Three Years of Anxious Waiting, Linea Airdrop Finally Arrives: A Victory of "Whale Addresses"?

The most crucial signal of the Linea airdrop is its avoidance of a "Sybil Attack", directly targeting the strategy of "using multiple accounts for airdrop farming".

Original Article Title: "Have You Received the Linea Airdrop?"

Original Article Author: KarenZ, Foresight News

Three years of anticipation! The Linea airdrop has finally arrived. Today, the highly anticipated powerhouse project Linea opened the airdrop query channel and announced that token claiming will officially begin on September 10.

Regarding the community's response to the Linea airdrop, "below expectations" is the intuitive feeling of many users. Some regret not meeting the threshold, have been left empty-handed, or received an amount far below their expectations. Many users have also shared screenshots of receiving tens of thousands of airdrop tokens, highlighting significant differences in airdrop distribution outcomes and the notable advantage of "quality addresses" in this airdrop.

However, setting aside emotional discussions, it is not difficult to see that this airdrop has clearly selected users deeply involved in the ecosystem according to strict rules, marking a victory for quality addresses.

Linea Token Distribution Principle: Ecosystem First

Of the LINEA token supply, Consensys Software will retain 15% of the tokens, while the remaining 85% of the token supply will be allocated to the ecosystem:

· Of this, 10% will be allocated to early users and strategic builders, which will be fully unlocked and airdropped later;

· The remaining 75% will be allocated to the ecosystem fund. The Linea Alliance has approved allocating 4% to reward liquidity providers participating in Linea Surge (fully unlocked at TGE).

Linea Airdrop Eligibility and Distribution Mechanism

Linea distributed a total of 9,361,298,700 LINEA in the airdrop, with 749,662 addresses eligible to claim (fully unlocked at TGE). This airdrop primarily targets two types of participants: LXP (Linea Voyage) participants and LXP-L (Linea Surge liquidity providers).

I. LXP Participant Criteria

· Minimum Threshold: Must accumulate at least 2000 LXP;

· Tiered System: Classified into 7 levels based on LXP quantity, with higher levels receiving more tokens. Allocation within the same level increases linearly. The specific level divisions are as follows:

Level 1: 2000 LXP

Level 2: 3000 LXP

Level 3: 4000 LXP

Level 4: 4500 LXP

Level 5: 5000 LXP

Level 6: 6500 LXP

Level 7: 8000+ LXP

· Boost Mechanism: Users eligible under either of the following criteria will receive a 10% boost.

- Early User Boost: Users who interacted with the Linea network before Dencun upgrade (from Linea mainnet launch to March 27, 2024);

- Ongoing Activity Boost: Users who transacted on the Linea mainnet in any six months (each month) between August 1, 2024, and June 30, 2025.

- MetaMask Product Usage Boost: Users who use MetaMask for swaps or cross-chain functions on Linea, or who stake or hold with MetaMask before June 30, 2025.

II. LXP-L Participants

· Minimum Threshold: Must accumulate at least 15,000 LXP-L;

· Allocation Method: Linear distribution based on the amount of LXP-L owned, no upper limit;

· Design Purpose: Encourage liquidity providers to consolidate funds in a single address to prevent Sybil attacks.

III. Builder Airdrop

An additional 1% of the token supply is specifically allocated to strategic builders within the Linea ecosystem, including core applications and the community.

Protection Against Sybil Attacks and PoH Verification

To ensure tokens are distributed to real users, the Linea airdrop has set a minimum activity threshold and introduced Proof-of-Humanity (PoH) verification to filter out Sybil attacks.

Query and Claim Timeline

· Eligibility Query: Available on the Linea Hub from September 3, 2025;

· Claim Window: September 10, 2025, to December 9, 2025 (UTC), lasting 90 days;

· Unclaimed Token Handling: Tokens not claimed by the deadline will be reclaimed to the ecosystem fund.

Ode to Airdrop Hunters

Linea's airdrop rule design and final outcome represent a "standardized test" for the cryptocurrency field's "Airdrop Hunting" ecosystem. Some received nothing, while others obtained tens of thousands of tokens. The disparity behind this outcome is not merely luck but rather a reflection of the fundamental difference in levels of engagement.

The most crucial signal of the Linea airdrop was its avoidance of "Sybil Attacks" and its bias toward "genuine users." The project not only set high thresholds for LXP (starting at 2000) and LXP-L (starting at 15000) but also introduced Proof of Humanity (PoH) verification. Additionally, by implementing a rule to "encourage liquidity concentration in a single address," Linea directly combated the strategy of "multi-account airdrop farming."

Inspiration for Airdrop Hunters:

· Some projects (especially public chains and ecosystem projects) need to abandon the "quantity over quality" mindset and focus on quality addresses: Instead of spending time managing 10 "shallow interaction accounts," it's better to concentrate on interacting with 1-2 high-quality addresses.

· Prioritize the use of official project/parent company-related tools to seize hidden bonus points: In the Linea airdrop, the "MetaMask Product Usage Bonus" is a rule that is easily overlooked but carries significant signaling value. Utilizing MetaMask for exchanges and cross-chain transactions on Linea or for staking and MetaMask cards can result in an additional 10% airdrop boost.

· Embrace "Long-Termism" over "Short-Term Speculation": Linea's "Continuous Activity Bonus" directly incorporates the "time dimension" into the airdrop bonus criteria. The "time cost" of long-term participation serves as an invisible threshold for filtering high-quality users.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

‘It felt so wrong’: Colin Angle on iRobot, the FTC, and the Amazon deal that never was

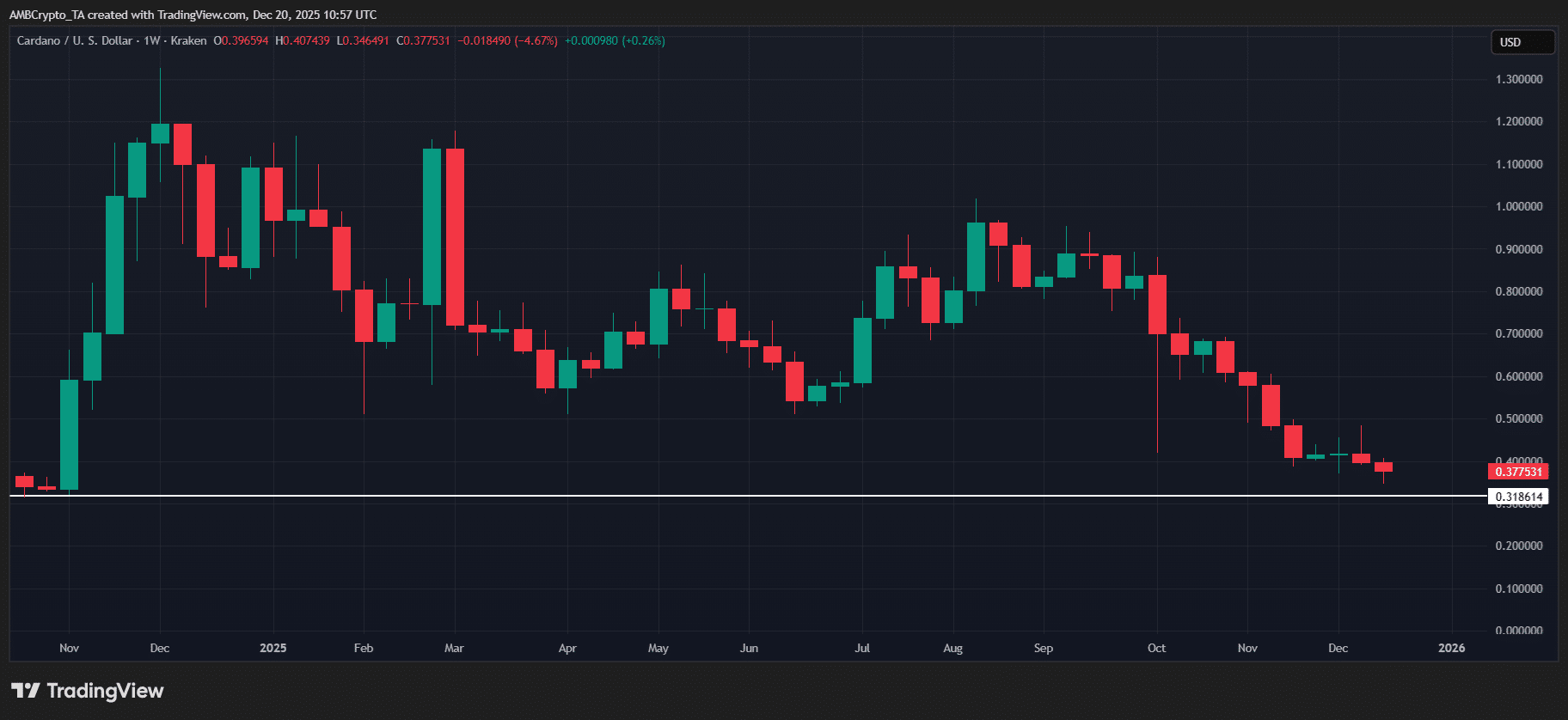

Cardano erases 100% of election rally gains – Can ADA hold top 10?

Why SEI must reclaim KEY support to avoid drop below $0.07