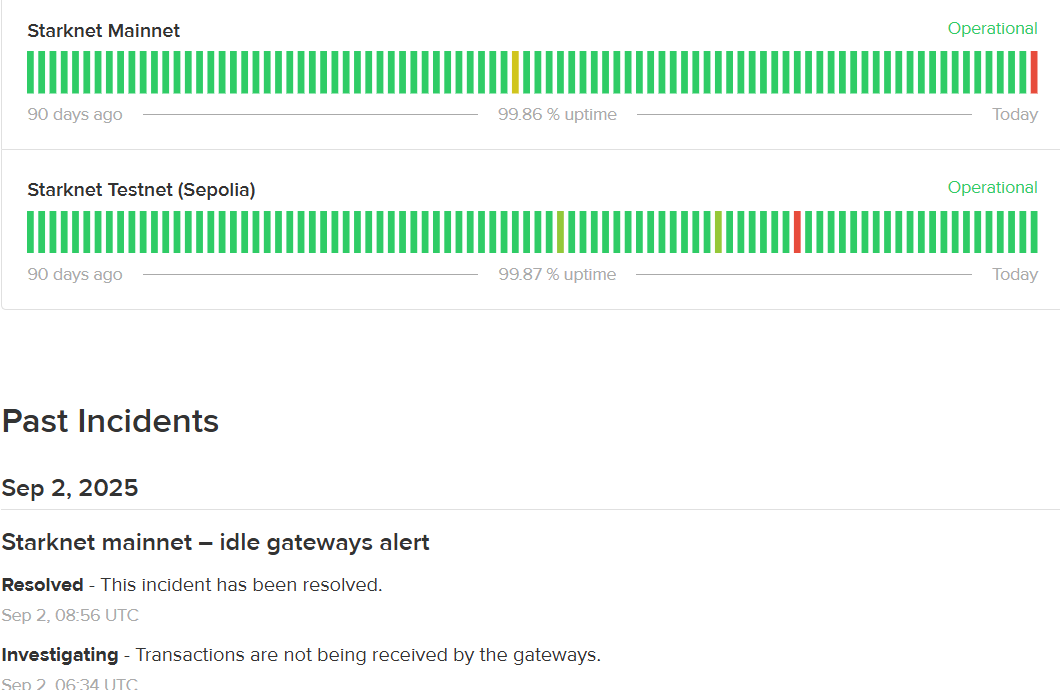

Source: status.starknet.io

This marked the second “major outage” on the mainnet within two months, raising questions about operational resilience for Starknet, Ethereum’s seventh-largest L2 by TVL (~$548 million per L2beat.com).

During the previous outage on July 18, Starknet experienced only 13 minutes of slow block creation and gateway delays.

Top Ethereum L2s by TVL. Source: L2beat.com

L2 networks are secondary blockchains built on top of the Ethereum mainnet to increase throughput by processing transactions offchain.

Starknet employs ZK-rollups using STARK proofs to deliver high-throughput, low-cost transactions to scale Ethereum.

What happened and how long did the Starknet outage last?

Starknet outage lasted 2 hours and 44 minutes after the sequencer could not recognize Cairo0 code. The team reported a committed blockchain reorganization from block 1960612, which removed approximately one hour of confirmed activity; transactions in the affected window must be resubmitted.

How did Starknet restore service and what did the team report?

Starknet was restored to full operation within three hours, according to a community-run X announcement. The post stated: “Block production is back to normal. Most RPC providers are up-and-running, and the remaining ones will upgrade shortly.”

The announcement confirmed that transactions submitted between 02:23 and 04:36 UTC were not processed and that a full timeline, root cause analysis, and mitigation plan will be published by the Starknet team.

Frequently Asked Questions

Which transactions were affected by the Starknet outage?

All transactions submitted between 02:23 and 04:36 UTC were not processed and must be resubmitted after validation by RPC providers. A reorg from block 1960612 removed one hour of activity that included these transactions.

Will this outage affect Starknet’s total value locked (TVL) or long-term adoption?

Short-term TVL (~$548M per L2beat.com) may be unaffected by an operational outage; however, repeated outages can erode trust among users and institutional participants. The team’s public timeline and preventive measures will be key to restoring confidence.

Key Takeaways

- Outage duration: Starknet experienced a 2h44m mainnet outage caused by a sequencer error.

- Action required: Users must resubmit transactions sent between 02:23 and 04:36 UTC due to a reorg from block 1960612.

- Context: This is the second major Starknet outage in two months; the network holds roughly $548M TVL (L2beat.com).

Conclusion

Starknet’s recent outage underscores operational risks for L2 rollups even as they scale Ethereum. The sequencer’s failure to read Cairo0 caused a 2 hour 44 minute disruption and a reorganization from block 1960612; affected transactions must be resubmitted. COINOTAG will monitor the official timeline and mitigation updates published by the Starknet team and report developments.