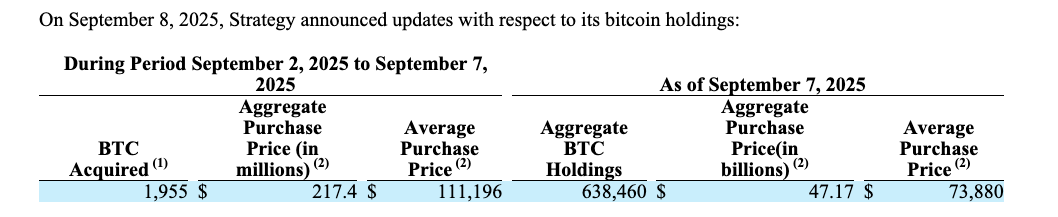

Strategy’s Bitcoin holdings stood at 638,460 BTC after it acquired 1,955 BTC between Sept. 2–7, increasing its total cost basis to about $47.2 billion and an average price of $73,880 per coin, according to a Form 8‑K filing and market price data.

-

Strategy added 1,955 BTC for $217.4M between Sept. 2–7 (Form 8‑K)

-

New coins bought at an average of $111,196 each as BTC briefly topped $113,000 (CoinGecko price data).

-

Strategy now holds 638,460 BTC, purchased for ~ $47.2B at an average price of $73,880 per BTC.

Strategy Bitcoin holdings rise to 638,460 BTC after a 1,955 BTC buy; read the SEC‑filed details and funding sources. Stay informed with COINOTAG coverage.

What are Strategy’s current Bitcoin holdings?

Strategy’s Bitcoin holdings total 638,460 BTC as of the latest Form 8‑K. The company reports the aggregate cost basis at approximately $47.2 billion and an average purchase price of $73,880 per BTC, reflecting cumulative acquisitions across multiple months.

How did Strategy acquire the latest 1,955 BTC?

Between Sept. 2 and 7, Strategy purchased 1,955 Bitcoin for $217.4 million, per a Form 8‑K filed with the US Securities and Exchange Commission. The 1,955 BTC were bought at an average price near $111,196 each as Bitcoin briefly traded above $113,000 (CoinGecko market data).

An excerpt from Strategy’s Form 8‑K. Source: SEC

An excerpt from Strategy’s Form 8‑K. Source: SEC

Strategy funded the latest purchases using proceeds from at‑the‑market (ATM) equity offerings, including Series A Perpetual Strike Preferred Stock (STRF), Series A Perpetual Strike Preferred Stock (STRK), and common stock (MSTR). The company has continued a steady buying cadence following larger purchases earlier in the summer.

How does this purchase compare to prior months?

August purchases were smaller, totaling roughly 7,714 BTC for the month. By contrast, July saw substantially larger accumulation at 31,466 BTC and June recorded 17,075 BTC. The latest 1,955 BTC fits the pattern of ongoing accumulation, but at a reduced monthly pace versus July.

Why does average cost differ from recent trade price?

The reported average cost per BTC of $73,880 reflects aggregated purchases over multiple years and price cycles. Recent buys at an average of $111,196 reflect short‑term market levels during the Sept. 2–7 window, while the aggregate basis smooths earlier, lower‑priced accumulations.

Frequently Asked Questions

How many BTC did Strategy buy between Sept. 2 and Sept. 7?

Strategy purchased 1,955 BTC for $217.4 million during Sept. 2–7, as reported in its Form 8‑K filing with the SEC. The per‑coin average for that trade window was about $111,196.

What funding sources did Strategy use for the purchase?

Strategy used proceeds from multiple at‑the‑market equity offerings, including STRF, STRK, and MSTR common stock, to fund the most recent Bitcoin acquisitions.

Is the SEC filing the source for these figures?

Yes. The primary source for the transaction and holdings numbers is Strategy’s Form 8‑K filing with the US Securities and Exchange Commission; market pricing reference is CoinGecko.

Key Takeaways

- Ongoing accumulation: Strategy continues to buy BTC, adding 1,955 BTC in early September.

- Aggregate holdings: Total holdings now 638,460 BTC with a cumulative cost basis near $47.2 billion.

- Funding mechanism: Purchases funded via ATM equity programs (STRF, STRK, MSTR).

Conclusion

Strategy’s steady purchases reinforce its long‑term Bitcoin accumulation strategy, bringing total holdings to 638,460 BTC and a combined cost basis of roughly $47.2 billion. For investors and observers tracking institutional demand, the SEC Form 8‑K filing and market price feeds are the primary references; monitor COINOTAG coverage for updates.

Published by COINOTAG · Updated: 2025-09-08