Solana CME futures open interest hits new high of $1.5B after launch of first US Solana staking ETF

Key Takeaways

- Solana CME futures open interest reached a new record of $1.5 billion.

- This surge began after the launch of the first US Solana staking ETF.

Solana CME futures open interest reached a new all-time high of $1.5 billion today, extending record demand that began building after the launch of the first US Solana staking ETF.

The milestone represents continued growth from August, when open interest first crossed the $1.0 billion threshold. The surge in institutional interest follows the introduction of the staking exchange-traded fund, which marked a significant development for Solana-based investment products in the US market.

Open interest measures the total number of outstanding derivative contracts that have not been settled, serving as an indicator of market activity and institutional participation in Solana futures trading.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tether financial analysis: Needs an additional $4.5 billion in reserves to maintain stability

If a stricter and fully punitive approach is applied to $BTC, the capital shortfall could range from 1.25 billion to 2.5 billion USD.

The fundraising flywheel has stalled, and crypto treasury companies are losing their ability to buy the dip.

Although the treasury companies appear to have ample resources, the disappearance of stock price premiums has cut off their financing channels, causing them to lose their ability to buy the dip.

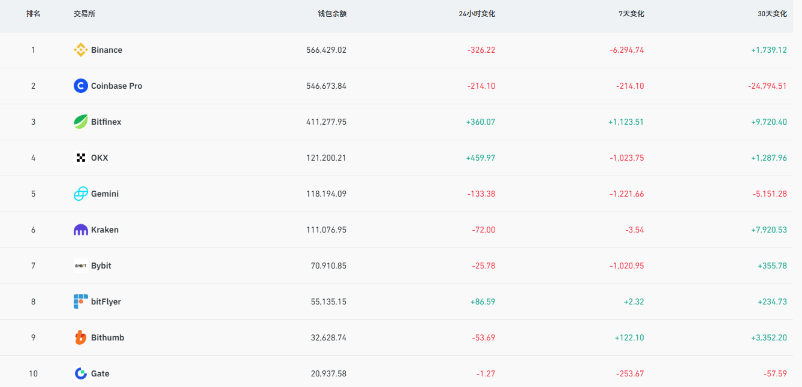

Nearly 10,000 bitcoins withdrawn from exchanges, is the market about to change direction?