Tether denies Bitcoin sell-off rumors, confirms buying BTC, gold, land

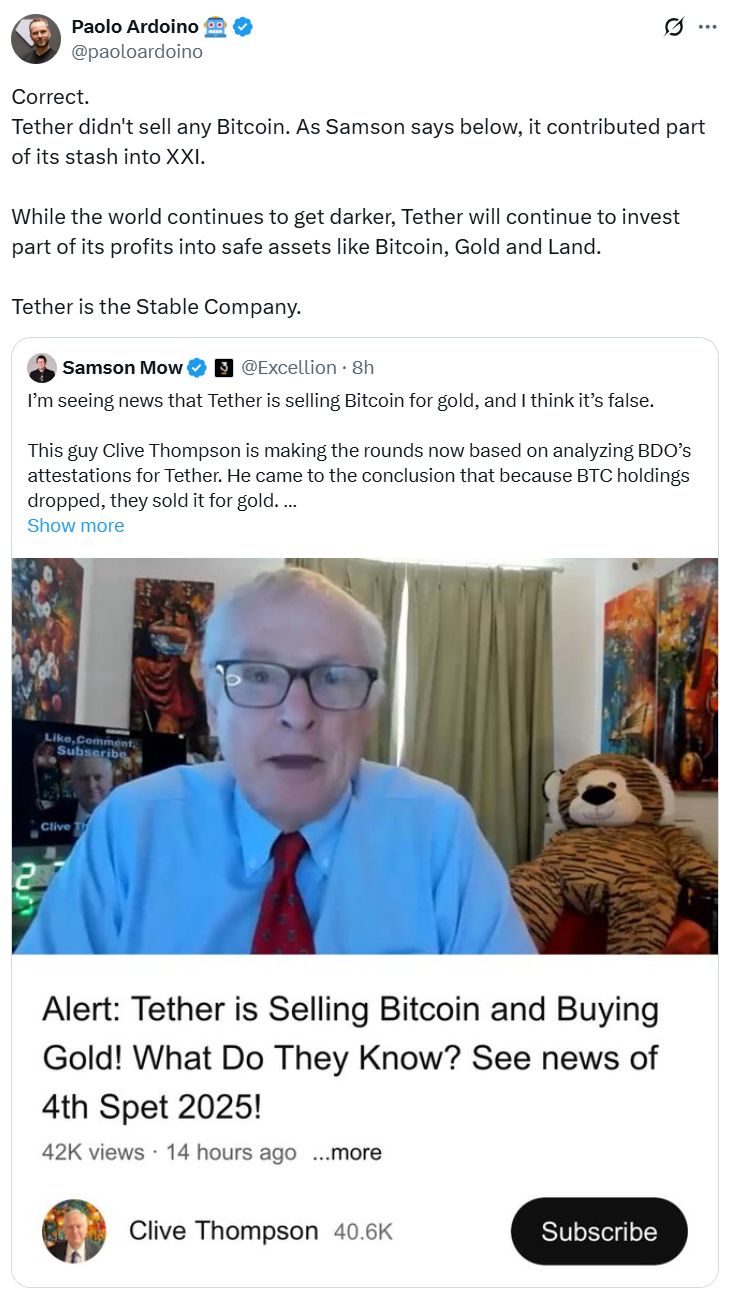

Tether CEO Paolo Ardoino has denied recent rumors that the stablecoin issuer is offloading its Bitcoin holdings to buy gold.

In a Sunday post on X, Ardoino said the company “didn’t sell any Bitcoin,” and reaffirmed its strategy of allocating profits into assets like “Bitcoin, gold, and land.”

The comments came in response to speculation from YouTuber Clive Thompson, who cited Tether’s Q1 and Q2 2025 attestation data from BDO to claim the firm had reduced its Bitcoin (BTC) position. Thompson pointed to a drop from 92,650 BTC in Q1 to 83,274 BTC in Q2 as evidence of a sell-off.

However, Jan3 CEO Samson Mow debunked the claim, noting that Tether transferred 19,800 BTC to a separate initiative called Twenty One Capital (XXI) during the same period. That included 14,000 BTC sent in June and another 5,800 BTC in July.

Related: Tether holds talks to invest across gold supply chain: Report

Tether moves $3.9 billion in BTC to XXI

In early June, Tether moved over 37,000 BTC, worth approximately $3.9 billion, across numerous transactions to support XXI, a Bitcoin-native financial platform led by Strike CEO Jack Mallers.

“Tether would have had 4,624 BTC more than at the end of Q1 if the transfer is accounted for,” Mow explained, adding that the firm actually increased its net holdings.

Ardoino echoed the explanation, saying the Bitcoin was moved, not sold. “While the world continues to get darker, Tether will continue to invest part of its profits into safe assets,” he wrote.

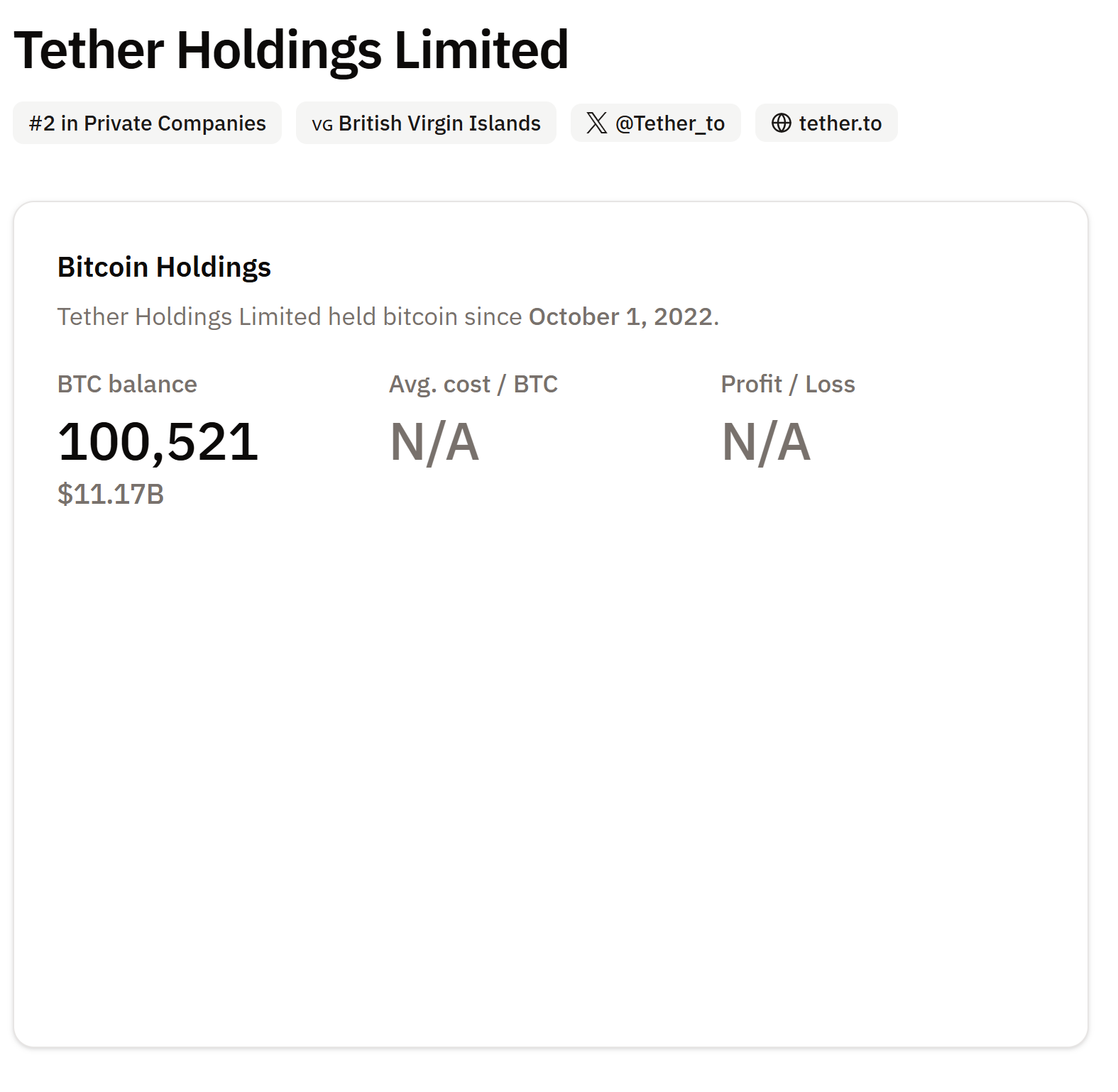

Tether, the issuer of the USDt (USDT) stablecoin, holds over 100,521 BTC, worth around $11.17 billion, according to data from BitcoinTreasuries.NET.

Related: Tether scraps plan to freeze USDT on five blockchains

El Salvador buys $50 million in gold

Tether’s Bitcoin sell-off rumors came as El Salvador revealed it has added 13,999 troy ounces of gold worth $50 million to its foreign reserves, marking its first gold acquisition since 1990. The central bank said the move is part of a diversification strategy to reduce reliance on the US dollar.

Before turning to gold, El Salvador built a $700 million Bitcoin reserve, holding 6,292 BTC. However, an International Monetary Fund report in July claimed that the Central American country has not made any new Bitcoin purchases since February.

Magazine: Bitcoin is ‘funny internet money’ during a crisis: Tezos co-founder

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Terra Luna Classic Shakes the Crypto Market with Surprising Developments

In Brief LUNC experienced a significant price decline following Do Kwon's sentencing. The court cited over $40 billion losses as a reason for Do Kwon's penalty. Analysts suggest short-term pressure on LUNC may persist, despite long-term community support.

NYDIG: Tokenized Assets Offer Modest Crypto Gains as Growth Depends on Access and Regulation

Cardano Investors Split As Market Fatigue Sets In