Michael Saylor's Strategy buys $449M in Bitcoin after dodging an investor lawsuit

Key Takeaways

- Strategy acquired 4,048 Bitcoin, increasing its total holdings to 636,505 BTC.

- The purchase came after Strategy successfully defended against an investor lawsuit regarding accounting disclosures.

Strategy, the world’s top Bitcoin treasury firm, reported Tuesday that it snapped up 4,048 Bitcoin for $449 million between August 26 and September 1, its seventh consecutive week of buying.

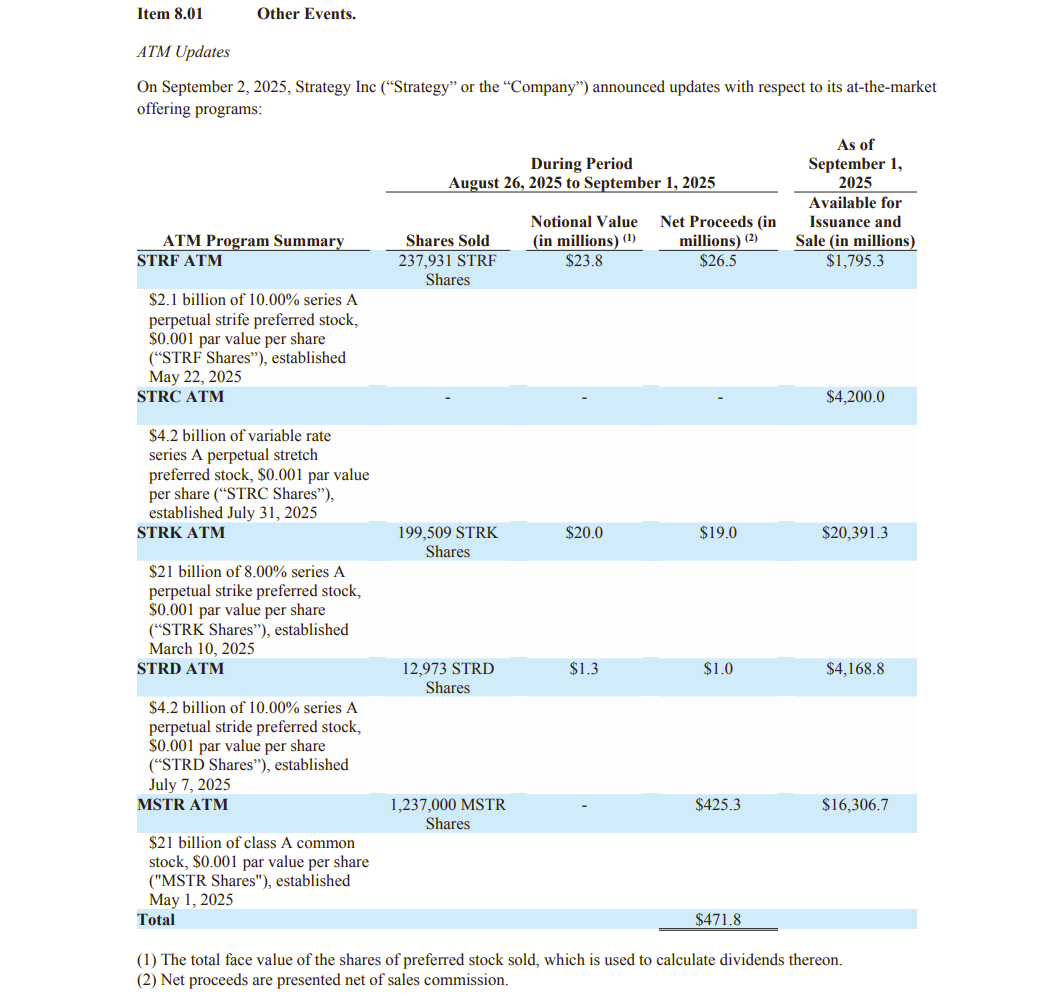

Strategy funded its latest acquisition primarily through proceeds from its at-the-market offerings. Between August 26 and September 1, the company raised a total of $471.8 million, led by sales of its class A common stock (MSTR). Other contributions included sales of STRF shares, STRK shares, and STRD shares.

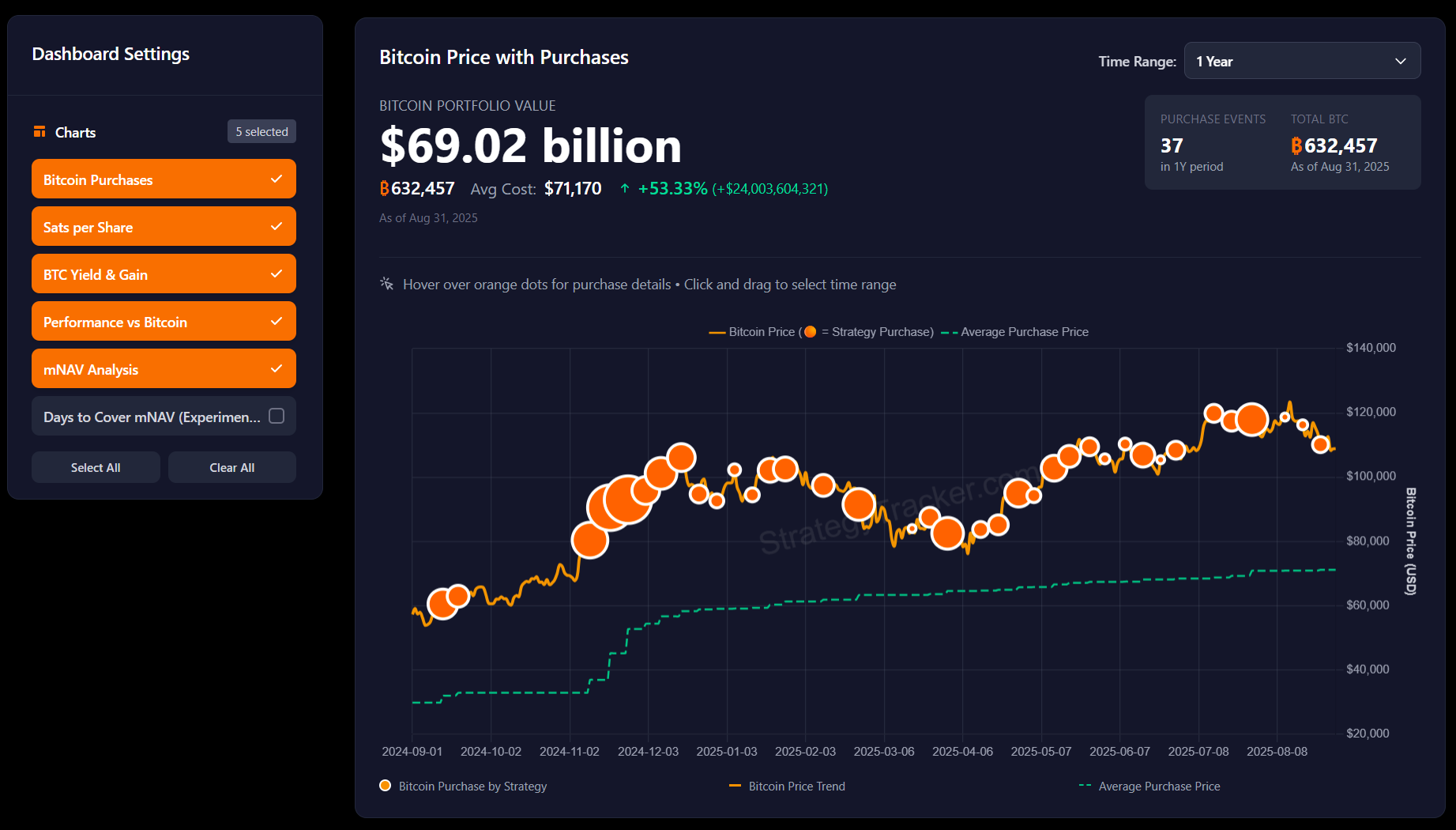

The company has accumulated over 39,000 BTC this quarter, with the largest purchase of over 21,000 BTC completed at the end of July.

The latest acquisition lifts Strategy’s total Bitcoin holdings to 636,505 BTC, valued at nearly $70 billion at current market prices. The stash represents more than 3% of the total Bitcoin supply.

Bitcoin was trading at around $109,800 at press time, according to CoinGecko. The asset dropped as low as $107,295 last week amid market-wide volatility and closed August down approximately 7%.

The dip did little to rattle Strategy. On Sunday, Executive Chairman Michael Saylor hinted at an imminent purchase announcement, posting on X that “Bitcoin is on sale.”

Strategy now sits on more than $23 billion in unrealized gains, according to StrategyTracker.

The Nasdaq-listed firm recently dodged a lawsuit brought by investors over alleged misleading statements related to accounting standards. The plaintiffs argued that Strategy failed to timely disclose potential unrealized losses under the new rules.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: How Europe Wants to Enforce Its Version of the SEC

Stablecoin : Western Union plans to launch anti-inflation "stable cards"

Mars Morning News | SEC Expected to Issue "Innovation Exemptions" for the Crypto Industry in "About a Month"

The SEC is expected to issue an innovation exemption for the crypto industry. The UK "Digital Assets and Other Property Act" has come into effect. BlackRock's CEO revealed that sovereign wealth funds are buying bitcoin. Bank of America recommends clients allocate to crypto assets. Bitcoin selling pressure is nearing its end. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model continues to iterate.

a16z: Inefficient governance and dormant tokens pose a more severe quantum threat to BTC.