Key Market Information Discrepancy on September 5th - A Must-See! | Alpha Morning Report

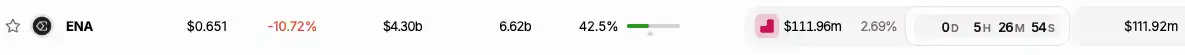

1. Top News: SEC Proposes Safe Harbor for Cryptocurrency and Revamps Broker-Dealer Rules 2. Token Unlock: $ENA

Top News

3.SEC Proposes Safe Harbor for Cryptocurrency and Revamps Broker-Dealer Rule

5.Musk's X Money Plan Hindered by Regulations and Employee Exodus

Articles Threads

Following the "core token" supported by the Trump family, the Trump family has once again used the guise of the crypto community to "make money" in the financial markets. On Wednesday, March 3, American Bitcoin, a Bitcoin mining and accumulation platform, debuted on the Nasdaq through a merger with peer Gryphon Digital Mining, with ABTC as its trading symbol. The stock price soared on the first day of trading. During early trading hours, American Bitcoin surged to $14.52, a more than 100% intraday increase. It later gave back most of its gains, closing at $8.04, up approximately 16.5%. Trading of the stock was temporarily halted due to significant price volatility. American Bitcoin is owned by Donald Trump's sons—Donald Trump Jr. and Eric Trump. After completing a share swap merger with Gryphon Digital Mining, the Trump sons and another Bitcoin miner, Hut 8 Corp., collectively own 98% of the company, with Gryphon's previous investors holding the remaining shares. Following the listing of the cryptocurrency project World Liberty Financial's token WLTI on several crypto exchanges earlier in the week, American Bitcoin marks the Trump family's second major event driving crypto assets into the mainstream capital markets this week. Its listing is seen as the latest test of investor interest in Trump family-related cryptocurrency enterprises.

2.《Market Prediction: Waller’s Bet, Key Moment for Fed Chair Succession》

With 9 months left until Powell's term ends, the discussion on who will succeed as the Fed chair has heated up. The Fed chair is arguably the most powerful economic position in the world. A single word from him can cause violent fluctuations in the capital markets, and a decision can affect the flow of trillions of dollars. Your mortgage rate, stock market returns, and even the volatility of crypto assets are closely related to the decisions made in this position. So, who is most likely to be the next chair? The market is gradually giving its own answer.

Market Data

Daily Market Overall Capital Heat (Reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Token Unlocks

Funding Rate

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New users get a 100 USDT margin gift—Trade to earn up to 1088 USDT!

Subscribe to ETH Earn products for dual rewards exclusive for VIPs— Enjoy up to 10% APR and trade to unlock an additional pool of 50,000 USDT

Bitget Spot Margin Announcement on Suspension of SANTOS/USDT, MYRO/USDT, DUSK/USDT, PHB/USDT, ALPINE/USDT Margin Trading Services

CandyBomb x RAVE: Trade futures to share 200,000 RAVE!