Jack Ma takes action? Yunfeng Financial bets $44 million on ETH, joins Ant Digital Technologies to enter the RWA sector

Author: Asher, Odaily

Yesterday, Yunfeng Financial, indirectly held by Jack Ma, issued an announcement stating that the company's board of directors has approved the purchase of ETH as a reserve asset in the open market. As of the announcement date, the group has cumulatively purchased 10,000 ETH in the open market, with a total investment cost (including fees and expenses) of $44 million.

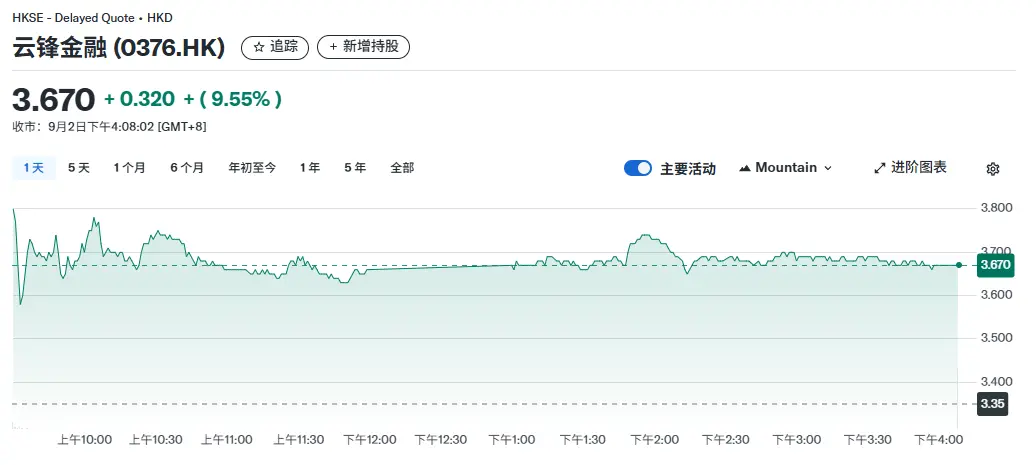

In addition, the group stated that holding ETH as a reserve asset aligns with its layout in cutting-edge fields such as Web 3, and can optimize its asset structure while reducing reliance on traditional currencies. Driven by this news, Yunfeng Financial (0376.HK) saw an intraday increase of nearly 10%.

Jack Ma and Yunfeng Financial

Yunfeng Financial has always been regarded as a "Jack Ma concept stock".

The controlling shareholder of Yunfeng Financial is Yunfeng Capital, which was jointly founded by Jack Ma and Yu Feng, founder of Focus Media, in 2010. The name "Yun" comes from Jack Ma, and "Feng" from Yu Feng. According to public data, Alibaba founder Jack Ma indirectly holds about 11.15% of Yunfeng Financial through Yunfeng Capital, 29.85% in Yunfeng Financial Holdings Limited, and 40% in Shanghai Yunfeng Xinchuang (without voting rights).

Additionally, Yunfeng Financial's predecessor can be traced back to Man Sang International Securities, established in 1982, and listed on the Hong Kong Stock Exchange in 1987, gradually growing into a leading local securities firm in Hong Kong. In 2015, Yunfeng Capital, led by Jack Ma and Yu Feng, acquired a controlling stake for HK$3.9 billion, driving the company's transformation. Subsequently, Yunfeng Financial acquired a 60% stake in MassMutual Asia (2018), and integrated licenses for securities, insurance, and asset management, gradually building a "finance + technology" ecosystem.

Yunfeng Financial's Purchase of Ethereum Is Just the Beginning

Yunfeng Financial announced yesterday that the company has included Ethereum as a strategic reserve asset. This move marks the group's initial foray into digital assets and the Web 3 sector. In the future, it will continue to promote the strategic adoption of crypto assets and digital financial innovation, and explore the inclusion of mainstream tokens such as BTC and SOL in its reserves.

At the same time, the group plans to deeply integrate digital assets with its own business, explore RWA (real-world asset) tokenization, and the potential application of blockchain technology in core businesses such as insurance and asset management, to build a "finance + technology" ecosystem.

Yunfeng Financial will flexibly adjust the scale of its digital asset reserves based on market developments, regulatory environment, and financial conditions. The group emphasized that it will continue to accelerate its Web 3 layout and promote fintech innovation to enhance customer service experience and financial autonomy.

Strategic Investment in Public Chain Pharos, Joint RWA Layout with Ant Digital Technologies

On September 1, Yunfeng Financial announced a strategic cooperation agreement with Ant Digital Technologies, and made a strategic investment in the Pharos public chain. The cooperation aims to accelerate the integration and innovation of Web 3 and traditional finance, and jointly lay out RWA (real-world asset) tokenization and the Web 3 sector through the Pharos public chain platform.

Pharos Project Introduction

Pharos is a new generation Layer 1 public chain focused on RWA.

In terms of performance, the network features modular design and high parallelism. The currently launched testnet can reach a TPS of 30,000, far exceeding other EVM and parallel networks. At the same time, Pharos adopts an innovative GPU-like architecture, improving storage efficiency by 80% and supporting a user base of billions. The core team of Pharos includes Web 2 experts from Ant Digital Technologies and Alibaba Blockchain, as well as seasoned Web 3 industry professionals.

In terms of financing, on November 8, 2024, Pharos completed an $8 million seed round led by Faction and Hack VC, with participation from SNZ Holding, Hash Global, MH Ventures, Dispersion Capital, Generative Ventures, and Chorus One.

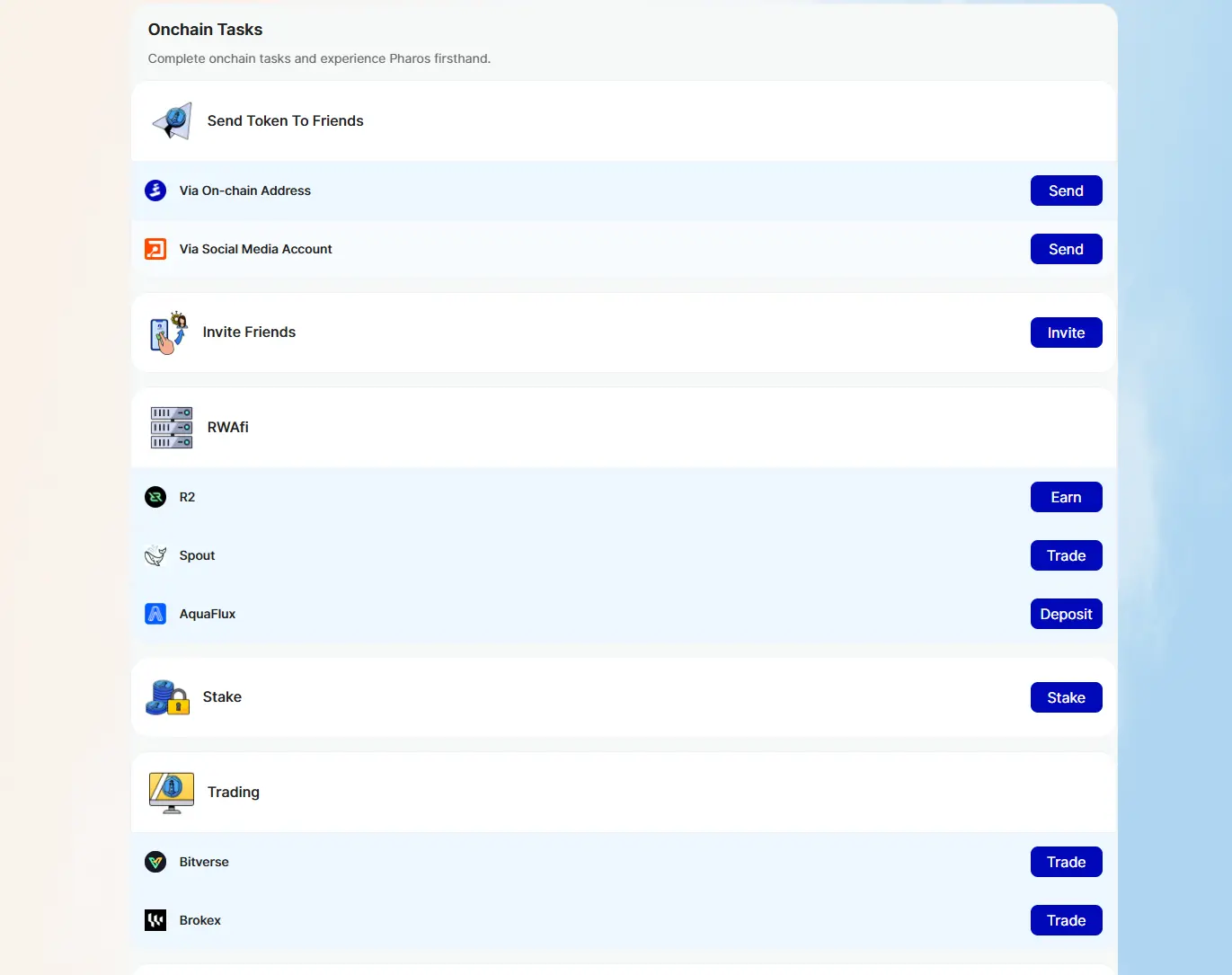

Testnet Season 2 Tasks Ongoing

Currently, Pharos has opened its second testnet season for early users to experience. The specific interaction steps are as follows:

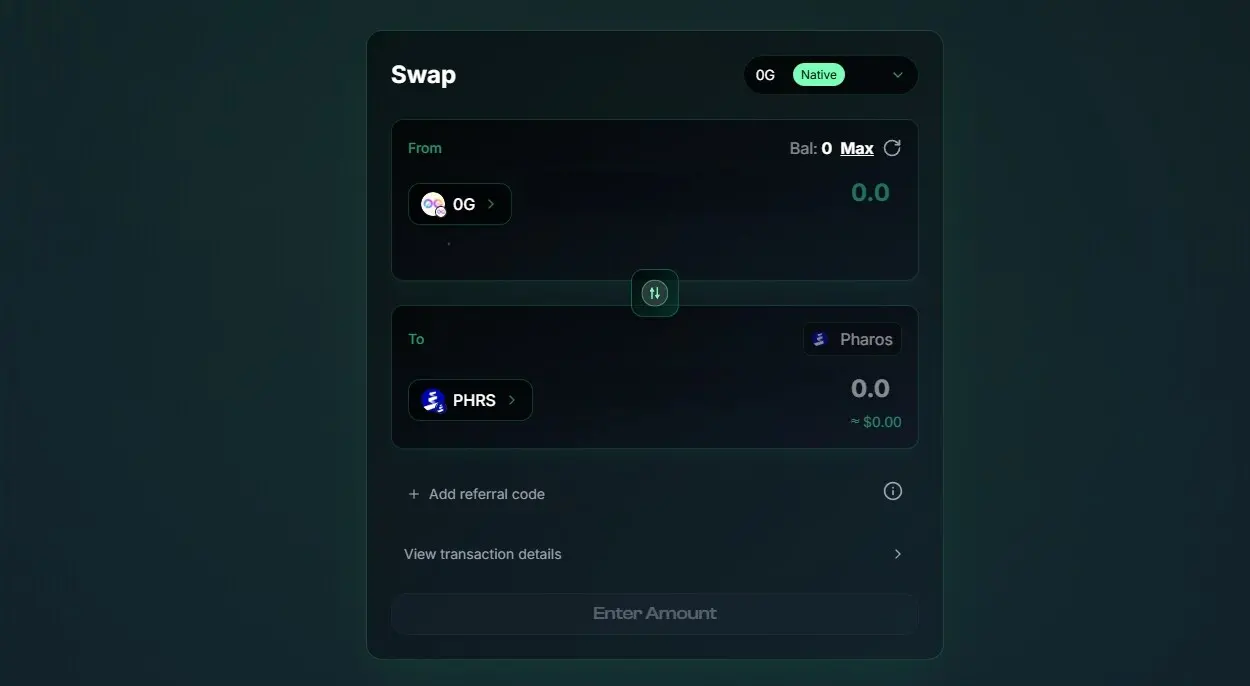

STEP 1. Claim test tokens. You can choose to first claim 0G test tokens and exchange them for PHRS test tokens.

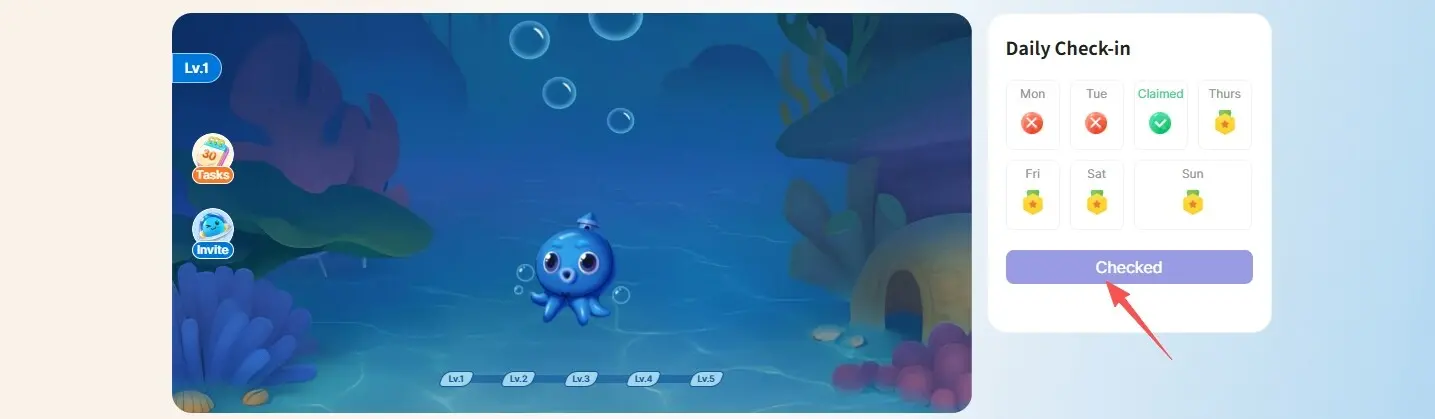

STEP 2. Enter the Season 2 interaction website, connect your wallet, and complete daily check-ins.

STEP 3. Complete on-chain interaction tasks and social tasks as required.

Summary

Yunfeng Financial, indirectly held by Jack Ma, has made a strategic move into Ethereum, not only demonstrating its belief in emerging technologies but also reflecting its forward-looking exploration of financial architecture.

From an overall strategic perspective, Yunfeng Financial is making a key step in optimizing company reserves and reducing reliance on traditional fiat currencies by increasing its digital asset holdings. At the same time, it is also attempting to deeply integrate traditional financial business with Web 3 technology, especially exploring blockchain application scenarios in insurance, securities, and other fields.

With Hong Kong's regulatory advantages in digital assets, Yunfeng Financial is expected to become an important bridge between traditional finance and the crypto ecosystem. Perhaps, for Jack Ma, the purchase of 10,000 ETH by Yunfeng Financial is just the beginning of its Web 3 layout—the real blueprint for digital finance is only just unfolding.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Market share plummets by 60%, can Hyperliquid return to the top with HIP-3 and Builder Codes?

What has Hyperliquid experienced recently?

The European class struggle behind Tether's acquisition of Juventus