Crypto KOL's Personal Account: Our Era Has Ended

In the next cycle, just talking is not enough; KOLs must actually take action.

In the next cycle, mere talk won't be enough—KOLs must actually get things done.

Written by: TM

Translated by: Luffy, Foresight News

I have no personal grudges against the people I'm about to mention, even though most of them dislike me for daring to speak the truth. That's fine—this isn't about personal grievances, it's about the truth.

Before "criticizing" others, let me first talk about how I became a KOL.

How I Became a KOL

I started trading cryptocurrencies in 2017 and have been active in the crypto Twitter community since 2020.

During the last bull market, things were still simple: on one side were voices with real insight, and on the other were "traffic players" who just chased engagement. But back then, no one cared much about this, because the mainstream play was hyping altcoins. Influential people couldn't pump a coin by themselves—the truly important thing was sharing investment logic and core viewpoints.

For me, becoming a KOL was once a dream job—making money by talking about the technology I love.

But after the bear market devoured most of my net worth, I started wanting to actively make money, instead of just holding a bunch of "positions" and hoping for a stroke of luck.

It was from that point on that everything changed.

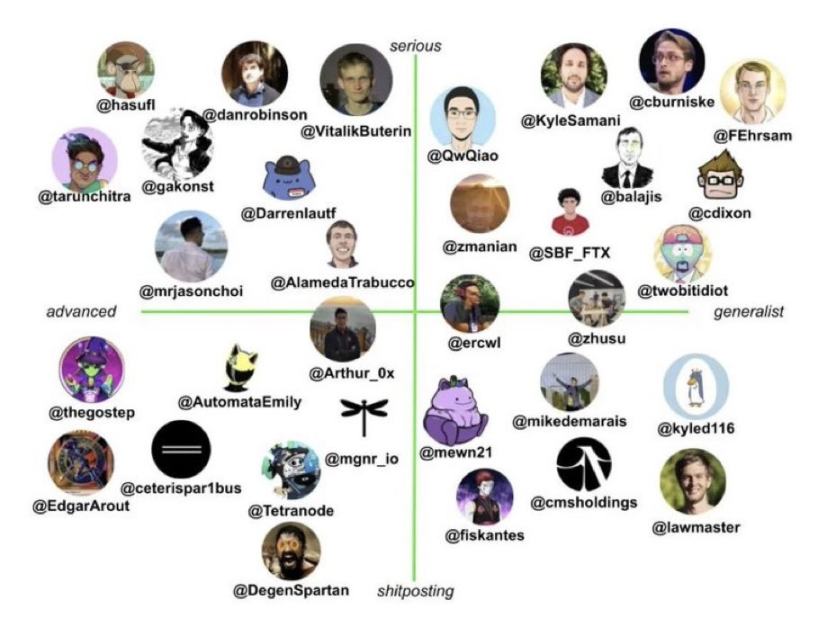

KOLs during the 2021 bull market

The Rise of Meme Coin KOLs

In the winter of 2023, the first influential Solana ecosystem meme coin, WIF, quickly went viral, with its market cap once soaring to several billions of dollars. They once promised a big marketing event: projecting the WIF logo onto the Las Vegas Sphere, but in the end, nothing came of it. The $3 million raised from the community is still frozen to this day.

Even so, launching a meme coin was not easy at that time. This changed in the summer of 2024 with the emergence of Pump.fun (a meme coin launch platform), where Mitch became the first to issue the token Xiwifhat on the platform.

There’s a pattern here: KOLs always manage to catch trends early and become the center of attention. But ask yourself: do they get ahead because they truly have unique insight, or because they have direct connections with platforms and funds?

Take Mitch for example—he uses his public wallet to "harvest" followers, because people really do copy-trade his positions. He carefully selects coins, builds a position first, and after his followers buy in and push up the price, he sells half when it doubles. For him, this is a zero-risk operation.

He’s not the only one—he just does it on a larger scale.

Previously, promoting meme coins would have been seen as outright scamming. But overnight, these "scammers" became popular instead.

Next came Murad. He used to work in banking and knows how to package himself: making slides, presenting seemingly credible investment logic, dissecting "fan psychology"—all wrapped in a veneer of professionalism.

He also built his own copy-trading platform, released "curated coin lists," and manipulated token supply behind the scenes. Coincidentally, one of the coins he "recommended," SPX, was listed on a centralized exchange a week later. Was this really just a coincidence?

That was when I realized: in this cycle, the only way to make money is to be a meme coin KOL. I sold out my principles and paid the price for it.

Why do I only talk about meme coin KOLs? Because in the past two years, KOLs in other fields have basically become irrelevant. If you missed an entire cycle, your opinions no longer carry weight.

The Rise of New Faces

By October 2024, I suddenly encountered some new faces: Orangie, Rasmr, Mika. Their follower counts skyrocketed at an astonishing rate, seemingly out of nowhere, and in perfect sync—a classic case of "industry pushers."

But to be fair, Threadguy doesn’t belong to this group. He built up his influence step by step by posting long-form threads and speaking freely in X Spaces.

Faze Banks re-entered the scene, bringing with him the "Los Angeles Vape Clique"—a group of scammers banding together with the sole purpose of "harvesting." What happened next needs no further explanation.

After that, Orangie went viral across the internet, attracting a large group of young fans who loved Fortnite and Friday Night Funkin’, who easily identified with him.

The moment before Adin Ross realized he was being scammed

The No Man’s Land of KOLs

In today’s crypto space, there are no real "central figures" anymore. People no longer listen to KOLs, and even resent them.

I’ve asked several communities, "Who’s your favorite KOL?" The answer is always: "None. They all deserve to die."

Now there isn’t even a clear "mainstream play"—it’s more like the "endgame" of meme coins: no real utility, just the act of issuing tokens. Every project is fighting for attention from the same small group of well-funded traders.

The "harvesting nature" of this market has reached its peak, with most traders losing badly. The "no crying in the casino" mentality forces people to throw their last bit of money into coins with a one-in-a-thousand chance of skyrocketing and a 999-in-a-thousand chance of rugging.

This is a sad market. KOLs survive in this environment and make things worse, but we can’t blame them entirely. We’re the ones who put them on this pedestal—or rather, we enabled their rise.

They’re "Playing Chess" While We Watch the Show

When 99% of people in this field don’t even have their own opinions, the word "KOL" itself is a joke. They’re like feathers in the wind, pushed around by wave after wave of traffic, with no independent thought.

When was the last time you saw a sincere recommendation with "no hidden interests, no engagement farming"?

Every KOL mentioned in this article has blocked me.

Why? Because I think independently and dare to speak the truth, which threatens their "game."

In my experience, people would rather block you than face the truth. Not seeing the harm they cause makes it easier for them to keep scamming with a clear conscience.

But karma is real, and "on-chain spirituality" (meaning on-chain actions always leave traces, and good or evil will be repaid) is not just empty talk. You reap what you sow.

At this point, there’s nothing more to say.

The Future of KOLs

Nothing in crypto ever repeats itself—whether it’s narratives, scams, or absurd farces. Sometimes history rhymes, but it never repeats exactly.

What will the future look like? I think the market will shift toward "utility." In the next cycle, mere talk won’t be enough—KOLs must actually get things done, at least put real money on the line. Only then will power return to the real builders, not those who are just "putting on a show."

I’ve already noticed that paid community income is declining. People are waking up and don’t want to be harvested anymore. In the future, there will be even more resistance to KOLs.

In the past, developers who rugged would receive death threats. I’m not saying this extreme approach is good, but it did make developers think twice. We may never return to that extreme, but the market will definitely move toward a "reputation-based system." And that will change everything.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

House of DOGE Issues 2025 Shareholder Letter: 730M Treasury, NASDAQ Listing, Payments Launch

How to Buy DeepSnitch AI Before It Launches?

Critical Bitcoin 2026 Forecast: Fidelity Executive Predicts Market Struggles

Revolutionary Move: Forward Industries to Tokenize Its Shares, Unlocking 6.8M SOL Treasury