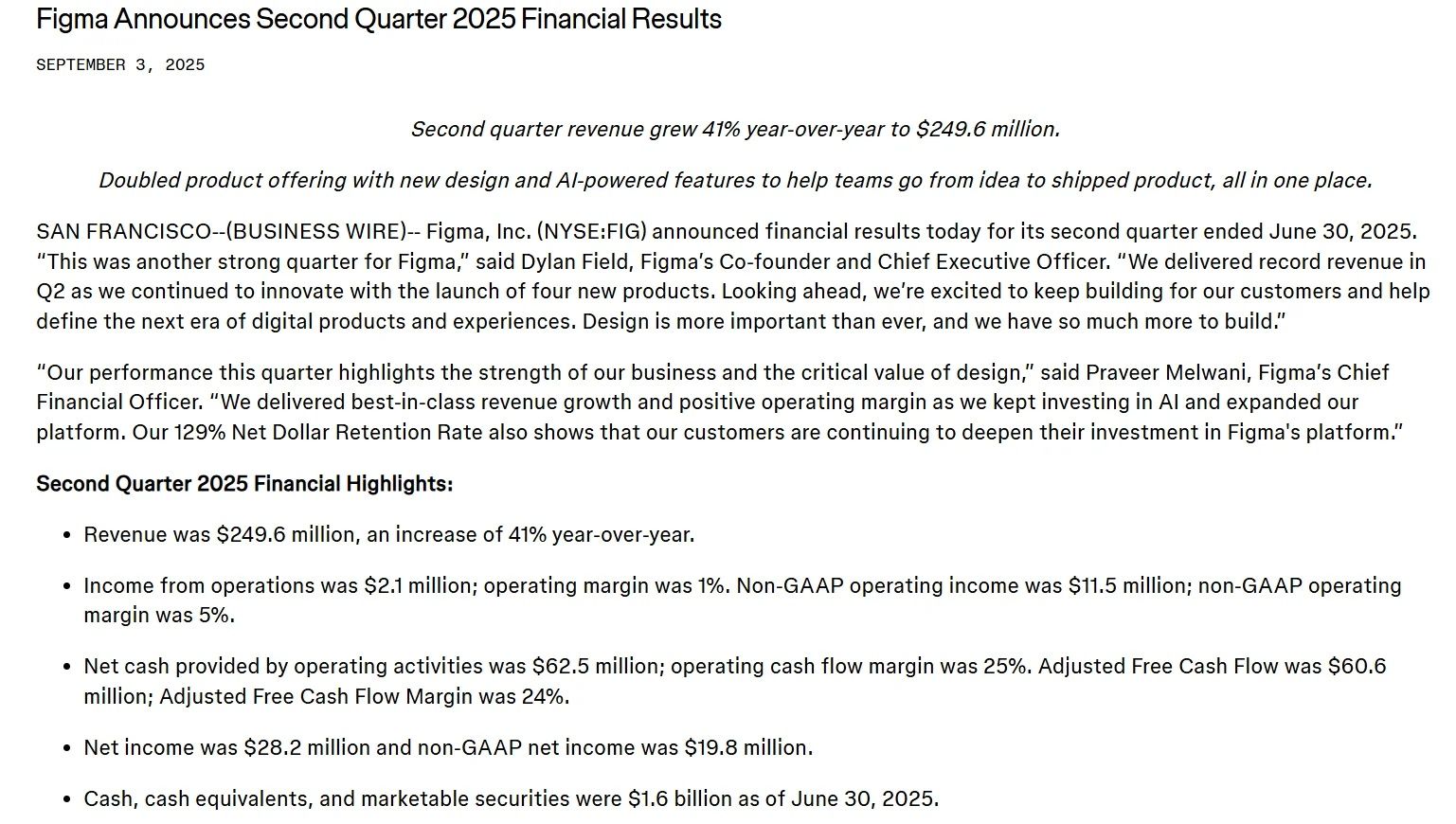

Figma Q2 revenue strong, adjusted net profit slightly below expectations, shares fall over 14% after hours

Design software company Figma has released its financial results for the second quarter ending June 30, 2025. The financial report shows: Q2 revenue was $249.6 million, a year-on-year increase of 41%, with adjusted net profit of $11.5 million. Full-year revenue is expected to be between $1.021 billion and $1.025 billion.

Key Financial Highlights for Q2 2025:

Revenue reached $249.6 million, up 41% year-on-year

Operating income was $2.1 million, with an operating margin of 1%;

Non-GAAP operating income was $11.5 million, with a non-GAAP operating margin of 5%

Operating cash flow was $62.5 million, with an operating cash flow margin of 25%

Adjusted free cash flow was $60.6 million, with a free cash flow margin of 24%

Net profit was $28.2 million;

Non-GAAP net profit was $19.8 million, below market expectations of $20.2 million.

As of June 30, 2025, the company held a total of cash, cash equivalents, and marketable securities of $1.6 billion.

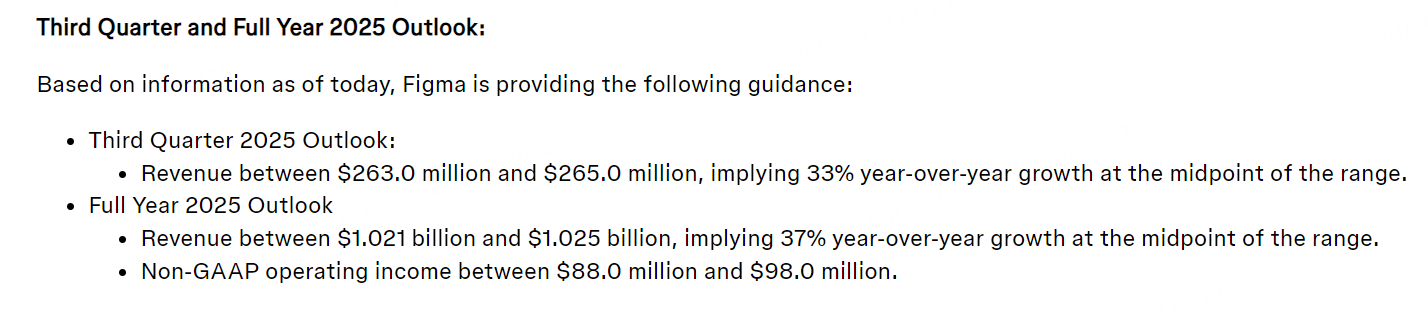

Figma also announced its expectations for the third quarter and full year of 2025:

For the third quarter of 2025, revenue is expected to be between $263 million and $265 million. Based on the midpoint of the range, the year-on-year growth rate is about 33%;

For the full year 2025, revenue is expected to be between $1.021 billion and $1.025 billion, with the midpoint corresponding to a year-on-year growth rate of about 37%;

At the same time, non-GAAP operating profit is expected to be between $88 million and $98 million.

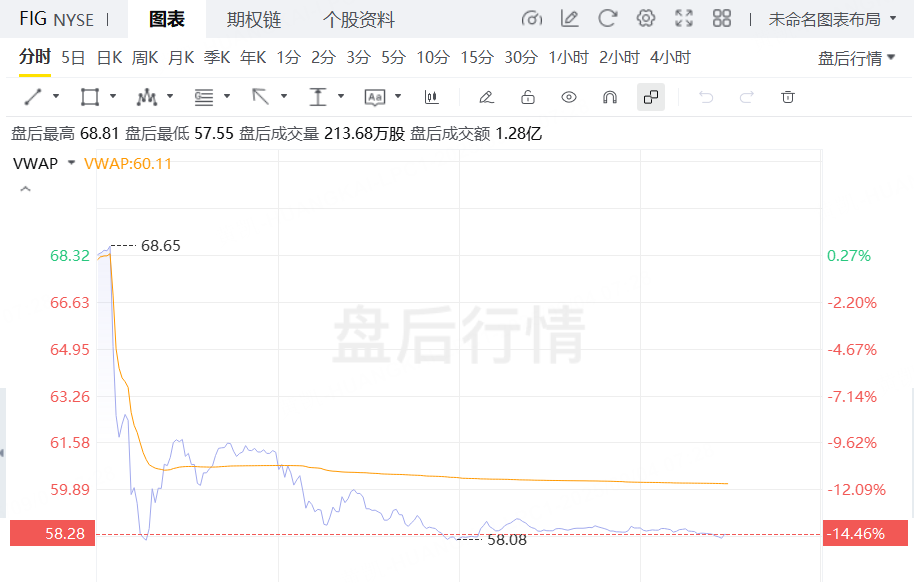

After the financial report was released, Figma's after-hours stock price fell by more than 14%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

No wonder Buffett finally bet on Google

Google holds the entire chain in its own hands. It does not rely on Nvidia and possesses efficient, low-cost computational sovereignty.

HYPE Price Prediction December 2025: Can Hyperliquid Absorb Its Largest Supply Shock?

XRP Price Stuck Below Key Resistance, While Hidden Bullish Structure Hints at a Move To $3

Bitcoin Price Prediction: Recovery Targets $92K–$101K as Market Stabilizes