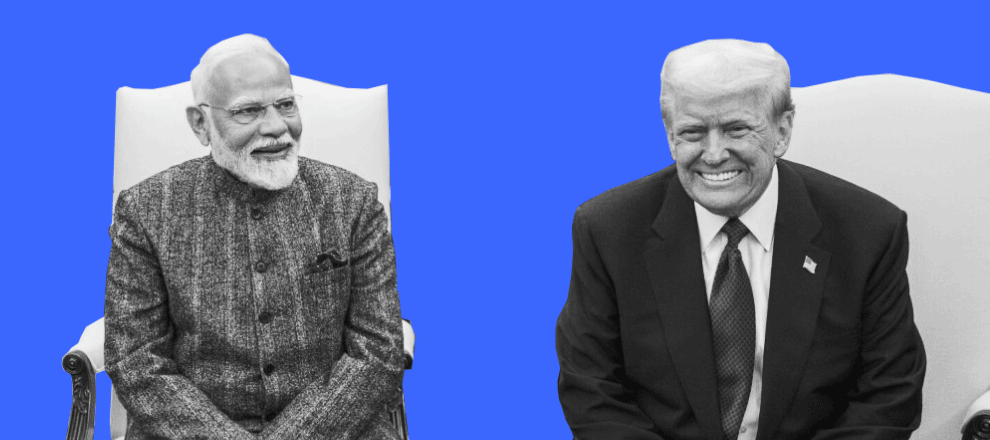

India ranked first and the U.S. second in the Chainalysis Global Crypto Adoption Index for 2025. Pakistan, Vietnam, and Brazil also made it into the top five.

Source: U.S. Embassy & Consulates in India

Chainalysis published its sixth annual Global Crypto Adoption Index, analyzing digital asset usage in 151 countries. India topped the index for the third year in a row but, for the first time, leads in all major categories.

Analysts note that the U.S. took second place thanks to the approval of spot Bitcoin ETFs and the growing participation of traditional financial institutions.

Key figures and insights from the report:

- India ranked first in retail (<$10,000) and institutional (>$1 million) transactions, as well as in the volume of activity on centralized and decentralized services.

- The APAC region recorded a 69% year-over-year increase in crypto transaction volume — from $1.4 trillion to $2.36 trillion. Latin America grew by 63%, Africa by 52%, North America by 49%, Europe by 42%, and MENA by 33%.

- In absolute terms, Europe ($2.6 trillion) and North America ($2.2 trillion) led in total crypto transaction volume.

- The volume of fiat-to-crypto purchases in the U.S. exceeded $4.2 trillion, four times higher than South Korea, which ranked second in this metric.

Eastern Europe emerged as an unexpected leader in per-capita crypto activity, with Ukraine, Moldova, and Georgia in the top three. The report highlights that economic instability, inflation, and distrust in banks are driving interest in digital assets.

The stablecoin market remains dominated by dollar-pegged USDT and USDC. However, the euro-pegged EURC grew an average of 89% per month, rising from $47 million in June 2024 to $7.5 billion in June 2025. PYUSD’s market cap also expanded from $783 million to $3.95 billion over the same period.

Bitcoin remains the main gateway into crypto markets, with fiat purchases totaling $4.6 trillion. Between July 2024 and June 2025, users bought more than $10.2 trillion worth of cryptocurrencies on CEXs via fiat pairs.

The index results show that crypto moved beyond being a niche tool and is increasingly used at both retail and institutional levels. India and the U.S. are setting the global trend, but the performance of Asian and Latin American countries indicates that the center of crypto-economics is shifting toward emerging markets.

In last year’s Chainalysis index , India and Nigeria showed the highest rates of adoption, with Indonesia, the U.S., and Vietnam also ranking in the top five.