Goldman Sachs adds Walmart and Valero Energy to its September "Conviction List," along with these other companies

Goldman Sachs has added four new stocks to its Conviction List in September, including some of the most well-known American brands as well as several energy stocks.

These stocks have been included in the investment bank’s “Conviction List - Directors’ Cut,” a list that brings together companies rated as “Buy” by Goldman Sachs. As part of its routine monthly adjustment, Goldman Sachs’ top stock picks for September include: McDonald’s, Walmart, Cadence Design Systems, and Valero Energy.

Meanwhile, two stocks have been removed from the list: Viper Energy Partners LP and Insmed. However, Goldman Sachs pointed out that removal from the list does not necessarily mean a change in its fundamental investment rating for those stocks.

Currently, Goldman Sachs’ Conviction List contains a total of 22 stocks, covering sectors such as healthcare, finance, natural resources, industrials, consumer, and telecommunications. Goldman Sachs considers these companies attractive investments based on multiple indicators, including revenue growth and current dividend yield.

Companies on the list include Johnson & Johnson, Bank of America, and AT&T. Some companies have performed exceptionally well, such as Alnylam Pharmaceuticals, whose stock price has nearly doubled this year (up 92%); GE Vernova Inc. has also risen by about 75%.

This updated list comes as Goldman Sachs closely monitors the health of the U.S. labor market, the progress of inflation, and the commercialization of artificial intelligence—all factors that could threaten the rally in U.S. stocks since the April lows. In a client report on Tuesday, the team led by Goldman Sachs analyst Steven Kron wrote that multiple headwinds “continue to weigh on market sentiment—but these may instead form a ‘wall of worry’ that provides a foundation for further stock market gains.”

Newly Added Stocks

Walmart

Goldman Sachs has set a price target of $114 for Walmart, implying an 18% upside for the largest retailer in the U.S. So far this year, the stock has risen 8%.

Analyst Kate McShane wrote: “Walmart, with its ‘Everyday Low Price’ strategy, is expected to continue gaining market share even as the retail environment faces rising product costs due to new tariffs.” She added that Walmart’s strong presence in food and low-priced apparel makes it “one of the most advantaged retailers,” as both categories tend to be relatively resilient in recessionary scenarios.

Goldman Sachs’ “Buy” rating on Walmart is in line with the overall Wall Street view. According to LSEG data, out of 44 analysts, 14 have given a “Strong Buy” rating and 29 have rated it as a “Buy.”

Valero Energy

As a refining company, Valero’s stock price has risen about 25% this year and offers a dividend yield of around 3%. Goldman Sachs believes there is still 7% upside potential for its stock price.

Analyst Neil Mehta stated that San Antonio-based Valero will benefit from a “structural upcycle in refining.” He holds a constructive view on the refining industry due to increased OPEC supply and Valero’s commitment to cash flow generation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple CTO Makes Notable Confirmation for XRP Holders

Catfish effect? Are stablecoins really not the enemy of bank deposits?

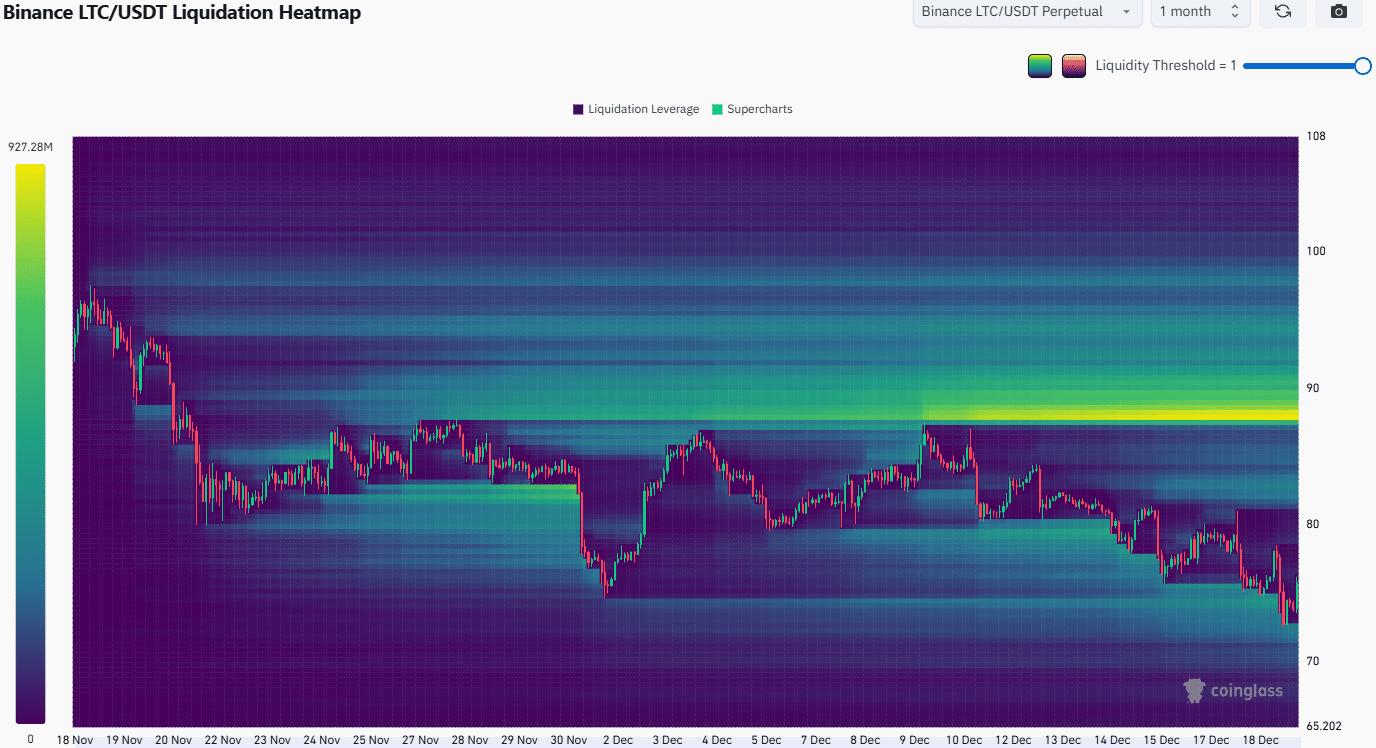

What next for Litecoin’s price after its $80-floor cracks?