SignalPlus Macro Analysis Special Edition: Seasonal Caution

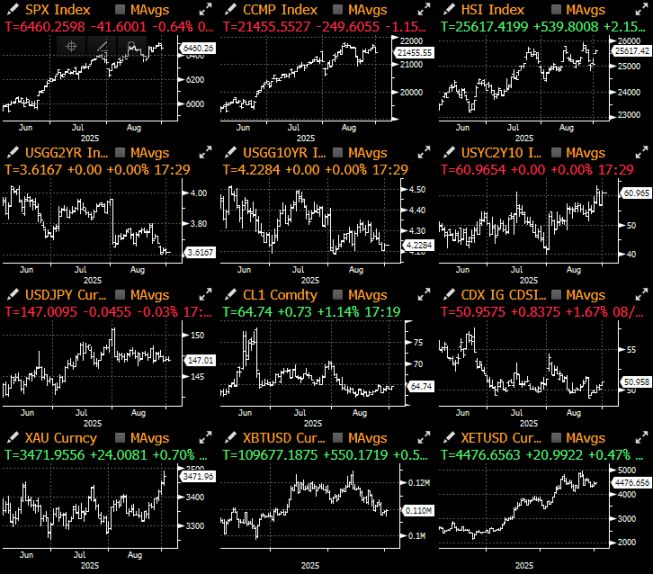

The overall market was flat over the past week, with the US market almost ignoring the two most anticipated events—NVIDIA's earnings report and Friday's PCE data.

The overall market was flat over the past week, with the US market almost ignoring the two most anticipated events—Nvidia's earnings report and Friday's PCE data. Although US stocks edged up slightly in low volatility at the beginning of the week, prices eventually pulled back before the long weekend due to weakness in tech stocks (Nvidia and Dell's earnings missed expectations).

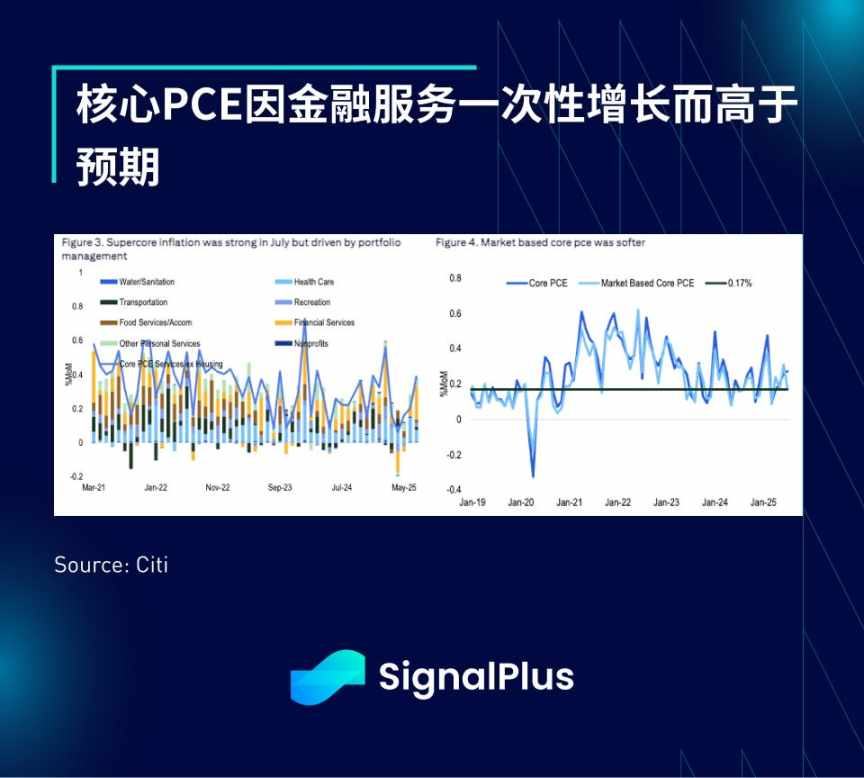

In terms of data, the core PCE inflation for July rose by 0.27% month-on-month and 2.9% year-on-year, in line with expectations. However, the "super core" services inflation was unexpectedly strong, reaching 0.39%. The market was willing to overlook a one-off increase in the financial services sector, keeping Treasury yields near recent lows.

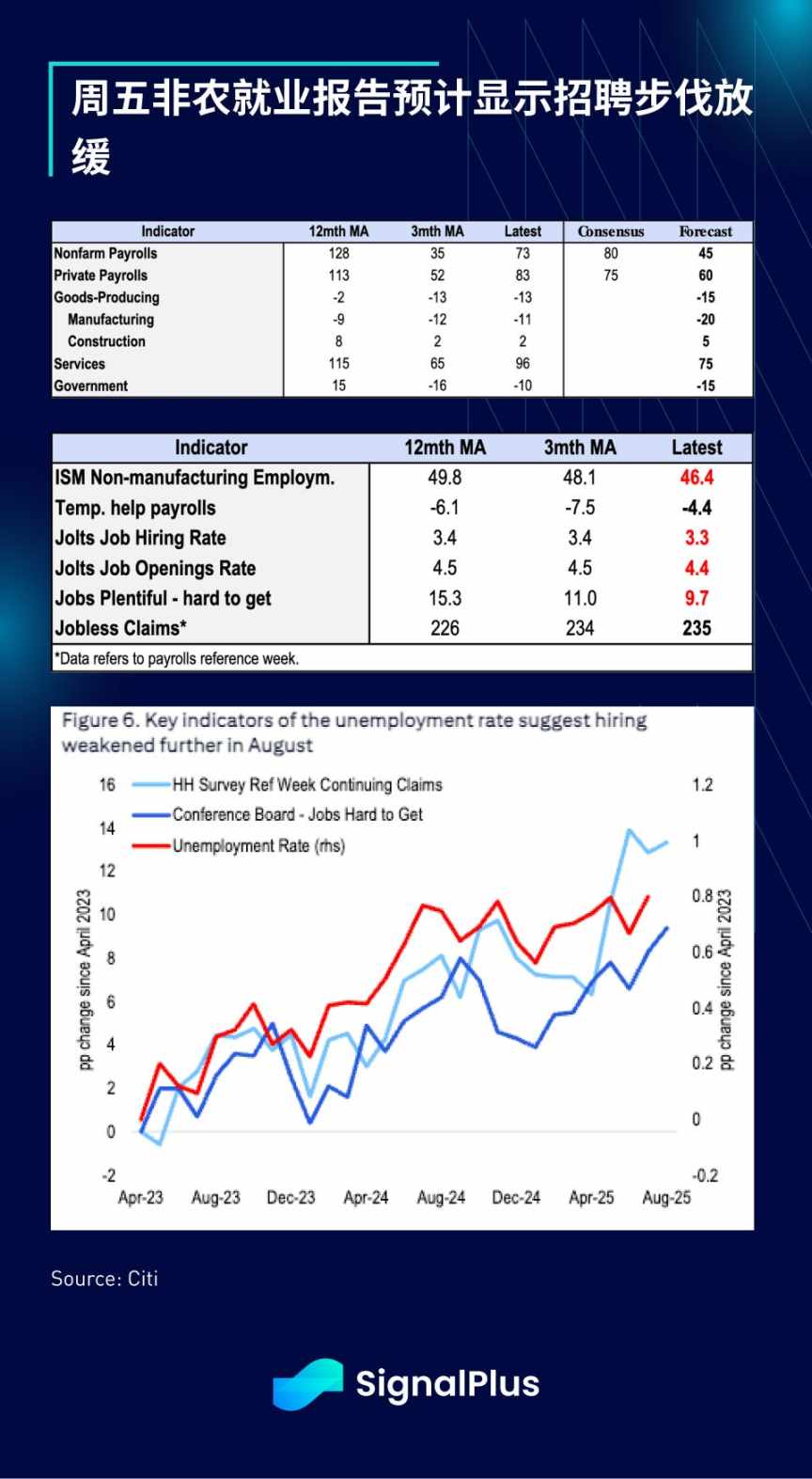

This week's focus will be Friday's Non-Farm Payrolls (NFP) report, with the market expecting total employment to increase by about 45,000 (private sector up by 60,000) and the unemployment rate at 4.3%. Given the weak hiring demand, the trend of slowing job growth is expected to continue, with about 50,000 new jobs added per month reflecting the reality of a slowing economy and reduced immigration.

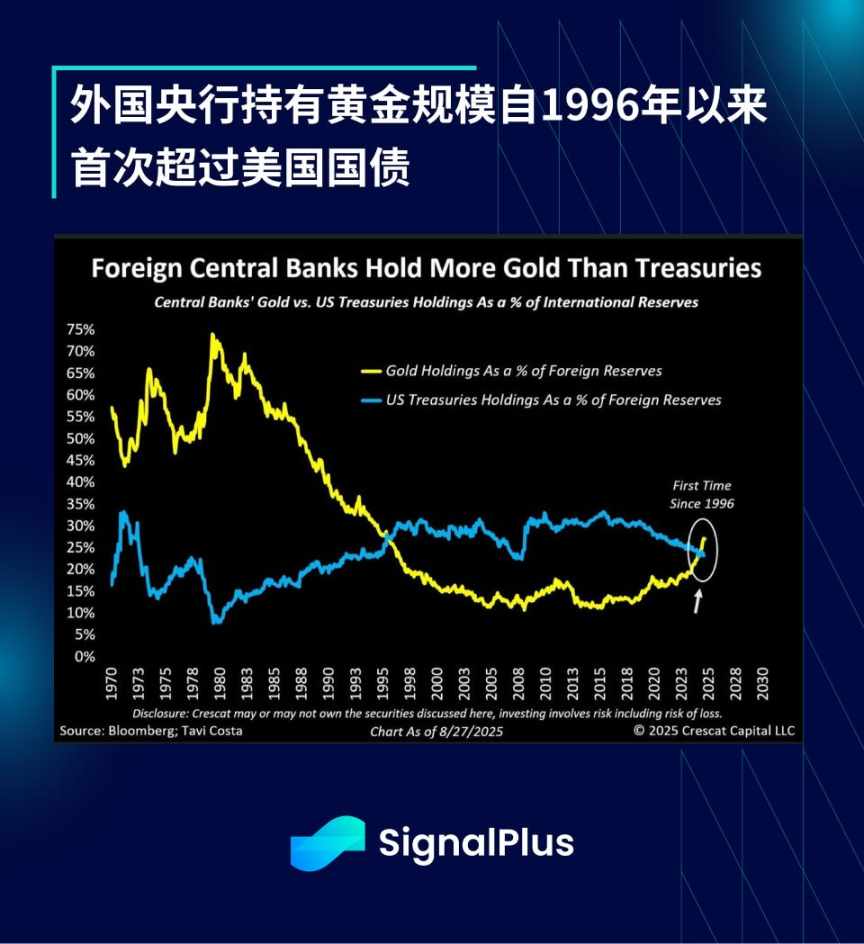

After the Federal Reserve's dovish pivot at the Jackson Hole meeting, precious metals surged, with gold approaching $4,000 and silver breaking above $40/ounce for the first time since 2011. In addition, due to ongoing geopolitical pressures and sticky inflation, the amount of gold held by foreign central banks surpassed US Treasuries for the first time since 1996, and this trend is expected to continue.

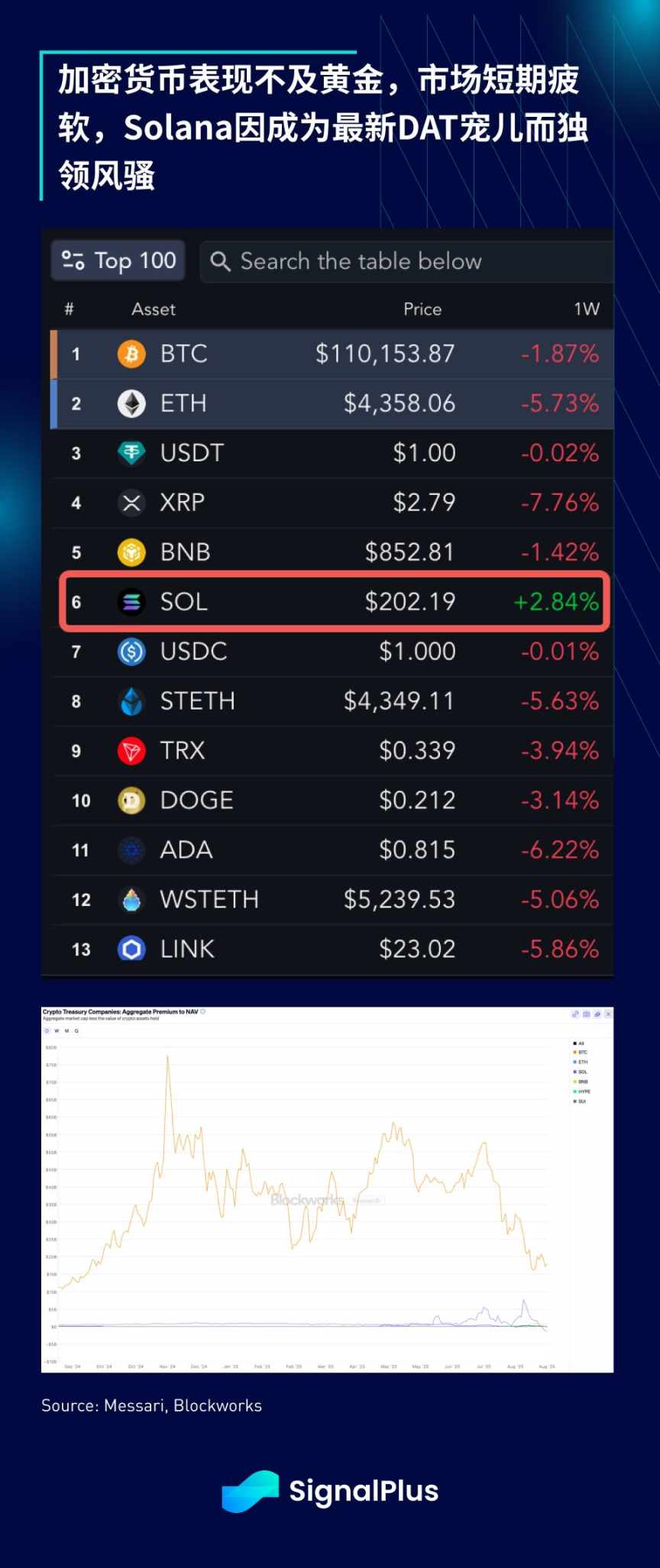

In the cryptocurrency sector, despite gold's strong performance, crypto prices fell last week, with the market bubble seemingly deflating slightly and the DAT premium overall retreating to near long-term lows. New capital inflows appear to have peaked, and a rotation of funds has emerged. Solana was the only cryptocurrency to rise this week, with SOL becoming the latest destination for the DAT frenzy, and the total value locked (TVL) on-chain also rebounded significantly.

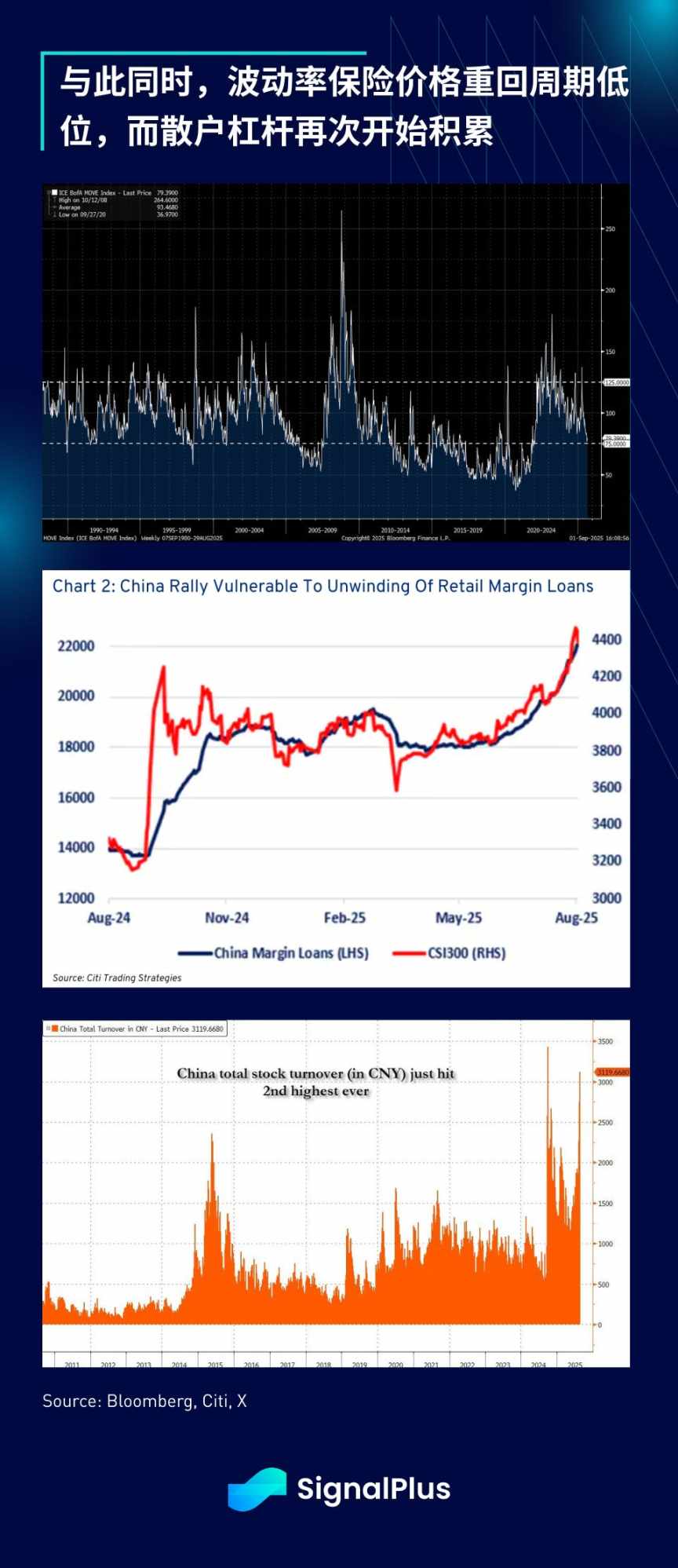

Looking ahead, we expect September to be a month of heightened volatility for risk assets overall. Over the past decade, September's seasonality has been unfriendly to stocks (decline), 10-year Treasury yields (rise), and Bitcoin (decline). Meanwhile, volatility premiums are at cyclical lows, while risk leverage is accumulating. Given that the Federal Reserve has already "front-loaded" its dovish intentions, if risk assets fall in September, what cards are left to play?

It is too early to judge for now, but as the seasonally tricky September–November period approaches, we recommend staying cautious. Wishing all friends smooth trading and good luck!

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dark Defender Highlights Why XRP Will Pump, Sets Price Target

Massive Bitmain ETH Withdrawal: $141.8M Move Sparks Market Speculation

Why might Americans be unable to afford cryptocurrencies by 2026?

Google Gemini Predicts XRP Could Hit $120 if This Happens