Germany Misses Out on $5B in Bitcoin, Says Arkham

A report from Arkham reveals that about 45,000 bitcoins linked to the Movie2K site were never seized by Germany. Their value approaches 5 billion dollars. We provide all the details in this article.

In brief

- Arkham identifies 45,000 BTC linked to Movie2K, unseized and inactive since 2019.

- Germany will have to prove the illegal origin of the funds to hope to take control over the bitcoin funds.

Germany Faces a Complex Legal Procedure

Arkham Intelligence has just published an analysis pointing to a cluster of more than 45,000 BTC spread across about a hundred wallets. These funds would come from revenues generated by Movie2K. This is a movie piracy site active until the late 2010s.

According to Arkham, the BTC involved have not moved since 2019. This suggests they still belong to the former operators of the site. Specifically, the report states that the detected addresses show movements similar to those already associated with Movie2K during previous legal investigations.

No recent movement has been observed. The aggregate of wallets, still dormant, now reaches a value close to 4.99 billion dollars according to the current bitcoin price .

To recover these BTC, authorities will have to demonstrate their direct link to the illegal activities of Movie2K. A requirement that represents a heavy burden of proof, especially since the identified wallets remain technically out of reach of investigators.

Decoding: without private keys nor control over the addresses, the seizure remains legally and technically inaccessible. So far, no authority has publicly acknowledged the existence of these funds (despite their traceability).

Bitcoin Seizure: A Potential Loss of Several Billions for Berlin

This discovery comes a few months after a major operation. In January 2024, the German police had indeed obtained the voluntary surrender of 49,858 BTC by two suspects linked to Movie2K. Authorities described this recovery as the largest bitcoin seizure ever carried out in the country.

But these bitcoins were resold between June and July 2024, at an average price of $57,900. This generated a total estimated revenue of 2.8 billion dollars.

The unrealized gain thus now exceeds 2 billion dollars. This gap rekindles criticisms about the public management of digital assets, even though German law requires the rapid sale of volatile assets to limit loss risks.

In any case, this case reignites discussions around a sovereign strategy on bitcoin. The question remains whether Germany will decide to keep its BTC rather than liquidate them upon seizure. This direction would directly influence the country’s perception in the crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Unmissable: Quack AI’s Builder Night Seoul Summit Unites AI and Web3 Leaders on Dec 22

SIA: From a super AI trading platform to a functional on-chain AI ecosystem

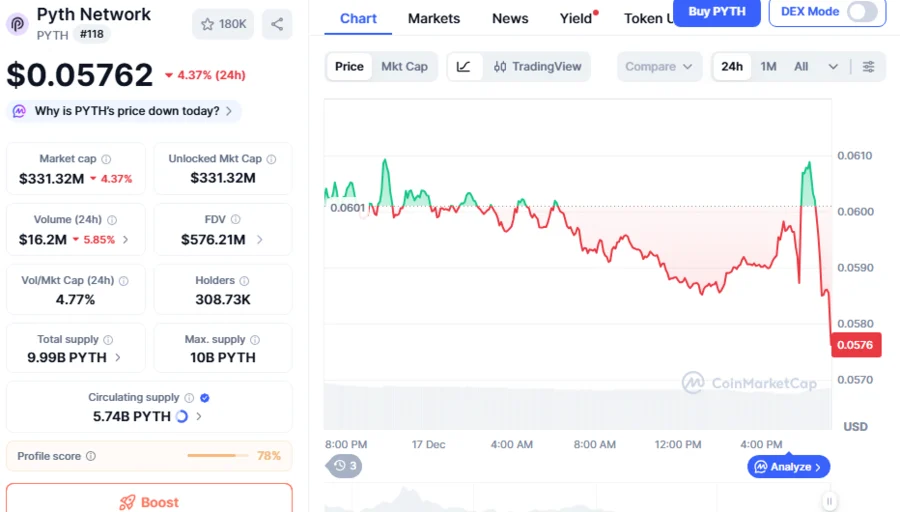

PYTH Drops 76% As Crypto Weakness Persists, Can New PYTH Network Reserve Trigger Market Rally?

Stunning Success: Sport.Fun’s FUN Token Sale Smashes 100% Target in One Day