BTC Market Pulse: Week 37

Bitcoin settled at around the Short-Term Holder cost basis but the stabilization remains fragile across the board. This week’s Market Pulse shows why cautious sentiment is still dominating.

Overview

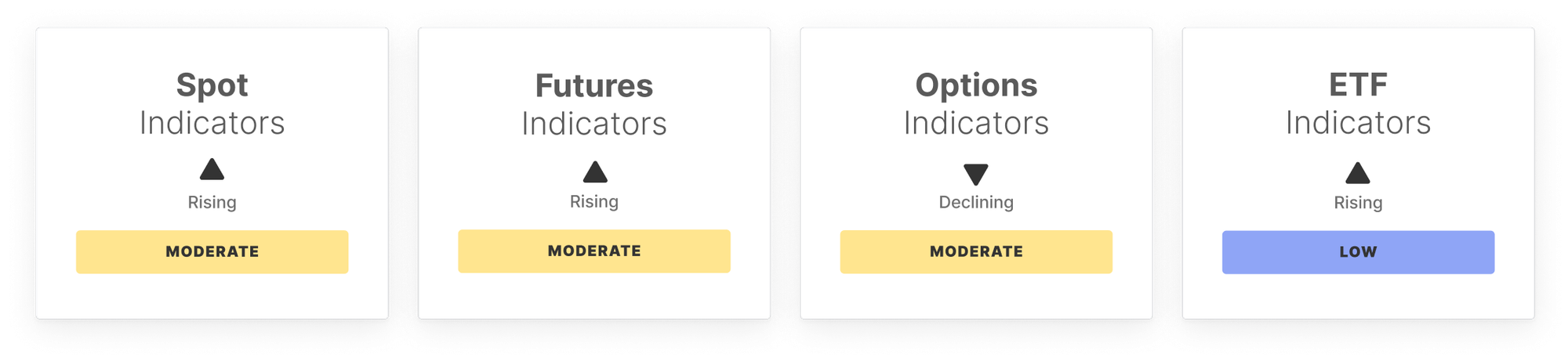

The past week saw Bitcoin trading above the cost basis of short-term holders, with the price oscillating around the $111k mark. In the spot market, momentum showed fragile recovery as RSI lifted toward neutral territory and Spot CVD improved, signalling reduced sell pressure. However, trading volumes declined, reflecting waning conviction and cautious participation at current price levels.

The futures market reflected stabilization with a modest rise in open interest and a strong recovery in perpetual CVD, suggesting buy-the-dip flows. Yet, funding rates fell, pointing to reduced bullish appetite and a more balanced sentiment.

In the options market, open interest declined, showing lighter engagement, while volatility spreads narrowed, suggesting calmer expectations. Still, 25-delta skew remained elevated, underscoring persistent demand for downside protection and defensive hedging.

ETF flows signalled moderation. Net inflows slowed, trading volumes remained subdued below statistical norms, and ETF MVRV rose modestly, pointing to cautious profit-taking potential but without signs of aggressive accumulation from TradFi participants.

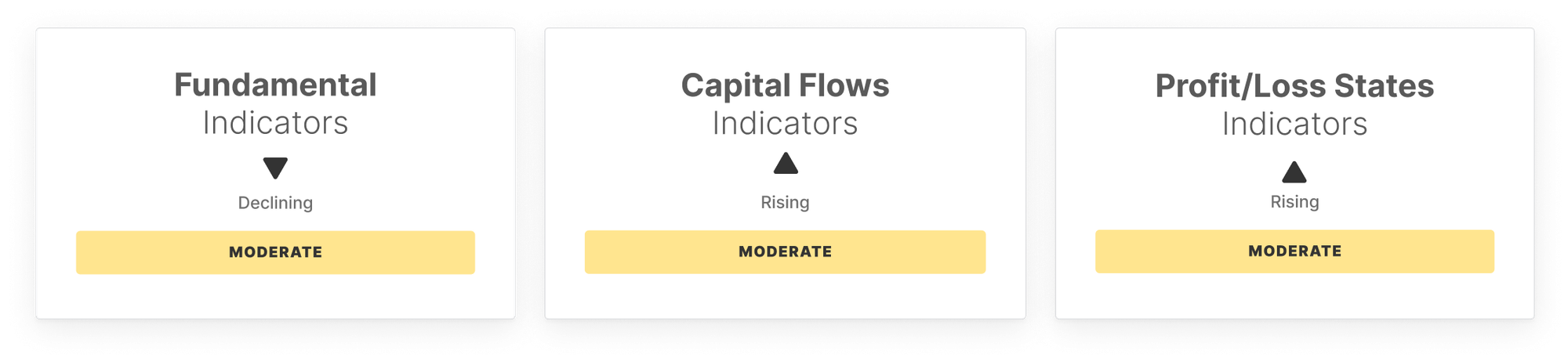

On the on-chain demand side, active addresses rose back within range, signaling a modest pickup in participation, though transfer volumes eased and fees declined, highlighting quieter conditions. The network shows signs of stabilization, but with no surge in organic activity.

Capital flows held fragile. Realized Cap inflows ticked higher, STH/ LTH ratios rose slightly, and Hot Capital Share eased, reflecting modest speculative activity but without strong long-term conviction.

Profit and loss states improved mildly, with supply in profit, NUPL, and Realized P/L all rising within normal ranges, signaling cautious optimism as investors realize profits without reaching extremes.

In sum, the market reflects fragile stabilization above short-term holder cost basis, with improvements in momentum and profitability offset by lighter volumes and defensive positioning. Sentiment remains cautious, leaning slightly bearish but with scope for short-term bounce-backs if demand re-emerges more decisively.

Off-Chain Indicators

On-Chain Indicators

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe nowPlease read our Transparency Notice when using exchange data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Exodus: Bitcoin ETFs See $825 Million in Outflows Over Five Trading Days

Bitcoin Nears Record Stretch of 1079 Days Without Heavy Selling as Market Holds Steady at High Levels

Ethereum’s TVL Could Explode in 2026 as Stablecoins and RWAs Expand

10x Research Outlines Key Events That Could Move Crypto in 2026