ETH Inflation Dilemma: Caused by the Successful Cancun Upgrade?

At what gas level will ETH begin to experience deflation?

At what gas level does ETH start to become deflationary?

Written by: 0XNATALIE

The Ethereum Execution Layer Meeting 195 discussed a proposal to adjust the minimum base fee for blobs. Blobs, introduced in the Cancun upgrade via EIP-4844, are a type of data storage used to store and process data on Ethereum at a lower cost. The current minimum base fee (MIN_BASE_FEE_PER_BLOB_GAS) is set at 1 wei. SMG researcher Max Resnick proposed increasing this minimum fee to accelerate fee adjustments during network congestion.

Raising the Blob Base Fee: Remedy or Poison?

The minimum base fee is the lowest fee required to process blob data. Since the implementation of EIP-1559, Ethereum's gas structure has changed. Previously, Ethereum transaction fees were determined by an auction mechanism: the higher the user's bid, the higher the priority for their transaction to be included in a block. This mechanism led to bidding wars among users during network congestion, causing transaction fees to spike unpredictably. EIP-1559 split gas fees into two parts: the base fee and the priority fee (tip). The base fee for each transaction is burned and automatically adjusts based on network congestion. When network activity is high and block space is heavily utilized, the base fee rises accordingly, making transaction costs more predictable and slowing ETH inflation by burning a portion of ETH. Users can still incentivize miners with tips, but these are not burned and are paid as rewards to miners. Setting a minimum base fee for blobs means that even when the network is idle, the cost to process blob data will not fall below this minimum. Raising this minimum increases the cost for L2s to submit data to the mainnet, theoretically burning more ETH.

Max proposed increasing the minimum base fee from 1 wei to 160,217,286 wei, aiming to reduce the time needed for price adjustments to reach reasonable levels. He believes that the current blob price increases too slowly during price discovery (i.e., determining the appropriate blob gas price), taking about 160 blocks (approximately 32 minutes) to reach a reasonable price from zero. This delay means it takes too long to reach appropriate fee levels when the network starts to become congested. By raising the minimum base fee to a value closer to a reasonable price, fees can reach the appropriate level more quickly, ensuring that the Ethereum network can process transactions and blob data more rapidly and stably. Max believes that adjusting to 160,217,286 wei will not significantly increase the final blob gas price but will greatly shorten the time needed for prices to reach equilibrium.

Community Opinions

This proposal sparked heated discussion in the community. Ryan Berckmans opposed raising the blob base fee, arguing that Ethereum's current strategy is to attract more users and developers by offering low-cost or even free data availability (DA) during periods of low congestion, thereby building network effects. This strategy is similar to "capturing the market" first to gain greater market share and ecosystem value in the future. He believes that increasing fees would raise market barriers and weaken the network's neutrality, and since the blob market is not yet fully stable, such an adjustment should not be rushed.

Blockworks team member D believes that raising the minimum fee not only fails to address Ethereum's current scaling issues but also weakens Ethereum's competitiveness in data availability services. He advocates for scaling L1 to increase execution fees and making DA services cheaper to enhance Ethereum's overall competitiveness and attract more rollups, further expanding ETH's usage and demand. clusters founder foobar holds a similar view, arguing that raising fees is short-sighted, would damage Ethereum's credibility, and could lead rollups to migrate to alternative chains like Celestia, undermining Ethereum's core value.

Nethermind contributor Bena Adams supports the proposal. Bena mentioned that although the economic difference between 1 wei and 1 gwei is small, 1 wei as the minimum unit is indeed inappropriate when the Ethereum network faces congestion. While fees theoretically increase with congestion, the minimum unit of 1 wei causes fee growth to be too slow, failing to reflect actual network congestion in a timely manner and thus unable to regulate network demand effectively.

Ethereum researcher Potuz pointed out that if the beacon chain (CL) rather than the execution layer (EL) set this fee, the minimum fee might have been set directly at 1 Gwei (i.e., 1 billion wei), since the beacon chain uses the uint64 data type for fees instead of uint256. uint64 has lower precision when handling decimals, so it typically wouldn't use a value as small as 1 wei as the minimum fee unit. Therefore, if the fee had originally been set by the beacon chain, this controversy over the minimum fee unit being too small might never have arisen.

Can This Really Alleviate ETH Inflation?

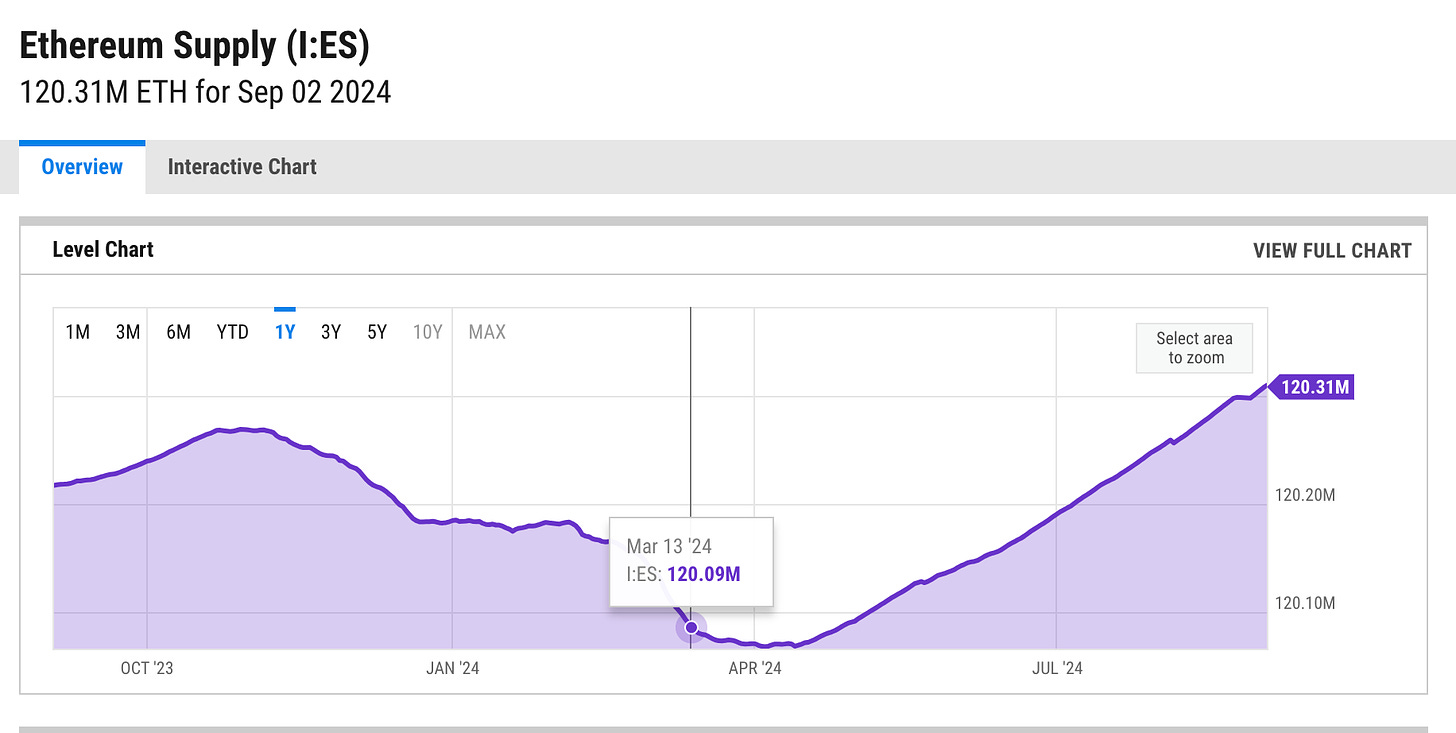

Additionally, supporters of raising the minimum blob base fee argue that doing so can help alleviate ETH inflationary pressure. For example, Cygaar from the Abstract team believes that before the implementation of EIP-4844 (March 13, 2024), rollups were the main source of ETH gas consumption. However, the current blob price is almost free for rollups, and Ethereum gains almost no value from L2 DA costs. A short-term solution is to raise the blob base fee, increasing burning and thus reducing ETH inflationary pressure.

However, ambient founder Doug Colkitt pointed out that currently, although blob space utilization on the Ethereum network has reached about 80%, this space is mainly occupied by low-value spam transactions. These low-value transactions are very sensitive to fee changes, meaning that if blob fees increase even slightly, these transactions will quickly decrease or disappear altogether. Ultimately, this will not significantly increase ETH's burn rate.

When Will ETH Start to Become Deflationary?

Setting blobs aside, at what base fee level per Ethereum block will ETH start to become deflationary?

ETH has no supply cap. Under the PoS mechanism, ETH's annual issuance mainly depends on the amount of staked ETH and overall network activity. As the amount of staked ETH increases, issuance rises accordingly, while the burn mechanism introduced by EIP-1559 partially offsets this growth. After EIP-1559, the annual issuance rate is about 0.5-2% (depending on the amount of staked ETH and network activity), with a target average block size of 15,000,000 gas and an average block time of 12.05 seconds. ETH will start to become deflationary when the amount burned exceeds the annual issuance.

The ETH burned per block equals the sum of the base fees for all transactions in that block, calculated as: base fee × block size (target value 15,000,000 gas). The annual burn is: ETH burned per block × number of blocks per year (with an average block time of 12.05 seconds, there are approximately 2,620,000 blocks per year).

Assuming an annual ETH issuance of 1%, with the current supply of 120,330,000 ETH, this is about 1,203,300 ETH. For ETH to become deflationary, the annual burn must exceed 1,203,300 ETH. Therefore, the following relationship can be established:

Base fee × 15,000,000 × 2,620,000 > 1,203,300

Calculations show that when the base fee is about 30.62 Gwei, ETH can start to become deflationary. Similarly, if the annual ETH issuance is 0.5%, the base fee needs to be about 15.31 Gwei for ETH to become deflationary. If the annual ETH issuance is 2%, the base fee needs to be about 61.23 Gwei for ETH to become deflationary.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Do Kwon’s Sentence: Could a Shorter Prison Term Await in South Korea?

JP Morgan’s move to Ethereum proves Wall Street is quietly hijacking the digital dollar from crypto natives

Solana News: Network Begins Testing Post-Quantum Cryptography

Did MicroStrategy make the worst bitcoin purchase in 2025?