Metaplanet's Bitcoin Strategy Faces Setback: Stock Price Plunges 60%, Can Preferred Shares Reverse the Downward Spiral?

Author: Nancy, PANews

Original Title: Is Metaplanet Caught in a "Downward Spiral"? Preferred Shares Step In After Stock Price Plummets 60%

The Bitcoin flywheel of Japan's MicroStrategy, Metaplanet, is slowing down.

At the recently concluded shareholders' meeting in Tokyo, Metaplanet attempted to boost market confidence through a capital increase plan and new financing methods, with Eric Trump, son of Donald Trump, making a personal appearance to show support. Despite the lively atmosphere at the event, this high-profile "vote rally" did not seem to fully convince investors. The company is facing the dual challenges of an internal financing cycle breakdown and shrinking regulatory arbitrage opportunities. Whether the new financing strategy can reshape its growth logic remains to be seen.

Launching Up to $3.8 Billion in Financing, Aiming to Become the Second Largest Bitcoin Treasury Company

On September 1, at a special shareholders' meeting, Metaplanet President Simon Gerovich reviewed the company's transformation from a struggling hotel business to a Bitcoin treasury company, emphasizing the achievements made in its 16 months of operation as a Bitcoin reserve company. He outlined the company's plan to accumulate 210,000 bitcoins by 2027, accounting for 1% of the total supply.

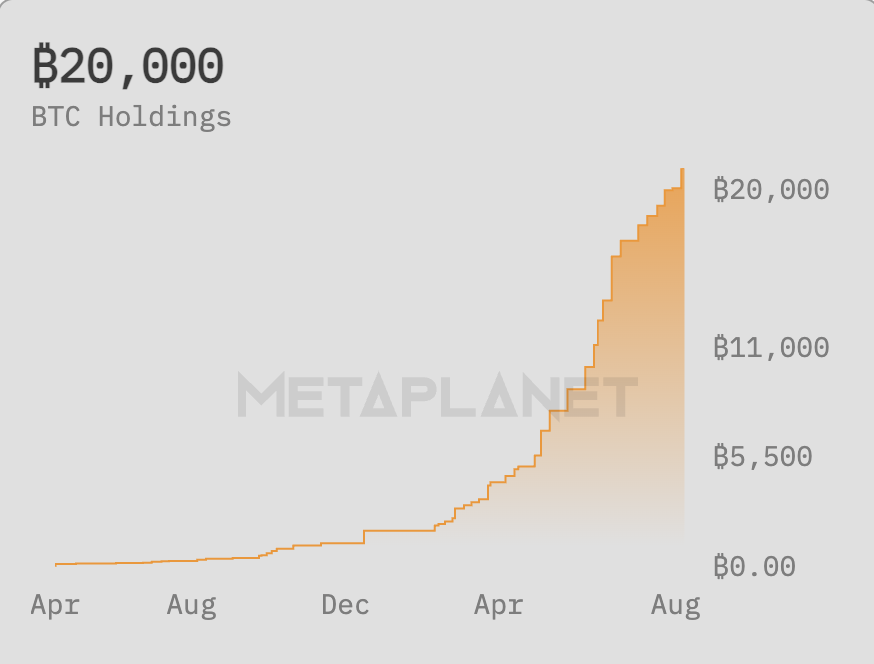

According to the latest data from BitcoinTreasuries.net, Metaplanet currently holds 20,000 bitcoins, with an average holding cost of $102,607, ranking as the sixth largest publicly listed company in terms of bitcoin holdings, just behind Strategy, MARA, XXI, Bitcoin Standard Treasury Company, and Bullish— all US-listed companies— and the only Japanese company in the global Top 10. Based on current prices, Metaplanet's market capitalization has exceeded $2 billion, and as of September 2, its bitcoin yield is nearly 7.5%.

To this end, Metaplanet has been approved to raise up to $3.8 billion to purchase more bitcoin. Over the next two years, the company will use its newly launched perpetual preferred share product (Metaplanet Prefs) to buy 190,000 bitcoins. According to Simon, preferred shares will not only become Metaplanet's core financing tool for acquiring more bitcoin, but also establish a bitcoin-backed yield curve, with potential returns possibly surpassing traditional Japanese fixed-income products. In the context of limited returns in traditional markets, if Metaplanet successfully issues and promotes this innovative product, it is expected to become Asia's largest bitcoin-backed fixed income issuer.

Previously, Strategy had already launched perpetual preferred shares. These stocks typically do not have voting rights, but their dividends are superior to common shares. However, this model is uncommon in Japan, mainly due to the conservative financing structure of Japanese companies, strict legal and regulatory requirements, and investors' preference for fixed income.

It is understood that Metaplanet will issue two types of preferred shares (with a maximum dividend of 6%) for investors with different risk appetites. Class A preferred shares are similar to traditional fixed income, offering a 5% yield; Class B comes with an option to convert to common shares but carries higher risk. Simon pointed out that this product has four major advantages: first, it provides a new financing channel; second, it eliminates the pressure of frequent refinancing; third, its financing cost is lower than most peers (benefiting from Japan's long-term low interest rates); fourth, by capping the issuance of preferred shares at 25% of bitcoin net assets, it establishes a financial risk "safety valve" for the company.

At the meeting, Metaplanet shareholders also passed several resolutions, including increasing the authorized share capital (revised cap to 2,723,000,000 shares), allowing shareholder meetings without a fixed location (enabling online meetings), and establishing authorized share classes. Simon also announced that Metaplanet's goal is to become the world's second largest bitcoin holding company after Strategy, and stated that Metaplanet's per-share bitcoin ratio has increased to 2274% over the past year, far surpassing Strategy's 86%.

It is worth noting that Metaplanet strategic advisor Eric Trump also attended this special shareholders' meeting. He holds 3.3 million shares of Metaplanet, supports Metaplanet's bitcoin strategy, and highly praised, "Simon is one of the most honest people I have ever met in my life. You have an outstanding leader and a great product in bitcoin—this is a winning combination." Additionally, Simon revealed that Fidelity and Charles Schwab are Metaplanet's largest shareholders, holding about 20% of the shares.

Stock Price Plummets 60%, Metaplanet Faces Dual Pressure

Contrary to the bustling scene at the shareholders' meeting, Metaplanet is experiencing the constraints of its flywheel strategy.

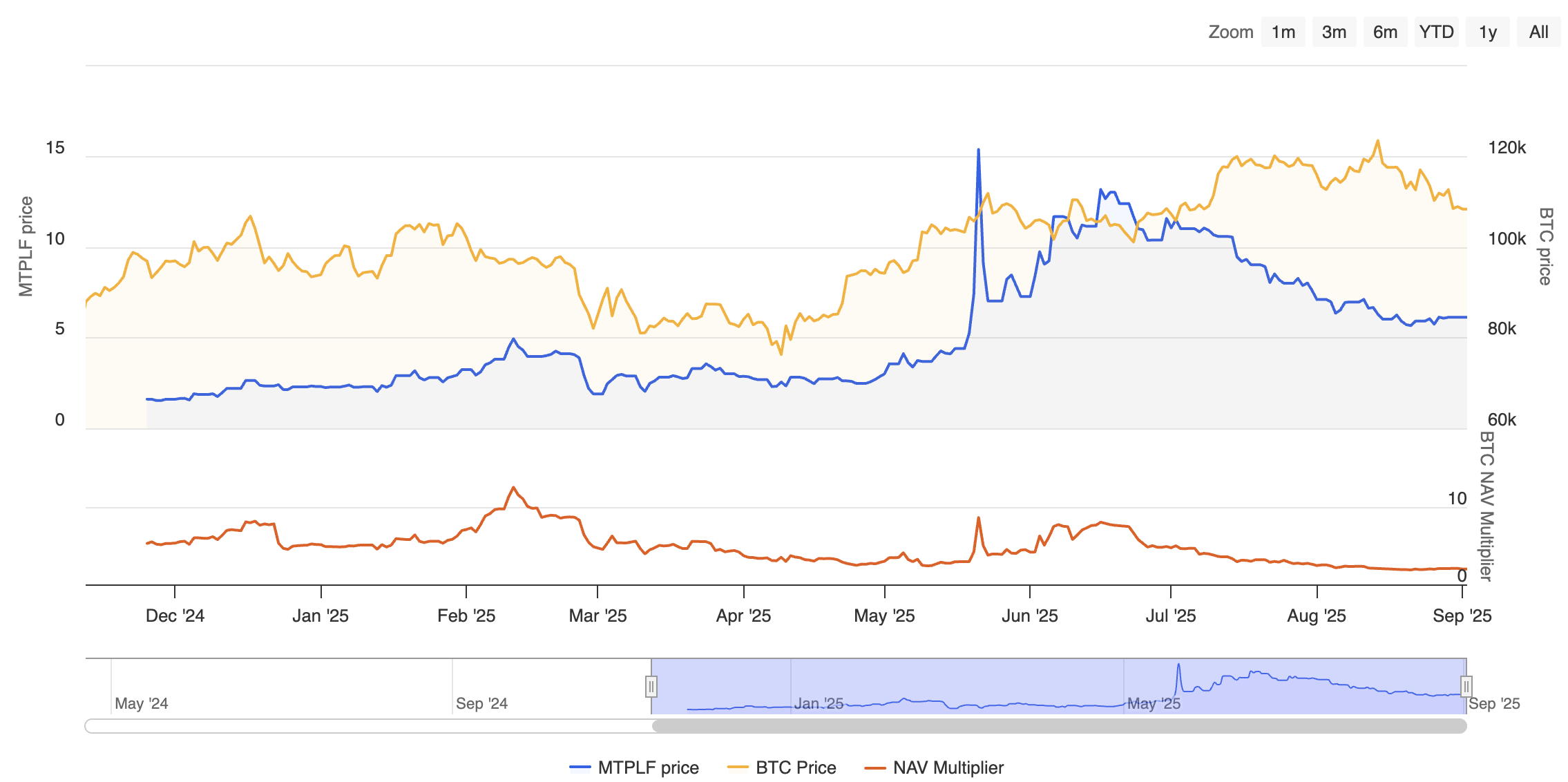

Although Metaplanet has become a leading bitcoin reserve company, its new plan has had limited effect on boosting the stock price, which rose only 0.83% after today's opening, with a rather lukewarm market response. In fact, since its all-time high of $15.35 in mid-May, its stock price has fallen by about 60.2%. At the same time, the growth rate of bitcoin holdings has slowed significantly, increasing by only about 16.7% in the past month, compared to a 92.7% surge in the previous month.

Moreover, Metaplanet's bitcoin premium is narrowing. The so-called premium, that is, the multiple of market capitalization to the company's book value of bitcoin net assets (NAV), is a key indicator of whether the "bitcoin treasury model" is viable. The smaller the premium, the less advantage the company has in issuing shares to finance bitcoin purchases, and the higher the cost of increasing holdings; the larger the premium, the lower the cost of issuing shares to buy bitcoin, and the more effectively the company can expand its bitcoin holdings. Data shows that Metaplanet's NAV Multiplier (market cap to net asset value ratio) was as high as 8.5 times at the end of May, but has now dropped to just 1.9 times. This means that investor confidence in its bitcoin holdings is significantly weakening.

But Metaplanet's challenges are not limited to the company itself; the external environment is also changing.

Previously, one reason Japanese investors preferred to buy crypto concept stocks rather than hold crypto assets directly was regulatory arbitrage in the tax system. PANews previously reported that, due to Japan's heavy tax burden on crypto assets and the more favorable tax regime for stock investments, capital was more inclined to buy crypto concept stocks. However, the latest developments show that the Financial Services Agency (FSA) of Japan plans to revise the tax system in 2026, adjusting the progressive tax rate on crypto assets from a maximum of 55% to a unified 20% rate, consistent with stocks. Once implemented, the tax gap between holding spot crypto and holding related concept stocks will narrow significantly, and the motivation to buy stocks instead of holding coins will also weaken.

It can be said that Metaplanet is facing dual pressure. On the one hand, the internal flywheel is losing momentum: premium is narrowing, stock price is falling, bitcoin holding growth is slowing, and the financing model is constrained. While Metaplanet is hoping to attract overseas funds by issuing preferred shares, whether this can save the day remains to be seen; on the other hand, external arbitrage is disappearing, and tax reform has weakened the institutional appeal of crypto concept stocks, so potential investors may directly turn to spot or ETF.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto, TradFi sentiment improves: Will Bitcoin traders clear shorts above $93K?

Bitcoin catches a bid, but data shows pro traders skeptical of rally above $92K

Trending news

MoreBitget Daily Digest (Dec. 9)|Michael Saylor is promoting a Bitcoin-backed banking system to governments; the CFTC has launched a digital asset pilot program allowing BTC, ETH, and USDC to be used as collateral

[English Thread] Wake-up Call and Review for the Crypto Industry in 2025: Where Is the Direction of the Next Cycle?