Litecoin banter: a playful social-media exchange between Litecoin’s official account and crypto influencer Benjamin Cowen drew wide attention and briefly shifted trader sentiment, with Litecoin up ~69% year-over-year but still well below its 2021 peak.

-

Playful social-media feud sparked renewed interest in Litecoin (LTC)

-

Litecoin is ~73% below its May 2021 high yet up ~69% over the past year (CoinMarketCap data).

-

Several asset managers (e.g., Grayscale, Canary Capital) have filed documents for Litecoin ETP/ETF products with the SEC.

Meta description: Litecoin banter: Litecoin vs Benjamin Cowen exchange draws traders’ attention—read market context, data and implications for LTC. Analyze now with COINOTAG insight.

After Benjamin Cowen mocked Litecoin’s price action, Litecoin jabbed at his hairline, joking it “reminds me of the great recession.”

What happened in the Litecoin vs Benjamin Cowen exchange?

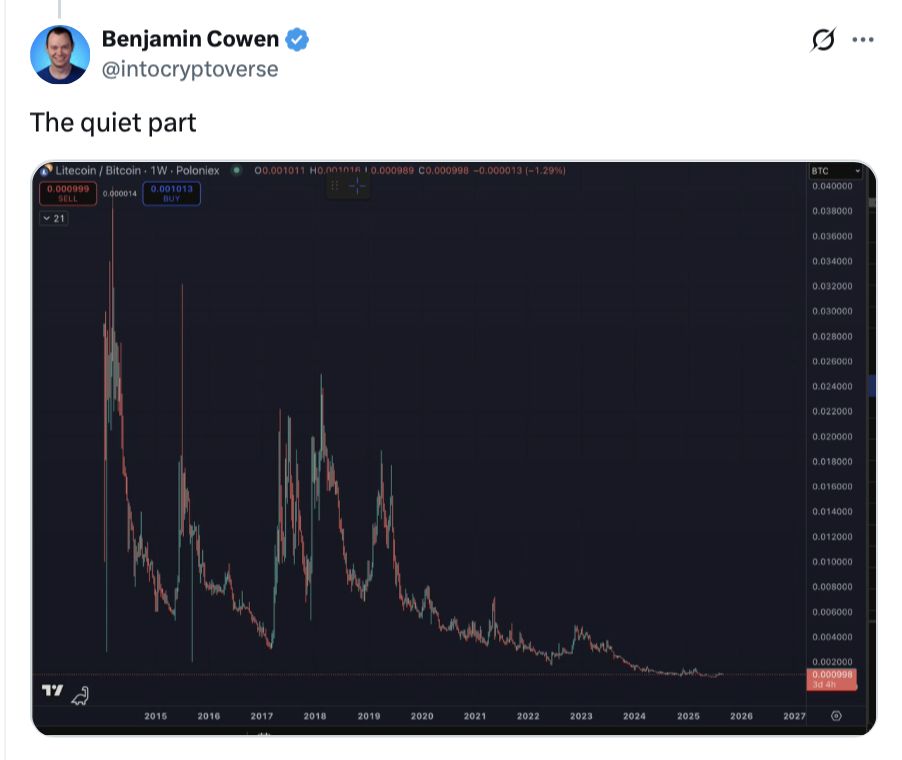

Litecoin banter began when crypto influencer Benjamin Cowen posted a chart poke at Litecoin’s long-term price action versus Bitcoin, prompting the official Litecoin X account to reply with a series of jokes. The exchange was light-hearted but quickly amplified community engagement and short-term trader sentiment.

Source: Benjamin Cowen

Source: Benjamin Cowen

How significant is Litecoin’s price context right now?

Litecoin (LTC) remains materially below its May 2021 all-time high of $410.26, down approximately 73%. Its market capitalization peaked near $25.89 billion and currently sits around $8.52 billion, per CoinMarketCap. Despite that, LTC has climbed roughly 69% over the past 12 months, indicating renewed investor interest.

Why did the wider crypto community react?

Litecoin’s official social account leans into memes and banter to engage its ~1.2 million X followers. Community members, including other project accounts like Dash, joined the thread, turning a niche chart joke into a wider conversation. Light-hearted spats like this often produce short-term increases in attention and retail trading volume.

Source: Dash

Source: Dash

How did traders respond?

Some traders publicly shifted tone to bullish after the exchange; one named trader posted “Buying Litecoin immediately.” The dialogue coincided with ongoing institutional activity: asset managers such as Grayscale and Canary Capital have filed documents with the U.S. Securities and Exchange Commission (SEC) to list Litecoin-focused exchange-traded products.

What are the fundamentals behind this social-media-driven attention?

Short-term social media attention does not equate to long-term fundamental change, but it can influence retail flows and volatility. Key data points to watch:

- Price history: ~73% below May 2021 ATH, ~69% Y/Y gain (CoinMarketCap).

- Market cap: current ~ $8.52 billion (CoinMarketCap).

- Regulatory filings: Grayscale and Canary Capital have filed U.S. documents related to Litecoin ETP/ETF proposals (SEC filings referenced in plain text).

Frequently Asked Questions

Did the Litecoin–Benjamin Cowen exchange move the market?

Short-term attention rose and some traders publicly signaled buying interest, but there is no evidence yet of a sustained market trend directly caused by the exchange. Price movements should be evaluated with on-chain and market data.

Are there Litecoin ETFs coming to the U.S.?

Asset managers including Grayscale and Canary Capital have submitted filings related to Litecoin exchange-traded products with the U.S. SEC; these filings are public regulatory documents and may affect institutional demand if approved.

What is Litecoin’s long-term outlook based on current data?

Litecoin’s long-term fundamental outlook depends on adoption, network activity, macro liquidity and ETF/ETP approvals. Current data shows significant historical drawdown from 2021 highs but strong Y/Y gains, which some traders interpret as a recovery signal.

Key Takeaways

- Social-media matters: Playful banter can drive attention and short-term sentiment.

- Mixed metrics: LTC is far below its ATH but up materially year-over-year.

- Watch filings: Pending ETP/ETF filings by Grayscale and Canary Capital are important for institutional inflows.

Conclusion

This Litecoin banter episode highlights how social media can quickly reshape community sentiment and draw traders’ focus to assets like Litecoin. Monitor price action, market-cap metrics and regulatory filings for a clearer signal; for ongoing coverage and data-driven analysis, follow COINOTAG updates and regulatory disclosures.