- Market cap coin fell from $1.87B to $1.79B, closing near daily lows as selling pressure dominated.

- Official Trump Struggles: Despite early peaks above $1.68B, the token ended near $1.66B, highlighting persistent downward bias.

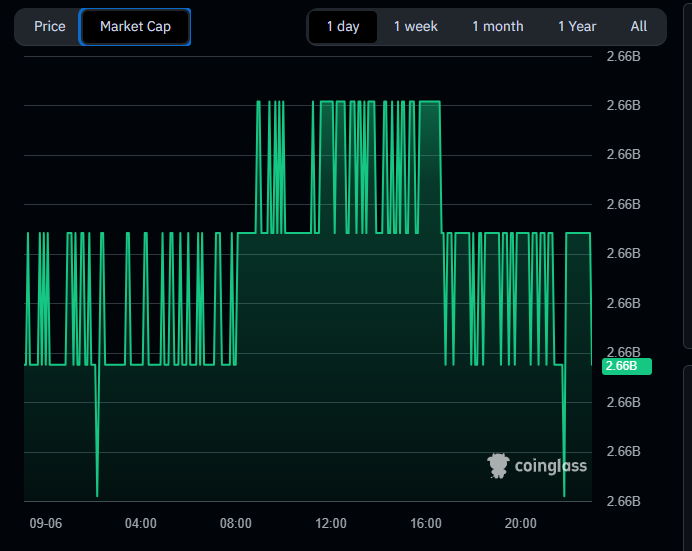

- World Liberty Financial USD Volatility: Trading stayed near $2.66B but showed erratic spikes and drops, signaling unstable liquidity conditions.

Altcoin markets showed mixed yet downward-leaning activity across the past day, with Pudgy Penguins, Official Trump, and World Liberty Financial USD reflecting weakness. Price charts revealed declining momentum, unstable liquidity, and limited rebound strength across these tokens. The day ended with market caps slipping near session lows, reinforcing a bearish trend.

Pudgy Penguins Market Activity

Pudgy Penguins recorded a clear downward pattern across the day, falling from near $1.87B to around $1.79B. Early activity showed several upward spikes, but momentum quickly weakened under consistent selling. Market pressure erased initial gains and left the token under sustained bearish sentiment.

Source:Coinglasss

During midday, activity attempted stabilization, though recovery attempts failed to build strength. Weak rebounds quickly faded and the market resumed its downward direction. The overall trend signaled limited demand and confirmed weaker participation across trading.

By evening, Pudgy Penguins closed near its daily bottom, underlining limited buying strength. The token faced resistance at higher levels throughout the session. The decline reflected broader weakness in market demand for NFT-based projects.

Official Trump Market Activity

The Official Trump token displayed mixed but generally negative trading behavior, fluctuating between $1.66B and $1.68B. The day began with a climb, supported by peaks above $1.68B, though momentum slowed quickly. As selling strengthened, the market lost traction and drifted downward.

Source: Coinglass

By midday, the token dropped below $1.67B and struggled to regain upward strength. Rebounds were weak and inconsistent, showing limited demand during afternoon trading. The chart captured a choppy pattern with repeated dips and quick reversals.

The session ended near $1.66B, confirming a net loss compared with earlier highs. Pressure outweighed demand through late trading hours. The performance emphasized a weakening trend across political-themed tokens.

World Liberty Financial USD Market Activity

World Liberty Financial USD presented an irregular pattern throughout the day, holding around $2.66B. The chart revealed sharp spikes and drops, pointing to unstable activity. The structure reflected inconsistent liquidity and frequent erratic movements.

Source: Coinglass

Midday levels were closer to the upper band, but strength proved temporary. Evening movements showed more volatility, with sudden dips dragging the market back down. These fluctuations highlighted unstable market conditions and inconsistent participation.

By the session close, the token hovered near $2.66B, though weakness dominated late performance. Market behavior underscored fragmented participation and a lack of steady direction. The irregular chart pattern reflected uncertainty within this asset’s trading base.