Memecoin Searches Rise Again, Still Well Below January Peak

After the January explosion, interest in memecoins sees a more measured return. Google searches indicate persistent curiosity, but less euphoric, reflecting a new caution among investors. Without the usual noise from social networks, this crypto dynamic could mark an evolution towards a more mature market approach.

In brief

- Google searches show a renewed interest in memecoins, although well below January’s euphoric peak.

- Less noisy, the current memecoin dynamic relies on a stronger crypto infrastructure and better defined strategies.

- Marked by past excesses, the market is now moving towards a more cautious and potentially more sustainable approach.

Memecoins: less noise, but stronger foundations

Historically, memecoins thrived on viral campaigns and aggressive marketing, but enthusiasm experienced its steepest drop in 18 months . Today, the scene is changing: the current rise seems more supported by organic interest. The difference is significant, as the absence of media excesses could limit the risks of bursting speculative bubbles.

Behind this memecoin evolution also lies a strengthened infrastructure. Unlike the wave at the start of the year, memecoins now have better organized launch platforms and sophisticated trading tools. Users can develop real strategies beyond the simple “buy & hope” that defined earlier cycles.

This technical robustness does not erase risks, but it changes the landscape. Players have more leverage, more choices, and a better ability to adapt.

In other words, the memecoin market is no longer just a chaotic playground: it is structuring itself, professionalizing, and attracting new types of investors.

Lessons from past excesses: towards market maturity

Of course, the recent history of memecoins reminds us that enthusiasm can quickly turn to disenchantment. Spectacular rises are often followed by equally brutal falls. Projects without substance end up fading out, leaving behind a multitude of disappointed investors.

This collective memory now plays a key role. Many players are more cautious, aware that pure speculation is not enough. Caution does not eliminate attraction, but it forces a different approach. Memecoins could thus experience a second life, less explosive but more deeply rooted over time.

The transition is clear: we are moving from a cycle dominated by promotional excess to a phase where curiosity combines with the memory of failures. A dynamic that could restore to memecoins a unique place alongside bitcoin , not as a flash in the pan, but as a laboratory for experimentation and innovation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Remarkable Surge: Bitcoin Lightning Network Capacity Hits Highest Level in Over a Year

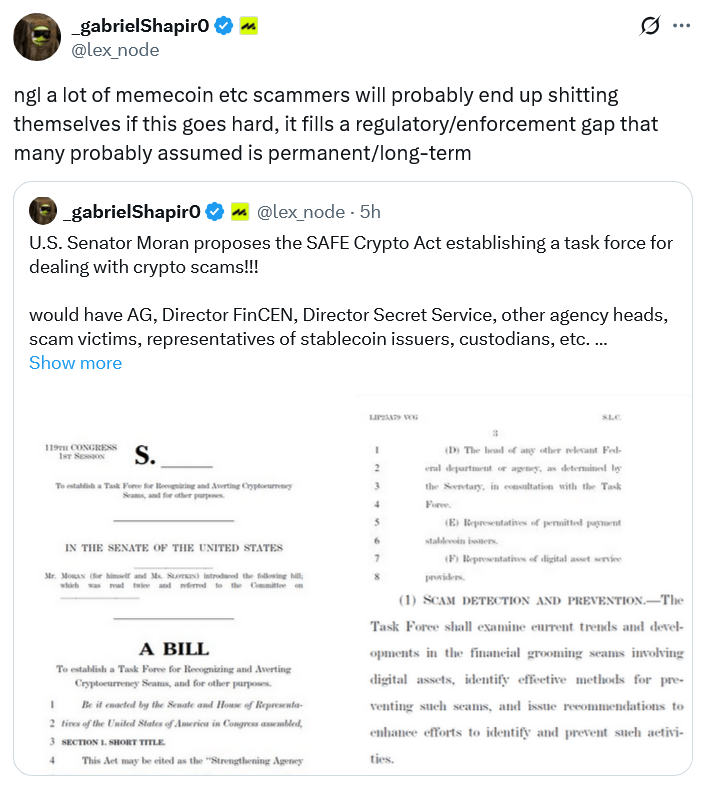

Crypto lawyer: The SAFE crypto bill will make scammers tremble.

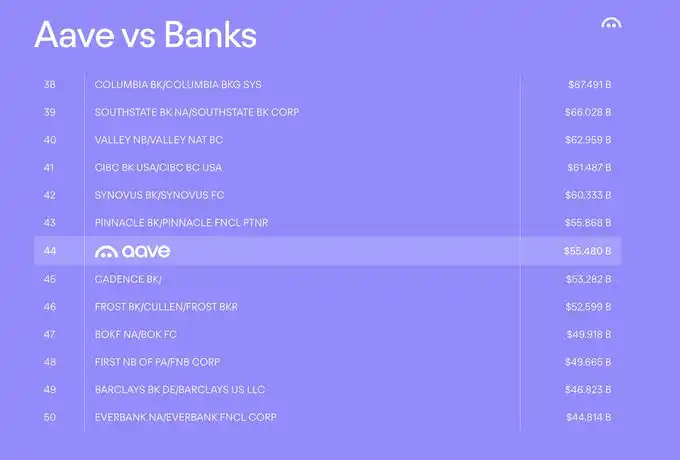

Aave founder outlines key focuses for 2026: Aave V4, Horizon, and mobile platforms