Itaú Asset crypto division is a new dedicated unit within Itaú Asset Management focused on building digital‑asset mutual funds, ETFs, custody solutions and staking strategies to capture alpha for clients. The unit leverages existing crypto products and internal custody to expand Brazil‑focused and global crypto offerings.

-

Dedicated crypto fund unit launched inside Itaú Asset Management

-

Led by João Marco Braga da Cunha, former Hashdex portfolio director, to scale ETFs, fixed‑income style crypto products and active strategies.

-

Operates within a mutual funds structure that oversees over 117 billion reais; Itaú Unibanco manages 1 trillion reais across client assets.

Itaú Asset crypto division expands digital‑asset funds, ETFs and custody; read our concise analysis on implications for Brazilian investors and institutional strategies today.

Itaú Asset is launching a crypto division within its billion-dollar mutual funds arm, aiming to deliver alpha for clients with digital assets trading.

What is the Itaú Asset crypto division?

Itaú Asset crypto division is a new, specialized unit inside Itaú Asset Management created to design, manage and distribute crypto mutual funds and ETFs while offering in‑house custody, staking and derivatives strategies. It aims to provide institutional‑grade digital‑asset exposure within the firm’s existing mutual funds framework.

Who is leading the new crypto unit?

João Marco Braga da Cunha, formerly portfolio management director at Hashdex, has been appointed head of the division. His role focuses on product development across volatility‑driven strategies and fixed‑income‑style digital instruments. The appointment leverages his ETF and fund management experience in Brazil’s nascent crypto market.

How will the unit expand Itaú’s crypto products?

The new division will develop a range of products from conservative, fixed‑income‑style crypto funds to higher‑volatility strategies such as derivatives and staking‑based funds. It builds on Itaú Asset’s existing Bitcoin ETF and a retirement fund that already provide digital‑asset exposure to clients.

What market context supports this move?

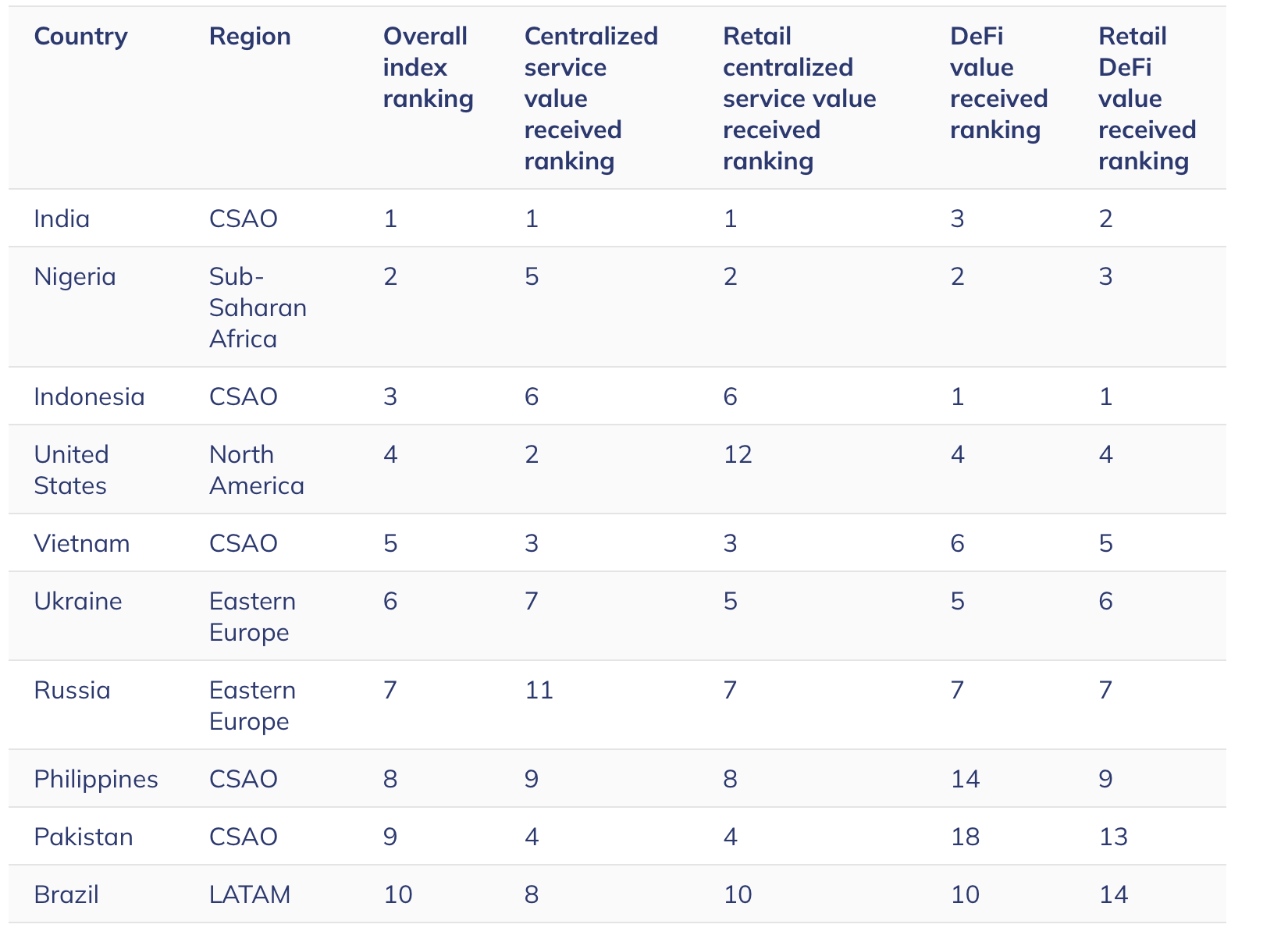

Brazil ranks highly in regional crypto adoption and was 10th globally in Chainalysis’ 2024 Global Crypto Adoption Index. The regulatory environment has evolved with comprehensive crypto rules introduced in 2023 and continuing policy debates in 2024–2025, creating both opportunity and regulatory monitoring needs for institutional products.

Source: Chainalysis, 2024 Global Adoption Index

Source: Chainalysis, 2024 Global Adoption Index

Why does Itaú see alpha in crypto?

Itaú Asset describes the crypto segment as having “unique characteristics for generating alpha” due to its relative youth and higher volatility. The firm expects to capture differentiated returns through active management, derivatives and staking strategies combined with institutional custody and risk controls.

What are the regulatory and tax considerations?

Brazil implemented a comprehensive crypto law in 2023, giving regulators oversight and defining rules for virtual asset service providers. In 2025, a proposed flat tax on crypto capital gains provoked controversy and was revoked; regulatory clarity remains an evolving factor for product design and client reporting.

Frequently Asked Questions

Question: How can clients access Itaú’s crypto products?

Retail and institutional clients can access select crypto products through Itaú’s mutual funds platform and the bank’s mobile trading app, which already supports trading of major cryptocurrencies with custody provided by the bank.

Question: Is custody handled externally?

No. Itaú provides in‑house custody for the crypto pairs offered through its mobile app, aiming to maintain control over asset security and regulatory compliance for fund structures.

Key Takeaways

- Strategic expansion: Itaú Asset created a dedicated crypto division to scale digital‑asset fund offerings and capture market opportunities.

- Leadership: João Marco Braga da Cunha brings ETF and portfolio management experience to lead product development.

- Regulatory dynamics: Brazil’s evolving crypto laws and tax debates will influence product design and client adoption.

How to evaluate Itaú Asset crypto funds (HowTo schema implemented below)

Assess fund objectives, custody safeguards, fee structure and regulatory disclosures before allocating. Monitor performance relative to benchmarks and review staking/derivatives exposure for risk management.

Conclusion

The Itaú Asset crypto division positions one of Brazil’s largest asset managers to deliver expanded digital‑asset products within an institutional mutual funds framework. Itaú Asset will combine in‑house custody, ETF experience and active strategies to serve clients as Brazil’s crypto ecosystem and regulation continue to evolve. Monitor product filings and regulatory updates for timing and investor suitability.