Key takeaways:

-

Dip buyers continue to accumulate Bitcoin and open new leveraged positions, but reclaiming the $112,000 level remains key.

-

Traders are on pins and needles ahead of Friday’s US jobs report.

Bitcoin’s ( BTC ) Wednesday rally to $112,600 vanished as sellers stepped in during the Asian trading session, and the downside spilled over into Thursday as the price dropped to $109,329. Weak ADP private hiring data shook traditional markets after the report showed an increase of 54,000 jobs added in August, while analysts had anticipated 75,000.

On Friday, the more significant US jobs report will be released and provide insights on whether the labor market is robust or running out of steam. Labor data released on Wednesday showed that the US now has more unemployed people (7.24 million) than those with jobs (7.18 million), and while economists are hopeful that August data will show 80,000 jobs added, some are fearful that the figure will fall far below the estimate.

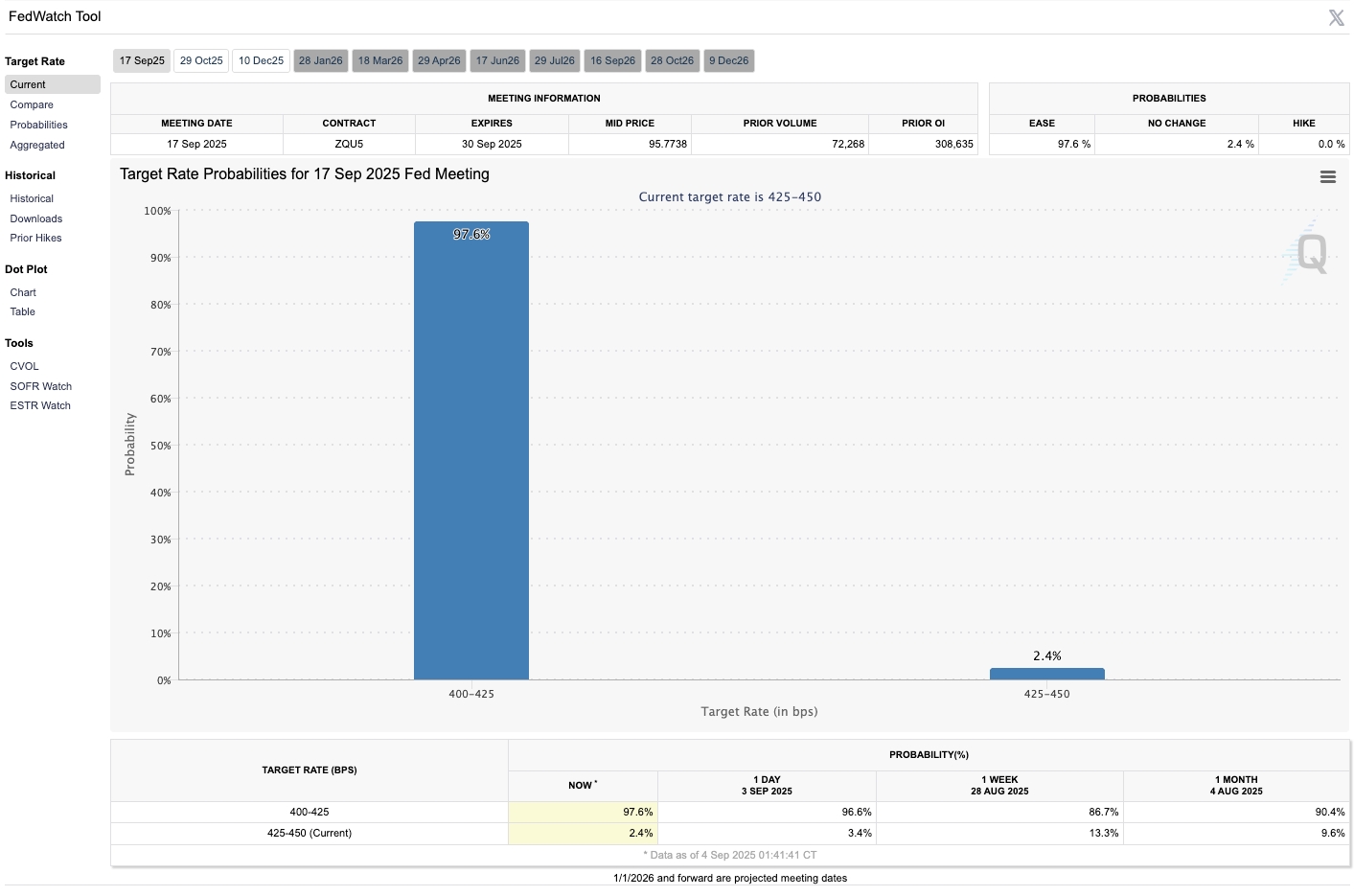

For Bitcoin traders, signs of a slowing labor market are a signal that should greenlight the US Federal Reserve to cut interest rates. The CME Group’s FedWatch tool currently shows a 97.6% probability that the Fed will lower the benchmark rate by 25 basis points in its September meeting, a move that many traders hope will spark a turnaround in BTC price.

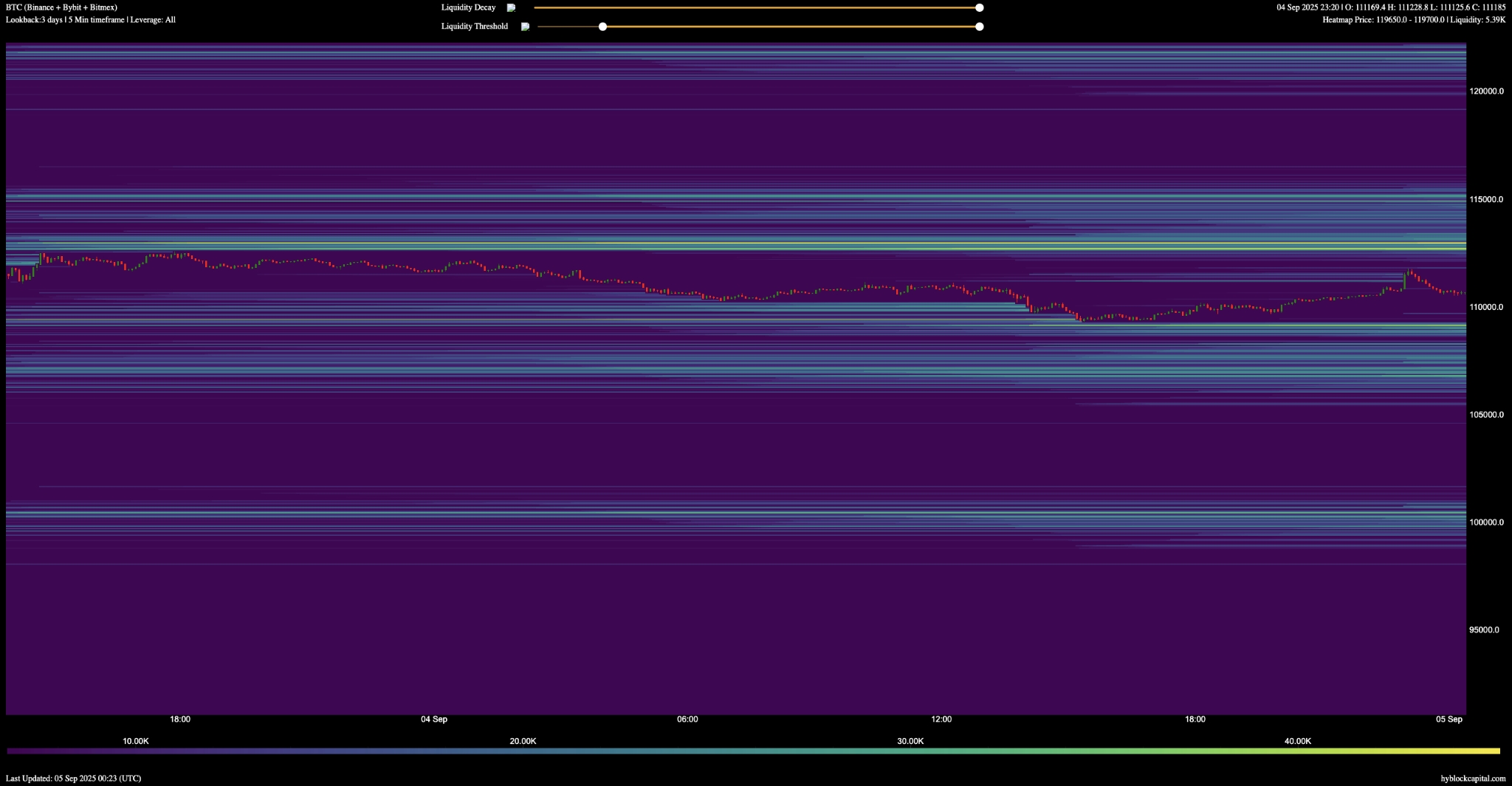

Although the market is on pins and needles about this week’s US jobs data, data from Hyblock shows retail and institutional-sized traders buying in the spot markets.