US IPO Analysis | ANEW Health (AVG.US): Leading Non-Pharmaceutical Pain Management Company Goes Public in the US, Global Expansion Drives New Growth Engine

With the global upgrade in health consumption and the rapid growth in demand for non-pharmaceutical pain management, local health service providers are also beginning to step onto the stage of the capital market.

Recently, Hong Kong-based pain management and health service provider Anew Health (AVG.US) updated its prospectus, planning to issue 1.8 million ordinary shares at a price of $4 to $6 per share and list on the Nasdaq Capital Market, with expected fundraising between $7.2 million and $10.8 million.

Amid the accelerating iteration of the global health industry, this health service provider, rooted in Hong Kong and expanding globally, is quietly emerging and about to take a key step toward IPO capitalization.

Solid Business Foundation, High-Quality Clients and Healthy Revenue Structure

According to Jinse Finance APP, Anew Health’s business operates under the “Functional Regeneration” brand, providing pain management and health services in Hong Kong. Established in 2007, Functional Regeneration has four service centers in Hong Kong and, through the “ANKH” brand, leverages over 16 years of pain relief and wellness experience, combining advanced Eastern and Western technologies to offer non-surgical, non-invasive, non-pharmaceutical pain management treatments and functional enhancement therapies, as well as related health product services.

According to the prospectus, in fiscal year 2025, Anew Health achieved total revenue of approximately $40.02 million, with its client base steadily expanding. During the fiscal year, the company served 10,039 clients, a 15% increase from 8,692 the previous year; the average annual spending per client also rose from $6,278 to $6,478, a year-on-year increase of 3.2%, reflecting enhanced client loyalty and spending power.

From a business structure perspective, the company’s revenue mainly comes from two segments: pain management and health services (accounting for about 99.9%) and health product sales.

It is worth noting that the company’s core business does not rely on “one-off transactions” but is built on prepaid packages and a membership system, meaning the company has strong cash flow predictability and business stability.

However, the company has faced short-term pressure on the profit side. It is understood that net profit fell from $11.73 million in fiscal year 2024 to $5.54 million in fiscal year 2025, mainly due to one-off expenditures and increased management costs from strategic expansion, including investment in new service centers, staff expansion, and one-time board bonuses, rather than a fundamental deterioration in operating profitability.

Excluding these factors, the company’s core business remains healthy. In other words, the issue does not lie in the business model itself, but in the necessary investments during the expansion phase. As new centers gradually enter a stable operating period, these investments are expected to become drivers of future revenue and profit growth.

Broad Industry Prospects, Clear Strategy Targeting Global Markets

From a development trend perspective, the non-pharmaceutical pain management sector in which Anew Health operates is ushering in a historic development opportunity.

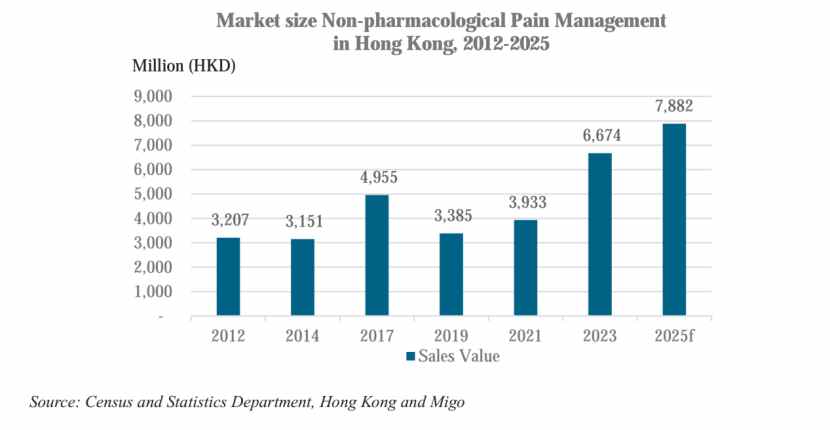

Data shows that from 2012 to 2025, the number of consumers in Hong Kong’s non-pharmaceutical pain management market grew from about 206,600 to an estimated 281,400, with a compound annual growth rate of 2.4%. During the same period, the market service value rose from HK$3.207 billion to an estimated HK$7.882 billion, with a compound annual growth rate as high as 7.2%.

The growth in market size is partly driven by the aging population trend in Hong Kong and globally, which has increased the prevalence of pain and musculoskeletal diseases. On the other hand, increased awareness of the risks of opioid dependence and the side effects of invasive surgery has also driven rapid growth in demand for non-pharmaceutical, non-invasive treatments.

Among them, Anew Health is a direct beneficiary of this trend. With 16 years of accumulation since its founding in 2007, the company has established a solid brand awareness in Hong Kong.

According to Jinse Finance APP, the “ANKH” brand emphasizes a “non-pharmaceutical, non-surgical” treatment philosophy, combined with its self-developed “RDS+” therapy, which integrates traditional Chinese meridian theory with modern energy treatment technologies such as laser, electric current, radio frequency, and ultrasound, helping clients achieve overall health improvement through “recovery, detoxification, and strengthening.”

This differentiated solution, which combines tradition and modernity, not only aligns with the cultural identity of Eastern consumers but also meets the global preference for scientific and non-invasive treatments, becoming the company’s core competitiveness.

From client feedback, the company’s service quality has been highly recognized. According to the company’s internal client survey for 2023 to 2024, over 87% of clients were satisfied with the therapists’ services, and nearly 70% clearly felt pain relief. High client satisfaction not only supports the company’s stable repurchase rate but also lays the foundation for enhancing brand value through word-of-mouth.

This listing in the United States is not only a key step for the company’s financing and expansion but also an important opportunity for its brand internationalization and service standardization. Looking ahead, Anew Health’s strategic focus is clear:

On one hand, the company will continue to deepen its presence in the Hong Kong market, further covering target groups through the establishment of new centers and strengthening its local market share; on the other hand, international expansion will also accelerate. The company plans to set up new service centers overseas, and with the capital power released by the IPO, it is expected to quickly replicate Hong Kong’s successful experience in other high-growth overseas markets.

Currently, Anew Health is at a critical stage of expansion and transformation. In the non-pharmaceutical pain management sector, its unique brand, therapies, and strategic layout are expected to make it the most representative listed platform in the industry. With the implementation of IPO financing, the company is expected to accelerate its expansion in Hong Kong and overseas markets, further consolidate its industry-leading position, and bring long-term growth returns to investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After a five-year exploration and a $1 billion valuation, why did it finally "give up"?

Bitwise CIO: How to Invest in the Crypto Industry

Trending news

MoreAfter a five-year exploration and a $1 billion valuation, why did it finally "give up"?

[Bitpush Daily News Highlights] Strategy increases holdings by another 10,624 bitcoin, bringing total holdings to 660,624; BitMine added 138,452 ETH last week, Tom Lee is optimistic about Ethereum strengthening in the coming months; US CFTC approves Ethereum, Bitcoin, and USDC as collateral for derivatives markets.

![[Bitpush Daily News Highlights] Strategy increases holdings by another 10,624 bitcoin, bringing total holdings to 660,624; BitMine added 138,452 ETH last week, Tom Lee is optimistic about Ethereum strengthening in the coming months; US CFTC approves Ethereum, Bitcoin, and USDC as collateral for derivatives markets.](https://img.bgstatic.com/multiLang/image/social/7e5c26545777dcf500ecdd4ceb4b3f701765168389911.png)