Former BlackRock Debt Chief Warns: "Vultures" Are Circling the Bolivia Crisis

The former head of emerging market debt at asset management company BlackRock, who is also the grandson of one of Bolivia's most well-known presidents, has stated his willingness to assist the winner of next month's presidential election in resolving the country's debt issues.

The second round of the presidential election on October 19 will be contested between centrist candidate Rodrigo Paz and right-wing former president Jorge “Tuto” Quiroga, the latter of whom has previously stated that Bolivia needs to renegotiate its $14 billion external debt.

Sergio Trigo Paz, during his tenure at BlackRock, participated in handling major sovereign debt default events worldwide, from Argentina to Ukraine. He told Reuters that Bolivia's current predicament means that "vultures"—that is, distressed debt investors—are lying in wait.

In a phone interview from Bolivia on Wednesday, Trigo Paz said that the Bolivian economy is currently in chaos, with foreign exchange reserves barely covering two months of imports, and that a crisis point may arrive in March next year: at that time, the new government will need to repay about $380 million in debt.

After working in London for 20 years, Trigo Paz returned to Bolivia this year. He pointed out: "The current environment is a breeding ground for distressed debt funds. They buy bonds at extremely low prices (a few cents on the dollar), pursue repayment through litigation, and patiently wait for their opportunity."

Bolivia's bonds, with a coupon rate of 7.5% and maturing in 2030, are currently trading at just under 80 cents on the dollar. After the ruling Socialist Party performed poorly in the first round of elections on August 17, the price of these bonds saw a slight rebound.

Trigo Paz also mentioned that a "short squeeze" triggered by local pension funds has distorted the bond market.

He said: "The macro-level challenges are not insurmountable... but at the current price of 80 cents on the dollar, the market is already priced for a 'perfect scenario' (i.e., the best outlook has been fully priced in)."

The core issue in this election debate is whether Bolivia should follow the "radical reforms" of neighboring Argentina's Javier Milei, or take a more gradual reform path with conditions attached.

The International Monetary Fund (IMF) has already recommended that Bolivia gradually remove costly fuel subsidies, abandon its pegged exchange rate to the dollar, and lift capital controls—all measures supported by Trigo Paz.

"Most importantly, we must be prepared for the challenges ahead," he emphasized, while urging the new government to act quickly. "Once you sit across the negotiating table from the IMF, you no longer hold the initiative."

Relevant Experience

Trigo Paz said he is willing to assist in resolving the debt issue as a technical expert, but has not yet contacted either Rodrigo Paz (his distant cousin) or Quiroga regarding this matter.

He said: "Whether I participate will depend on whether the (new government) truly has the will to resolve the current economic imbalance."

Trigo Paz's grandfather, Victor Paz Estenssoro, was a central figure in Bolivian politics for half a century. In 1985, during his final presidential term, he implemented comprehensive free-market reforms that successfully curbed hyperinflation and stabilized the national economy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

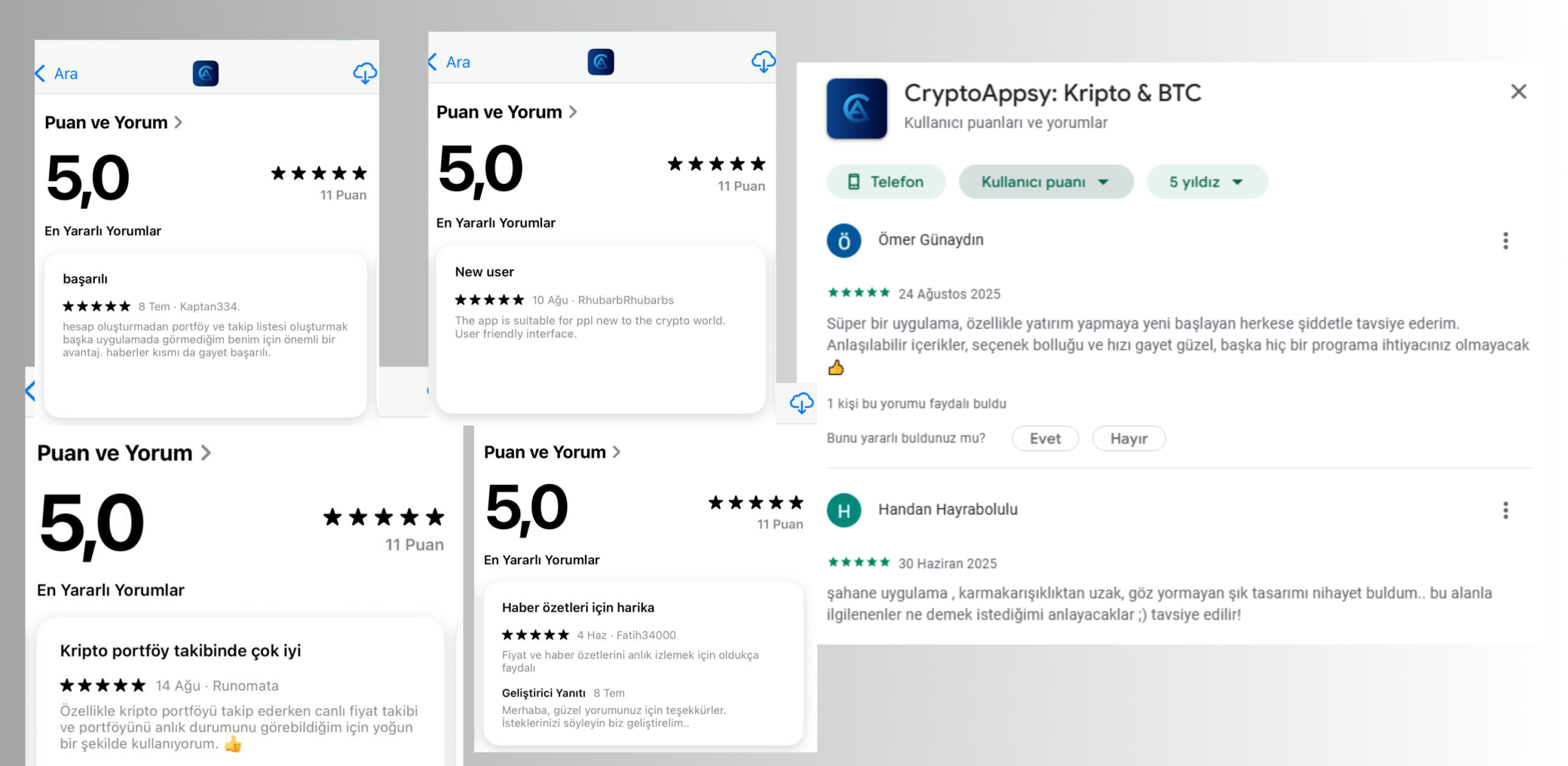

CryptoAppsy Empowers Crypto Enthusiasts with Instant Market Insights

Shardeum Surpasses 700 Million SHM Tokens Staked as Staking Delegators Program Expands

Crypto Industry Must Make Progress Before Trump Leaves Office: Etherealize Co-Founder

One of the Most Anticipated Altcoins May Be Approaching Launch – Tokens Are Moving, Here Are the Latest Data