Key Market Information for September 5th—A Must-Read! | Alpha Morning News

1. Top News: The SEC proposes a safe harbor for cryptocurrencies and reforms to broker-dealer regulations. 2. Token Unlock: $ENA

Selected News

1. Ethereum’s largest holding institution Bitmine has once again increased its holdings by 48,225 ETH, worth $207.54 millions

2. Crypto-friendly bank Lead Bank completes $70 millions financing at a $1.47 billions valuation, led by a16z and others

3. SEC proposes to provide a safe harbor for cryptocurrencies and reform broker-dealer rules

4. Justin Sun’s address transferred out 50 millions WLFI before being blacklisted by WLFI, with a remaining holding of 545 millions worth $102.3 millions

5. Musk’s X Money plan is hindered by regulatory issues and employee turnover

Articles & Threads

1. "Trump Family Strikes Again: American Bitcoin Makes Its US Stock Market Debut, Doubles Intraday Then Gives Back Most Gains"

Following the Trump family-backed "core token," the Trump family is once again leveraging the crypto banner to "raise funds" in the financial markets. On Wednesday, the 3rd (US Eastern Time), through a merger with peer Gryphon Digital Mining, the bitcoin mining and accumulation platform American Bitcoin was listed on Nasdaq under the stock ticker ABTC, with its share price surging on the first trading day. In early US trading, American Bitcoin once soared to $14.52, with an intraday gain of over 100%, but later gave back most of its gains, closing at $8.04, up about 16.5% at the close. Due to excessive price volatility, trading was temporarily halted during the session. American Bitcoin is held by Donald Trump Jr. and Eric Trump, the eldest and second sons of US President Trump. After completing the equity swap merger with Gryphon Digital Mining, Trump’s sons and another bitcoin miner Hut 8 Corp. together hold 98% of the company’s shares, with previous Gryphon investors holding the remaining shares. Following the listing of World Liberty Financial’s token WLTI on several crypto exchanges on Monday, American Bitcoin is the second major event this week in which the Trump family is pushing crypto assets into mainstream capital markets. Its listing is seen as the latest test of investor interest in Trump family-related crypto enterprises.

2. "Prediction Markets Bet on Waller as Fed Chair Succession Enters Critical Moment"

With 9 months left in Powell’s term, discussions about who will succeed as Federal Reserve Chair have reached a fever pitch. The Fed Chair may be the most powerful economic position in the world. A single word can cause dramatic swings in capital markets, and one decision can influence the flow of trillions of dollars. Your mortgage rate, stock market returns, and even crypto asset volatility are all closely tied to decisions made in this position. So who is most likely to be the next Chair? The market is gradually giving its own answer.

Market Data

Daily overall market capital heat (reflected by funding rates) and token unlocks

Data sources: Coinglass, TokenUnlocks

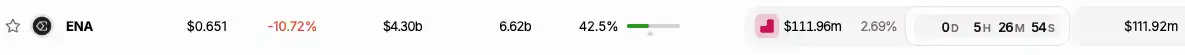

Token Unlocks

Funding Rate

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Federal Reserve Hawks Speak Out, Asset Price Crash Risk May Become New Obstacle to Rate Cuts

JPMorgan warns that if Strategy is removed from MSCI, it could trigger billions of dollars in outflows. The adjustment in the crypto market is mainly driven by retail investors selling ETFs. Federal Reserve officials remain cautious about rate cuts. The President of Argentina has been accused of being involved in a cryptocurrency scam. U.S. stocks and the cryptocurrency market have both declined simultaneously. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Citibank and SWIFT complete pilot program for fiat-to-crypto PvP settlement.

Pantera Partner: In the Era of Privacy Revival, These Technologies Are Changing the Game

A new reality is taking shape: privacy protection is the key to driving blockchain toward mainstream adoption, and the demand for privacy is accelerating at cultural, institutional, and technological levels.

Exclusive Interview with Bitget CMO Ignacio: Good Code Eliminates Friction, Good Branding Eliminates Doubt

A software engineer's brand philosophy.