The US Securities and Exchange Commission (SEC) has published its Spring 2025 agenda - with a clear focus on modernizing crypto regulation. Under the new chairmanship, the crypto sector is to be strengthened through targeted regulatory adjustments and integrated more efficiently into the regulated financial markets.

The SEC has presented a revised agenda that provides for both stricter rules for cryptocurrencies and easing of requirements for traditional financial players. The goal is to foster innovation, protect investors, and enhance the competitiveness of the US market in a global context, according to Reuters reports .

Innovation instead of restriction

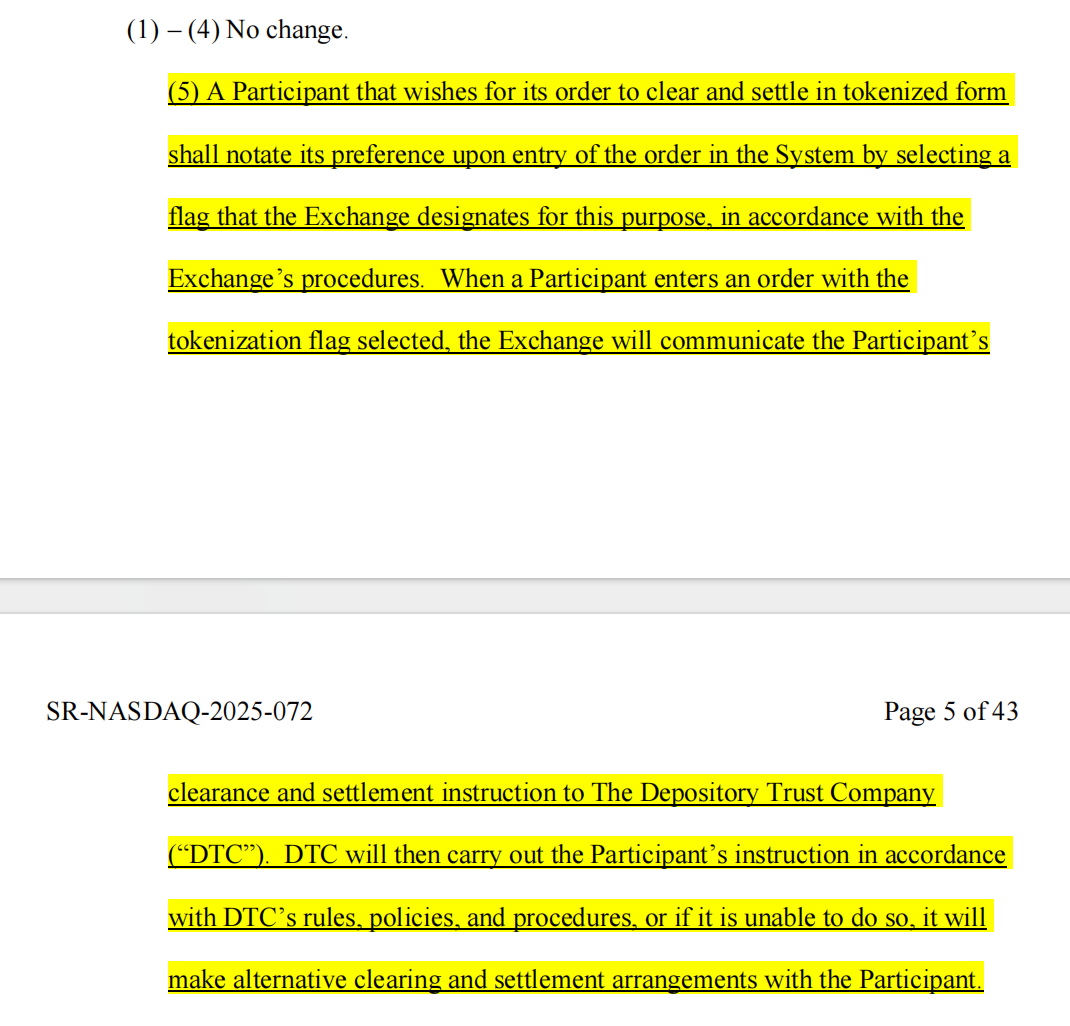

The revised agenda includes proposals to restructure the trading and regulation of digital assets. Planned measures cover the offering and sale of cryptocurrencies - including possible exemptions and safe harbors - as well as clarifications on how existing broker-dealer rules apply to crypto. At the same time, the SEC is considering allowing crypto assets to be officially listed on national exchanges and alternative trading systems. In addition, the SEC plans to simplify disclosure requirements to make capital formation in the market more efficient.

Transparency and efficiency

SEC Chair Paul Atkins emphasized that the agenda marks a new course: moving away from restrictive regulation toward an environment that promotes innovation, capital formation, market efficiency, and investor protection at the same time. The proposed changes are designed to lower regulatory hurdles and open the market more effectively to digital assets.

A central aspect of the agenda concerns dialogue with the industry. The SEC intends to work more closely with market participants, from established banks to crypto exchanges, to develop practical rules. This exchange is intended to ensure that new regulations not only focus on investor protection but also strengthen the competitiveness of the US financial center.

In addition, the agenda could send a signal to international markets. While Europe has already created a clear regulatory framework with MiCA, the SEC is now seeking to catch up. A more proactive and innovation-friendly policy could once again position the US at the center of the global crypto market and attract both capital and talent.