Ethereum slip below $4,300 has caught traders’ attention, with analysts warning of a possible bear trap ahead. At the same time, Solana is attracting institutional inflows, while MAGACOIN FINANCE is being talked about as a safe haven altcoin to diversify into, with its price increasing every hour and still under $0.001.

Ethereum Faces a Possible Bear Trap

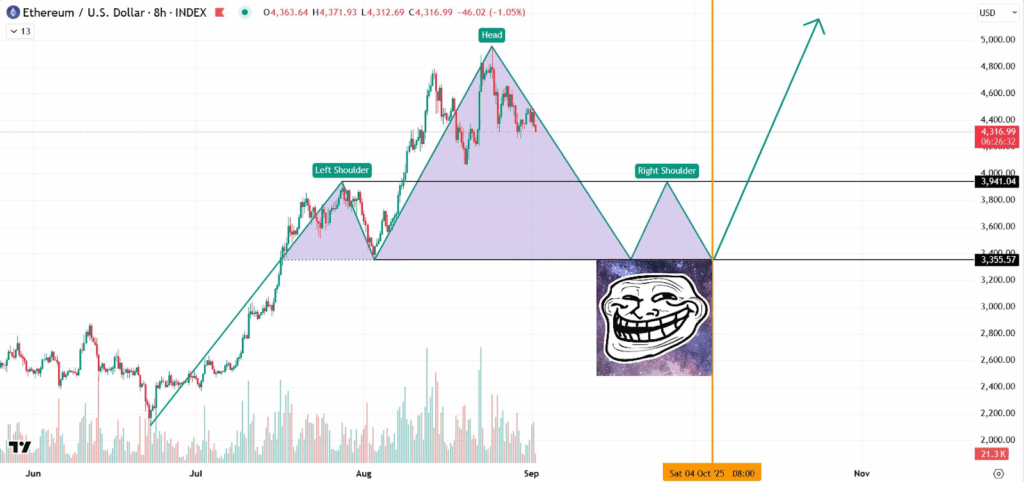

Ethereum has dropped below the $4,300 mark, leading to mixed reactions among traders. Some analysts, including Johnny Woo, suggest the correction could be short-lived and even set up for a “bear trap.”

Woo noted that the market may attempt to spook traders with bearish patterns in September, only to reverse in October. This would leave those who sold early scrambling to re-enter at higher prices.

The scenario outlined involves Ethereum sliding into the mid-$3,000 range before recovering strongly later in the year. Similar market behavior occurred in 2021, when Ether fell by nearly 30% in September before bouncing to an all-time high in November.

Other voices in the space caution against relying solely on charts, instead pointing to macroeconomic factors such as the U.S. Federal Reserve’s decisions and regulatory changes shaping Ethereum’s path.

Despite the recent dip, Ethereum remains one of the most widely used platforms for decentralized applications and payments, making it a key asset for both retail and institutional market participants.

Solana Gains Institutional Backing

While Ethereum consolidates, Solana is drawing attention from large investors. According to market data, Solana’s DeFi total value locked (TVL) has hit $11.78 billion, its highest since January. This suggests renewed confidence in the blockchain’s high-speed and scalable infrastructure.

Adding to the buzz, Galaxy Digital, Multicoin Capital, and Jump Crypto are working on a $1 billion corporate treasury dedicated to Solana. This initiative, supported by the Solana Foundation, could become the largest institutional holding in the network to date.

If completed, the move would surpass reserves held by companies such as Upexi Inc. and the DeFi Development Corporation.

Solana’s token price sits near $200, up over 6% in the last 30 days, and forecasts for 2025 range between $400 and $750. Some even project levels above $1,600 by 2030.

Solana’s strong adoption in DeFi and memecoins keeps it positioned as one of the most active blockchains on the market.

MAGACOIN FINANCE: Market Alternatives

Amid this rotation, MAGACOIN FINANCE is being highlighted as an alternative option. Unlike Ethereum’s volatility and Solana’s institutional exposure, MAGACOIN may offer traders a hedge and diversification option.

Its appeal grows as its price shows frequent movement, while still trading under $0.001. Some consider it a crypto worth paying attention to, as altcoin rotations could increase interest. For traders looking for an entry point, this could be the moment to observe MAGACOIN's performance.

Positioning Ahead

With Ethereum correcting and Solana gaining institutional traction, traders are weighing their next moves. Diversifying across major blockchains while considering a hedge like MAGACOIN FINANCE could be a balanced approach. The current market setup leaves little room for hesitation.