Venus Protocol suspends platform after phishing scam drains $27 million, XVS falls 6%

Venus Protocol temporarily suspended its platform on Sept. 2 after a user lost tens of millions of dollars in a targeted phishing incident.

The pause followed reports from blockchain security firm Cyvers, which flagged a suspicious transaction draining nearly $27 million from a single wallet.

According to reports, the stolen assets included $19.8 million in vUSDT, $7.15 million in vUSDC, $146,000 in vXRP, $22,000 in vETH, and 285 BTCB.

Cyvers added:

“The stolen funds are currently held in the attacker’s contract and remain unswapped.”

In its statement, the Venus team confirmed it was investigating the incident and was applying the necessary security protocols to protect its platform.

How the Venus whale was phished

While the scale of the loss initially raised fears of a protocol-level exploit, experts emphasized that Venus itself had not been compromised.

DeFi researcher Ignas, citing responses from ChatGPT, pointed out that the DeFi protocol operated optimally and explained that the attacker had exploited the pre-approved authorizations granted by the compromised wallet.

Meanwhile, SlowMist founder Yu Xian expanded on this, stating that the victim had been tricked into signing a malicious approval transaction. This action granted the attacker unlimited permissions to transfer tokens directly from the wallet.

He added that while the Venus smart contracts remain unaffected, the possibility of a hijacked frontend cannot be dismissed.

Xian also suggested the victim may have been targeted through a poisoning attack designed to compromise their computer.

According to him, the hacker demonstrated planning and sophistication, using complex funding sources, including gas fees routed through Monero exchanges.

He added:

“The large holder and we are coordinating, many details will not be expanded for now, and the actual loss is not accurate either, it may not have exceeded $20 million.”

The post Venus Protocol suspends platform after phishing scam drains $27 million, XVS falls 6% appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ECB Says Digital Euro Is Ready as Decision Shifts to EU Lawmakers

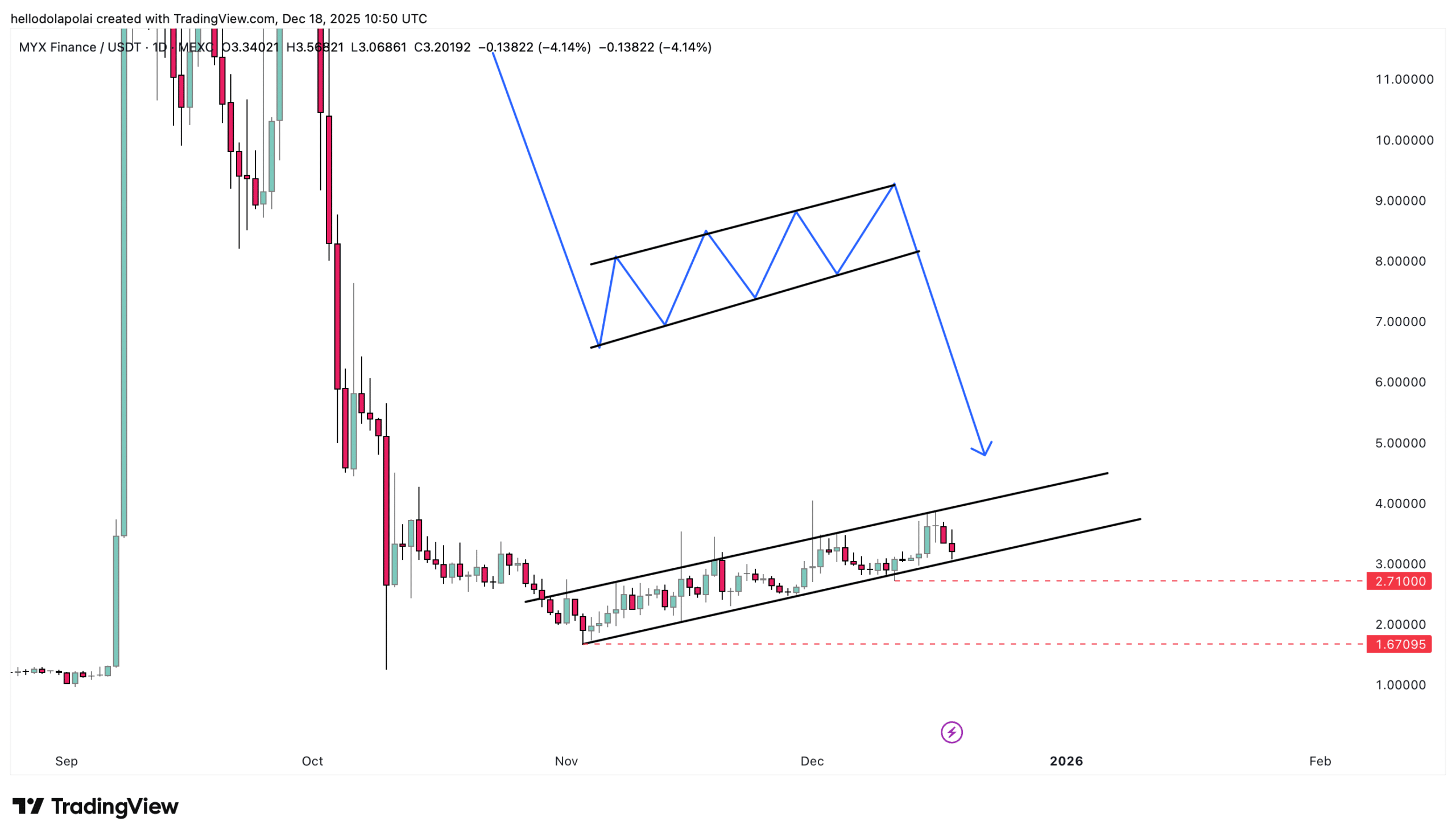

MYX drops 11% as liquidity dries up – Can bulls defend THIS support?

Take Down OpenAI? The Ambition of the Open-Source AI Platform Sentient Goes Beyond That