Aqua Scam Alert: "Rug Pull" is Becoming More Sophisticated

There may be a product, there may be partnerships, there may be code audits, but it could still be a scam.

The market is gradually heating up, and the dawn of the "Altcoin Season" seems to be looming. However, the issue of asset security is still not to be ignored. Especially when we have become accustomed to not worrying about "Rug Pulls" on Solana, and even consider "dev sells" and "money rug pulls" as common practices, "Rug Pulls" are still occurring, appearing in a more deceptive manner, threatening the assets we hold.

On September 9, ZachXBT posted on his personal channel stating, "Solana project Aqua is suspected of a Rug Pull, involving an amount of 21,770 SOL (approximately $4.65 million). Previously, this project had received promotion from Meteora, Quill Audits, Helius, SYMMIO, Dialect, and many KOLs. The related funds were split into four parts, first transferred to an intermediary address, and then flowed into multiple exchanges."

Currently, the team has closed the comment function on all posts on X (Twitter).

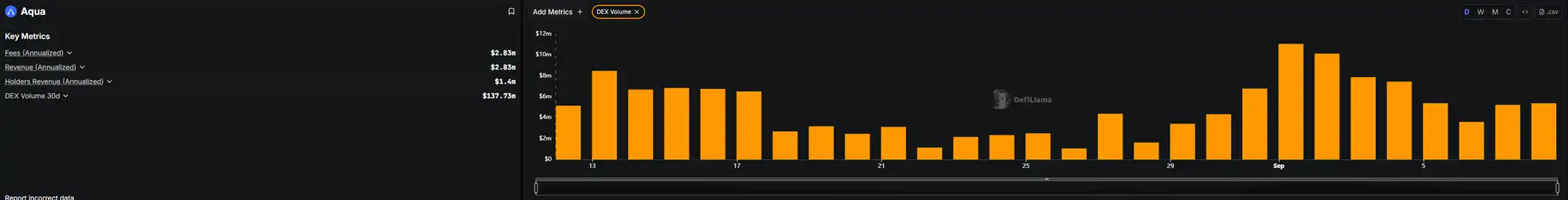

Compared to past "Rug Pulls," Aqua appears to be much more "legitimate." It has a real product, and you can even find the relevant data of the product on defillama. Defillama data shows that the Aqua Telegram trading bot had a trading volume of approximately $137 million in the past 30 days, with product revenue of about $2.83 million.

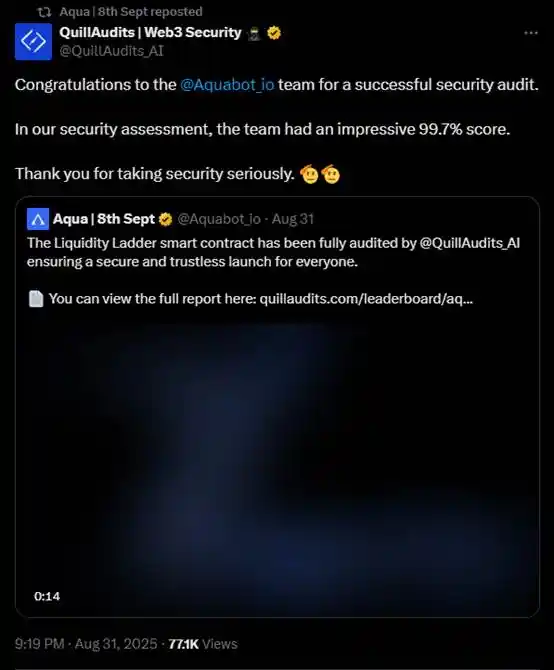

Aqua also had QuillAudits perform a code security audit.

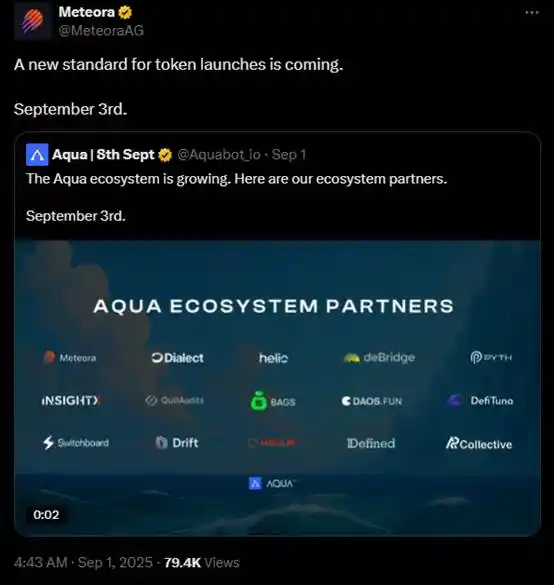

Meteora's official account retweeted Aqua's tweet to promote the project.

Helius also replied to the partnership tweet posted by Aqua.

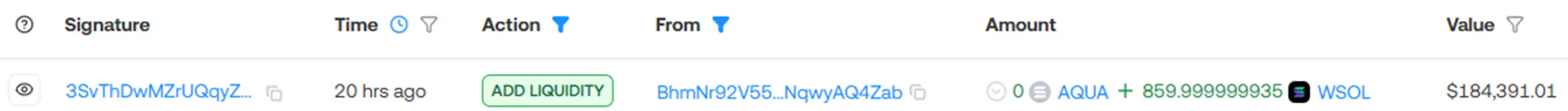

Various project teams' collaboration announcements, coupled with recommendations from many Chinese and English KOLs, enabled Aqua to raise 21,700 SOL (approximately $4.65 million), and all these funds have been transferred. Aqua's initial token liquidity is only 860 SOL (approximately $184,000).

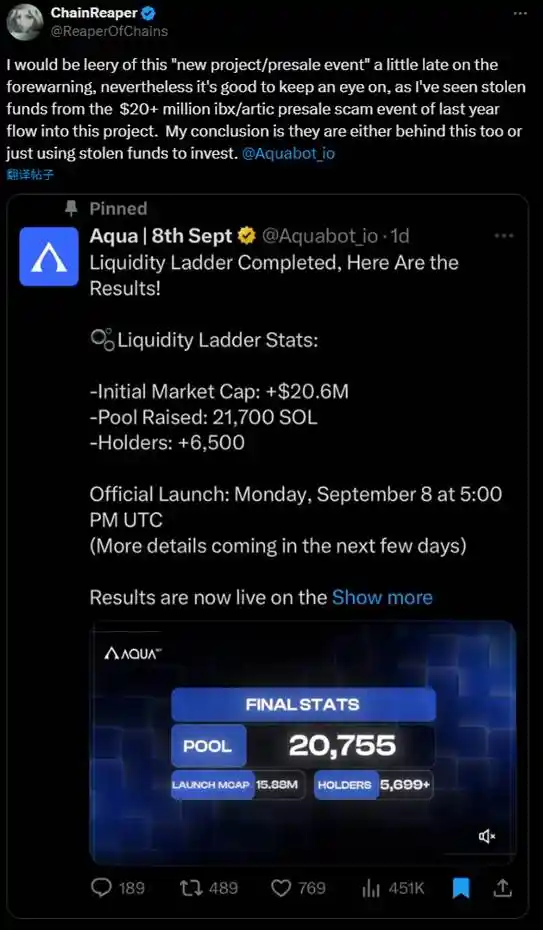

@ReaperOfChains, after on-chain data analysis, stated that funds stolen in last year's $20+ million IBXTrade's $artic scam flowed into the Aqua project. He believes that the mastermind behind IBXTrade must have been involved in some way, deep or shallow, in this Aqua scam.

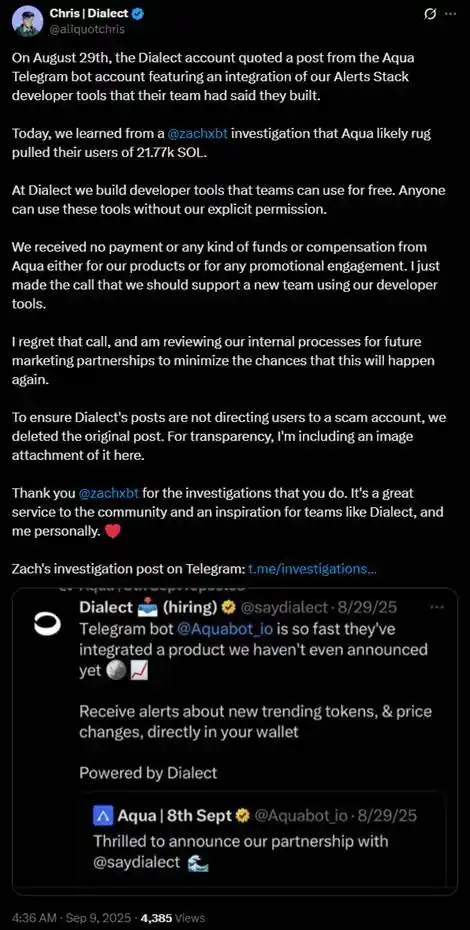

As of now, among the project teams that had interacted with Aqua on Twitter, only the founder of Dialect, @aliquotchris, has come forward to explain the situation. He mentioned that they just wanted to support a new team that had used their developer tools, regret their past decision, are reviewing internal processes for future collaborations to minimize the likelihood of such events happening again. Although Dialect's original tweet has been deleted to prevent more people from being directed to Aqua's related links, in order to openly acknowledge what Dialect had done in the past, he attached the original promotional tweet to this explanatory tweet.

Among the many silent project teams, this level of transparency stands out.

On April 18, according to Cointelegraph, based on the latest report from the blockchain analytics platform DappRadar, there have been 21 Rug Pull incidents since the beginning of 2024, compared to only 7 so far in 2025, showing a decreasing trend in their frequency. However, since the beginning of 2025, the Web3 ecosystem has lost nearly $6 billion due to such events, with 92% attributed to the collapse of Mantra's OM token (the token's founder denies it was a Rug Pull). In contrast, the total losses from Rug Pull incidents during the same period in 2024 were $90 million.

DappRadar analyst Sara Gherghelas points out that although the frequency of such events has decreased, they have become more destructive, with scams becoming increasingly complex and usually orchestrated by professional teams. The nature of these events is also evolving, with many incidents in the first quarter of 2024 originating from DeFi protocols, NFT projects, and meme coins, while in the same period in 2025, they are more prevalent in the meme coin space. Gherghelas also warns that a sudden surge in the number of active wallets for no clear reason, high transaction volume but low user activity, and projects with unverified smart contracts, limited GitHub activity, anonymous developer teams, or sudden DApp surges could all be warning signs of a Rug Pull.

The Aqua scam once again reminds us that even with a reputable project team's collaboration and promotion, even with the product having undergone code audit, even with extensive KOL promotion, a "Rug Pull" can still occur. Nothing can prevent the subjective misconduct of the project team, and when the project team acts maliciously, there is no way to expect any party to step forward and take responsibility.

Hopefully, every player in the crypto community can stay away from a "Rug Pull."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

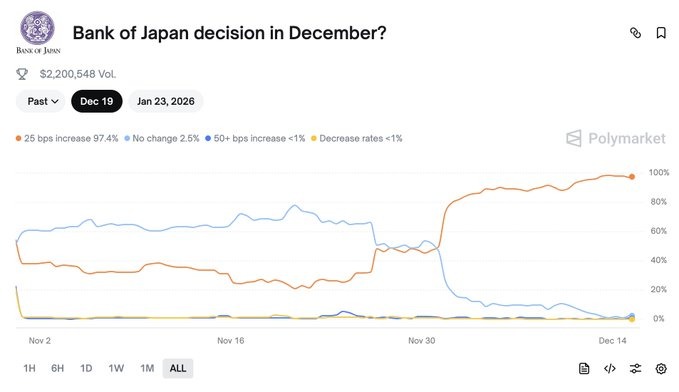

Bitcoin Price To Crash Below $70K as Japan Rate Hike Looms

“Quantum Threat to Bitcoin Is Decades Away”, Says Adam Back

Ethereum Founder Vitalik Buterin Wants Algorithm Transparency on X

“Crypto Cases Were Dropped Under Trump’s Second Term”, NYT Investigation Says