Analyst: September Rate Cut Almost Certain, Options Traders Expect Stable Stock Market

Jinse Finance reported that as a Federal Reserve rate cut in September has almost become a foregone conclusion, options traders generally expect the stock market to remain stable ahead of Thursday's CPI data release. The logic behind the market's expectation of a rate cut lies in the stagnation of U.S. employment growth and the need to stimulate the economy. Weak employment data on Friday further reinforced expectations of a 25 basis point rate cut. Although U.S. stocks fell slightly and the fear index rose marginally, it still remained below the key level of 20. Options traders expect the S&P 500 Index to experience about a 0.7% two-way fluctuation after the CPI is released on Thursday.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

OpenAI report: Enterprise AI applications surge

BlackRock: The wave of capital flowing into AI infrastructure is far from peaking

US crypto stocks opened higher, with MSTR up 2.61% and BMNR up 4.9%.

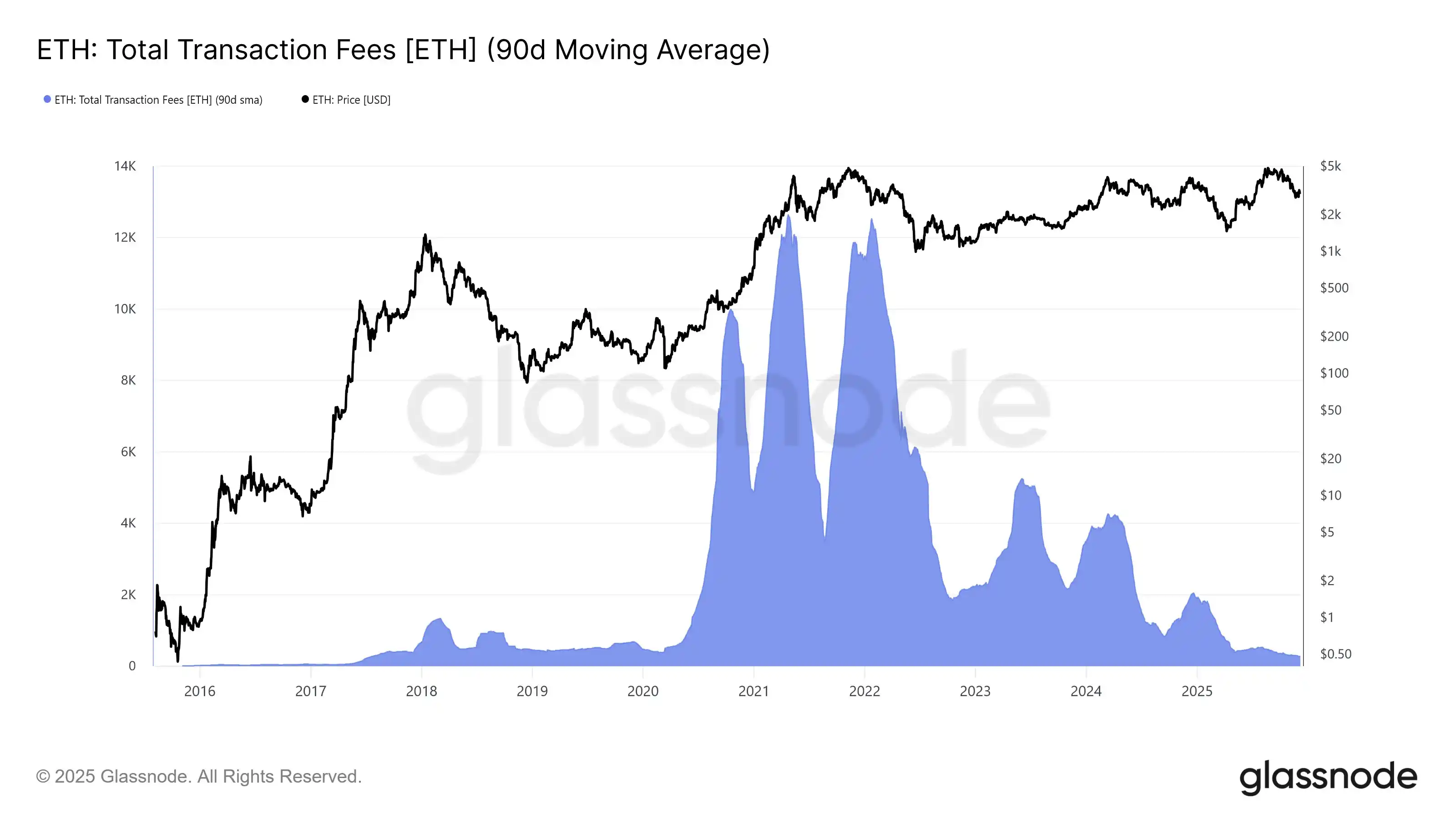

Ethereum network’s average daily total transaction fees hit the lowest level since July 2017