Kazakhstan Pushes for National Crypto Reserve by 2026

Kazakhstan will launch a state crypto reserve and digital asset law by 2026. President Tokayev promotes digital tenge adoption, unveils CryptoCity, and oversees Central Asia’s first spot Bitcoin ETF to strengthen financial innovation.

Kazakhstan plans to launch a state-backed crypto reserve and pass a digital asset law by 2026. President Kassym-Jomart Tokayev ordered the National Bank’s investment arm to create a State Digital Asset Fund to hold key digital assets.

He also pledged to expand the digital tenge and push banking reforms that channel funds into high-tech ventures.

Tokayev Orders Creation of Digital Asset Fund

President Tokayev said in his annual address on Monday that Kazakhstan must “create a full-fledged ecosystem of digital assets as soon as possible.” He proposed a State Digital Asset Fund managed by the National Bank’s investment corporation, designed to accumulate a strategic reserve of cryptocurrencies and tokenized assets.

The president instructed lawmakers to finalize a digital asset law before 2026 to regulate tokenized platforms and welcome new competitors.

According to Akorda Press, Tokayev said the fund would accumulate a strategic crypto reserve, focusing on the most promising assets of the new digital financial system.

He added, “Given the current realities, we must focus on crypto-assets. A State Digital Asset Fund should be established under the National Bank’s investment corporation.”

In response, crypto influencer Mario Nawfal commented, “THE SNOWBALL EFFECT IS REAL.”

Digital Tenge Rollout, CryptoCity Vision, and First Bitcoin ETF

Kazakhstan has emerged as one of Central Asia’s most proactive nations regarding digital assets. They launched the digital tenge in pilot mode in November 2023 and began using it in public budgets by mid-2025. Kazakhstan uses the digital tenge to finance projects through the National Fund and plans to expand its role nationally.

Tokayev also confirmed plans for a “CryptoCity” in Alatau, a southeastern city with a population of about 52,000. He said the city would become “the first fully digitalized city in the region,” where residents can use crypto payments in daily life. He described it as a model for combining “technological progress and the most favorable living conditions,” part of a national strategy to embed digital assets into everyday commerce.

The country also introduced Central Asia’s first spot Bitcoin ETF in August, underscoring its drive to become a regional leader in digital finance. The fund, launched by Fonte Capital on the Astana International Exchange, directly holds Bitcoin with BitGo as custodian.

Kazakhstan is already a leading hub for Bitcoin mining. Due to cheap power and favorable regulations, it was once responsible for roughly 13% of global hashrate. Yet the mining boom strained the power grid and spurred illegal operations.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

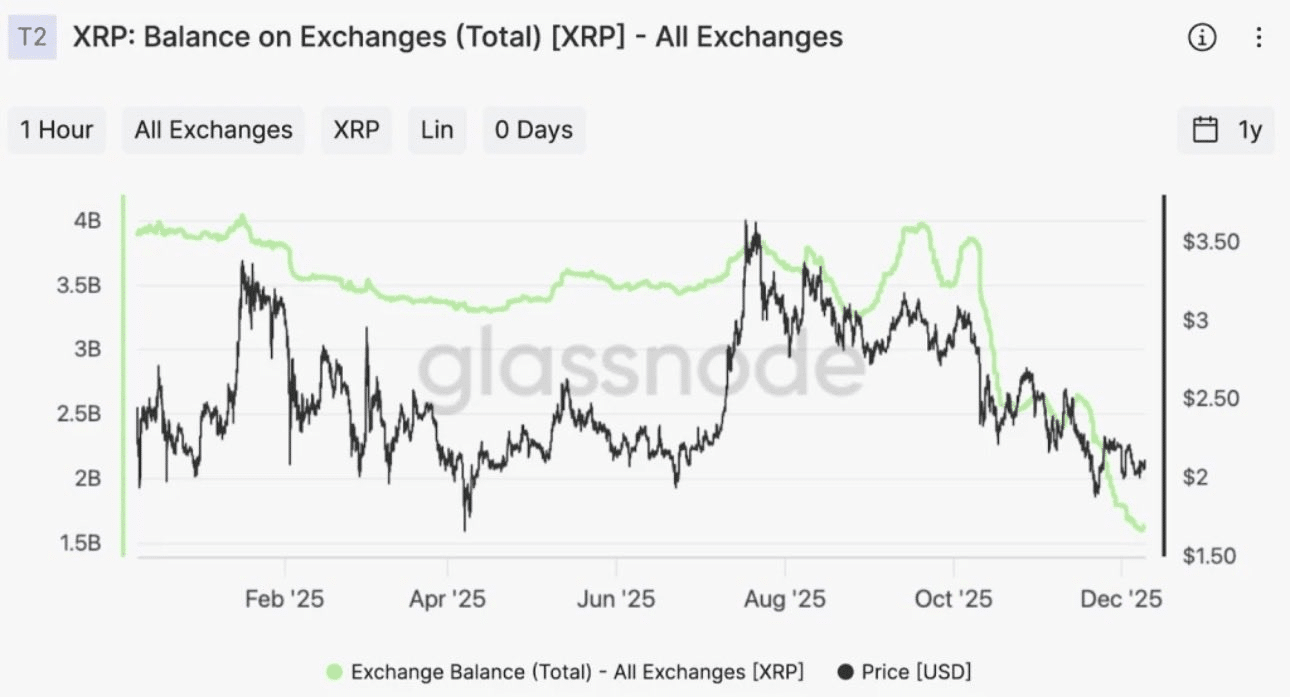

Reasons why XRP is poised to lead 2026 DESPITE drop below $2

BTC Exodus: Bitcoin ETFs See $825 Million in Outflows Over Five Trading Days

Bitcoin Nears Record Stretch of 1079 Days Without Heavy Selling as Market Holds Steady at High Levels

Ethereum’s TVL Could Explode in 2026 as Stablecoins and RWAs Expand