On September 8, 2025, Eric Trump, the second son of U.S. President Trump, issued a statement on social platform X (formerly Twitter), explicitly denying any potential business association with an Asian company. The statement was prompted by a photo of him with the CEO of the company, which some interpreted as possibly involving an acquisition or cooperation deal. In his statement, Eric emphasized that he did not know the person in the photo, had not participated in the company’s affairs, and reiterated that his only partner in Asia is the Japanese bitcoin reserve company Metaplanet.

The incident originated on September 5, when a user shared a photo on X of Eric with the CEO of abc company (formerly GFA). The user claimed: “After seeing this photo, overseas individuals flocked to buy.” abc company is a publicly listed Japanese company mainly engaged in crypto-related business, and its stock price had previously fluctuated due to market rumors. The photo was reportedly taken during Eric’s attendance at a conference in Asia, but was quickly interpreted as a potential business signal, causing abc’s stock price to fluctuate in the short term.

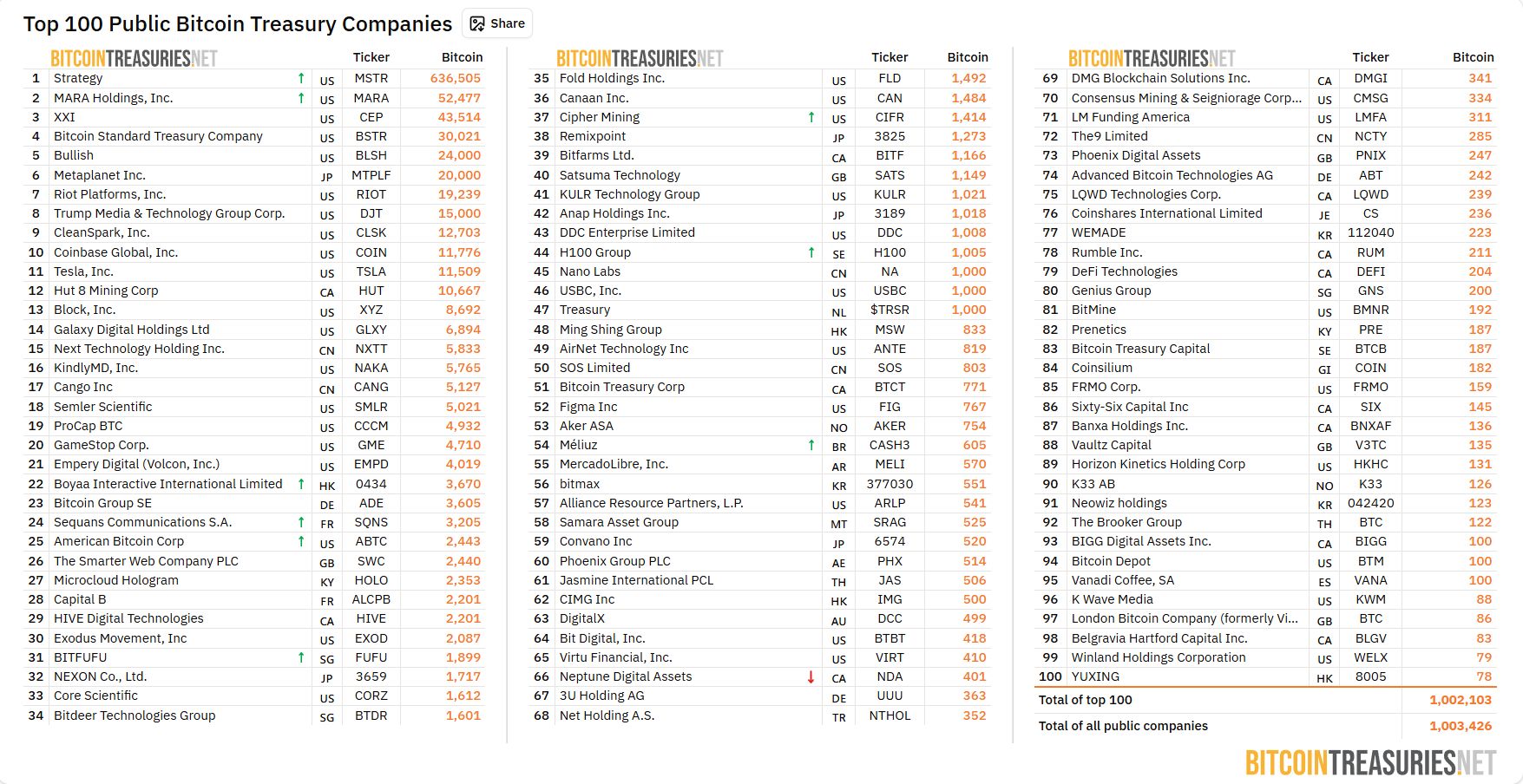

As early as March 2025, Eric was appointed as a member of Metaplanet’s Strategic Advisory Board. The company’s founder and CEO, Simon Gerovich, described Eric as “a global leading advocate for digital asset adoption.” Metaplanet was formerly a hotel operator, but shifted to crypto assets due to the impact of the COVID-19 pandemic. Influenced by U.S. bitcoin reserve pioneer Michael Saylor, Metaplanet began aggressively purchasing bitcoin in April 2024 and now holds more than 20,000 bitcoins, with a total value exceeding $2 billion, making it the world’s sixth-largest publicly listed bitcoin holder.

Eric’s trip to Asia further solidified this partnership. At the end of August, he attended the Bitcoin Asia conference in Hong Kong, where he predicted that the price of bitcoin would reach $1 million within a few years. He praised Gerovich’s strategy and said that he spends 90% of his time in the crypto community. Subsequently, on September 1, Eric appeared at Metaplanet’s special shareholders’ meeting in Tokyo to support the company’s overseas issuance plan of up to 130.3 billion yen (about $884 million), mainly for purchasing more bitcoin. The atmosphere at the meeting was enthusiastic, shareholders approved the plan, and Eric and Gerovich took the stage in matching Metaplanet jerseys, emphasizing bitcoin’s potential as an inflation hedge.

The Trump family’s expansion in the crypto field is not an isolated event. Since his father Donald Trump was elected president, he has pledged to be the “crypto president,” promoting policy support for digital assets to enhance the dollar’s dominance and banking system efficiency. Eric and his brother Donald Trump Jr. co-founded American Bitcoin Mining Company (ABTC), which was listed on Nasdaq on the 3rd of this month. The company already holds a large amount of bitcoin and is seeking expansion in Asia. The family business has benefited from the shift in U.S. policy, including the 2025 GENIUS Act and CLARITY Act, which provide a clear framework for stablecoins and digital asset classification, reducing uncertainty for institutional investors.

In 2025, Japan included digital assets in the Financial Instruments and Exchange Act (FIEA), launched regulated bitcoin ETFs, and incorporated crypto into Nippon Individual Savings Accounts (NISA), with the scale of crypto asset management expected to triple within two years. Capital gains tax was reduced from 55% to 20%, attracting global capital inflows. Metaplanet aims to hold 210,000 bitcoins by 2027, with a strategy emphasizing bitcoin as an inflation hedge, targeting an annualized return of 7-12%, far exceeding traditional assets. Eric’s involvement injects geopolitical credibility into the company and bridges the U.S. and Japanese crypto markets.

According to data, Metaplanet’s stock price has risen 740% in the past 12 months, far surpassing the 13% increase of the TOPIX index. After Eric’s clarification, the stock may further benefit from positive exposure, and bitcoin in the crypto market also rebounded amid volatility. Investors should pay close attention. Analysts point out that such events highlight the role of social media in asset pricing, as celebrity statements can instantly reverse narratives.

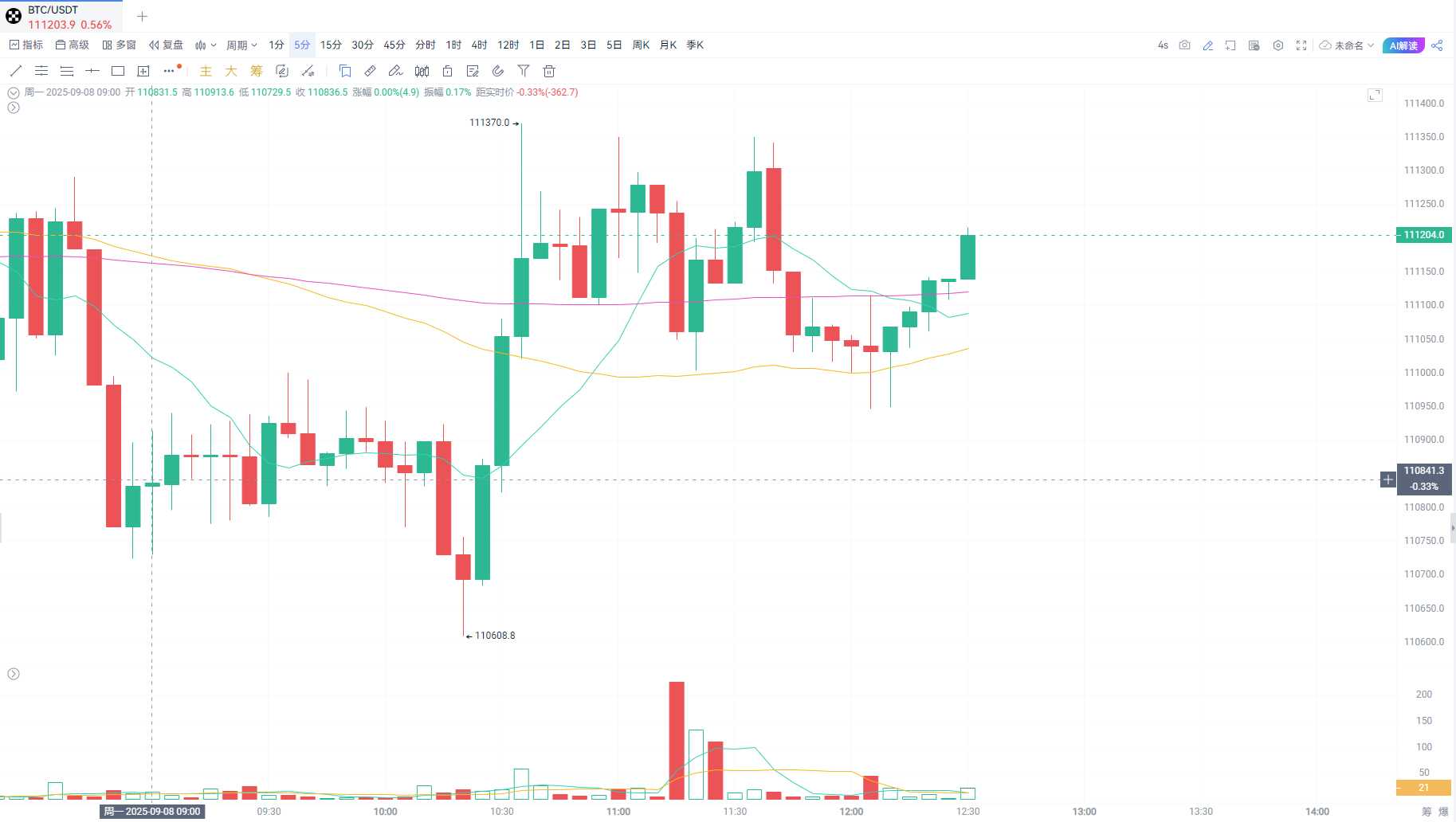

- MACD: On the hourly chart, DIF and DEA are close to the zero axis, the histogram has turned from green to red, and momentum is strengthening; on the daily chart, it is still in a weak area, but bearish momentum is weakening.

- RSI: The hourly RSI is 54.54, in a neutral-to-strong zone and not overbought; the daily RSI is 58.52, indicating a recovery in market sentiment.

- EMA: On the hourly chart, EMA7 (111,113.50) has crossed above EMA30 (111,004.59), indicating a positive short-term trend; EMA120 (110,844.27) provides broader cycle support.