Corporate Political Connections and Investor Sentiment in Biotech: Lessons from Mustang Bio's Volatility

- Mustang Bio's stock volatility highlights how FDA designations function as regulatory credibility signals, substituting for political influence in biotech investor sentiment. - The company's governance transparency—through board alignment and SEC compliance—builds trust in a sector where opaque practices often trigger skepticism. - Financial risks emerge from reliance on regulatory milestones alone, with $14.9M cash reserves against $11.3M liabilities and no political connections to buffer market shifts.

The biotechnology sector, inherently politically sensitive due to its dependence on regulatory approvals and public health mandates, offers a compelling lens through which to examine the interplay between corporate political connections, financial reporting, and investor sentiment. Recent developments at Mustang Bio , Inc. (NASDAQ: MBIO), formerly MSTY, underscore the complexities of navigating this landscape. While Mustang Bio has not been explicitly tied to political affiliations, its stock price surges and volatility—driven by FDA designations and clinical progress—highlight how regulatory milestones can substitute for political influence in shaping market perceptions.

The Role of Regulatory Milestones in Investor Sentiment

Mustang Bio's 223.53% stock surge on July 7, 2025, followed by a 7.8% post-market decline, illustrates the sector's susceptibility to regulatory news. The FDA's Orphan Drug Designation for its CAR T-cell therapy, MB-101, granted it tax incentives and accelerated review pathways. Such designations, while not political in nature, function as proxies for regulatory favor, signaling to investors that the company is aligned with public health priorities. This dynamic mirrors the academic finding that politically connected firms often see valuation premiums, albeit through a different mechanism. In Mustang Bio's case, the absence of political ties is offset by its ability to secure regulatory milestones, which serve as credibility signals in a sector where trust in governance is paramount.

Governance Transparency as a Substitute for Political Influence

Academic research on politically connected firms reveals that corporate governance structures moderate the effects of political ties. For Mustang Bio, robust governance—evidenced by its board composition, equity incentives, and compliance with SEC filings—appears to play a similar role. The company's use of restricted stock units (RSUs) for directors and its adherence to scaled reporting requirements as a Smaller Reporting Company suggest a commitment to aligning leadership with shareholder interests. This transparency, while not politically driven, fosters investor confidence in a sector where opaque practices can lead to skepticism.

However, Mustang Bio's financials—$14.9 million in cash reserves against $11.3 million in liabilities—highlight the risks of relying on regulatory milestones alone. The company's EBITDA deficit of $112,000 and net losses underscore the need for disciplined capital allocation. Here, the absence of political connections becomes a double-edged sword: without lobbying or policy advantages, Mustang Bio must rely on operational efficiency and clear financial reporting to attract capital.

Implications for Due Diligence and Risk Management

For investors, Mustang Bio's trajectory offers a case study in the importance of due diligence in politically sensitive sectors. While the company lacks political affiliations, its reliance on regulatory approvals and R&D-intensive strategies necessitates scrutiny of governance frameworks and financial transparency. Key considerations include:

1. Regulatory Alignment: Assess whether a company's pipeline aligns with public health priorities, as this can substitute for political influence in driving investor sentiment.

2. Governance Structures: Evaluate board composition, equity incentives, and compliance practices to gauge how effectively leadership is aligned with long-term value creation.

3. Capital Efficiency: Monitor burn rates and liquidity ratios to ensure a firm can sustain operations without overreliance on speculative financing.

Mustang Bio's recent capital-raising efforts—via public offerings and at-the-market programs—demonstrate its ability to secure funding despite its net losses. Yet, the company's leverage (current ratio of 1.3) and dependence on external financing highlight the fragility of its position. Investors must weigh these factors against the potential upside of its pipeline, particularly in rare disease therapies where market exclusivity can drive long-term profitability.

Long-Term Capital Allocation in a Politically Sensitive Sector

The biotech sector's dependence on regulatory and public health dynamics means that long-term capital allocation must prioritize resilience over short-term gains. Mustang Bio's focus on gene therapy and CAR T-cell treatments, while promising, requires sustained investment in clinical trials and partnerships. The company's collaborations with institutions like the City of Hope and Fred Hutchinson Cancer Research Center suggest a strategic emphasis on scientific credibility, which can mitigate the risks of political instability.

However, the absence of political connections also means Mustang Bio is more vulnerable to shifts in regulatory priorities or public sentiment. For instance, a change in FDA guidance or a decline in investor appetite for high-risk biotech ventures could erode its valuation premium. This underscores the need for diversified capital strategies and contingency planning, particularly in sectors where policy changes can rapidly alter the competitive landscape.

Conclusion: Balancing Governance and Innovation

Mustang Bio's experience illustrates that in politically sensitive sectors, the absence of corporate political connections does not preclude success—but it demands a heightened focus on governance transparency and regulatory alignment. For investors, the lesson is clear: due diligence must extend beyond financial metrics to include an evaluation of a company's ability to navigate regulatory environments and maintain stakeholder trust. In a world where political influence and public health priorities increasingly intersect, the firms that thrive are those that combine scientific innovation with robust governance and transparent reporting.

As the biotech sector evolves, the interplay between political connections, regulatory dynamics, and investor sentiment will remain a critical factor in capital allocation decisions. Mustang Bio's journey offers a timely reminder that in politically sensitive industries, the path to sustainable value creation lies not in lobbying for favor, but in building trust through accountability and innovation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Unmissable: Quack AI’s Builder Night Seoul Summit Unites AI and Web3 Leaders on Dec 22

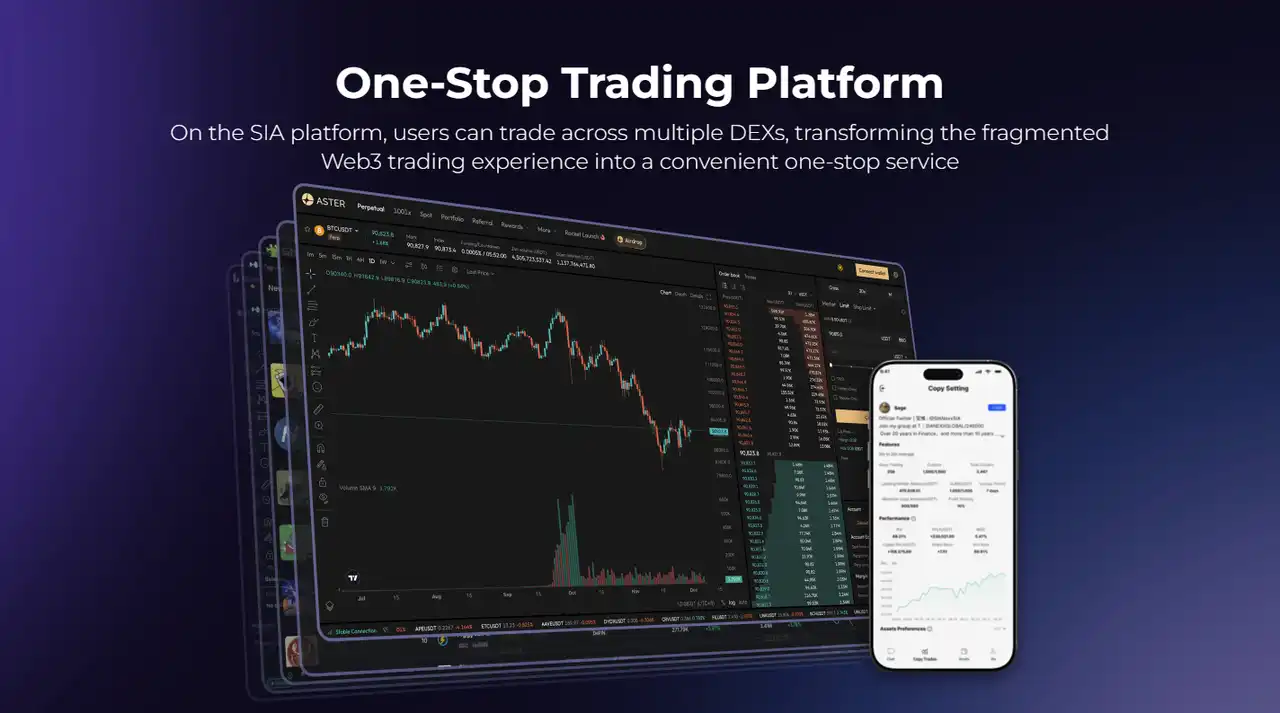

SIA: From a super AI trading platform to a functional on-chain AI ecosystem

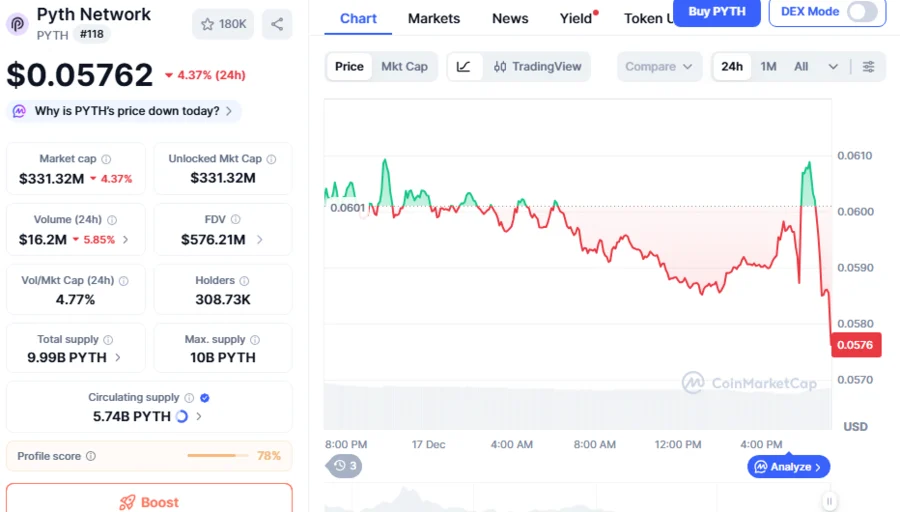

PYTH Drops 76% As Crypto Weakness Persists, Can New PYTH Network Reserve Trigger Market Rally?

Stunning Success: Sport.Fun’s FUN Token Sale Smashes 100% Target in One Day