Breaking: Trump Slams Powell, Calls for Immediate Rate Cuts as Crypto Prices Turn Bullish

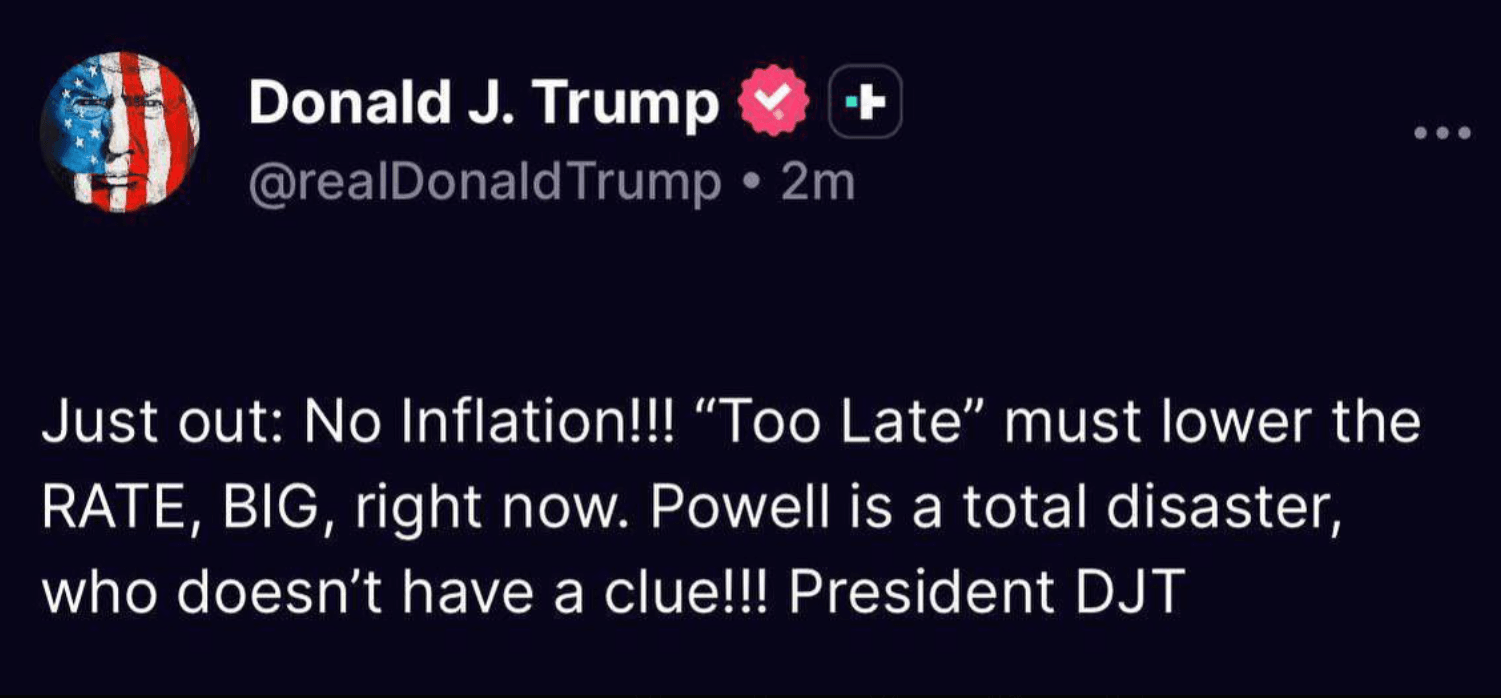

Trump’s Post on Truth Social

President Donald Trump took to Truth Social with a strong message directed at Federal Reserve Chairman Jerome Powell.

This statement underscores Trump’s long-standing criticism of Powell and the Fed’s handling of interest rates, reflecting his push for aggressive monetary easing.

Fed Expectations: September Rate Cut Likely

Trump’s comments come at a time when markets are already pricing in a Federal Reserve rate cut at the upcoming September 16–17, 2025 FOMC meeting. Recent weak jobs data and cooling economic indicators have strengthened expectations of a 0.25% cut.

However, the Fed has not yet made an official announcement. Investors can follow the official updates.

If Trump’s demands for a “BIG” cut were to be taken literally, markets could see a larger-than-expected move—something that could shock both traditional and crypto markets.

Why This Matters for Crypto

Lower interest rates generally mean more liquidity and cheaper borrowing, which can fuel speculative assets like Bitcoin and altcoins. Trump’s post could therefore add momentum to the bullish crypto narrative heading into Q4 2025.

- Bitcoin ($ BTC ): Often seen as a hedge against loose monetary policy, a confirmed rate cut could reignite demand.

- Altcoins: Lower yields on traditional assets may push investors toward riskier plays, increasing capital inflows into altcoins.

- DeFi & Stablecoins: A friendlier macro environment may support higher yields in DeFi, strengthening stablecoin demand and usage.

Market Outlook

If the Fed follows through with the expected 0.25% cut, markets may see steady support for risk assets. But if Powell resists pressure and holds rates steady, volatility could spike—something that could weigh on crypto in the short term.

Trump’s direct intervention highlights how politics and monetary policy are increasingly intertwined with crypto markets. For now, crypto traders should brace for heightened volatility around the September Fed meeting.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Interview with VanEck Investment Manager: From an Institutional Perspective, Should You Buy BTC Now?

The support levels near $78,000 and $70,000 present a good entry opportunity.

Macroeconomic Report: How Trump, the Federal Reserve, and Trade Sparked the Biggest Market Volatility in History

The deliberate devaluation of the US dollar, combined with extreme cross-border imbalances and excessive valuations, is brewing a volatility event.

Vitalik donated 256 ETH to two chat apps you've never heard of—what exactly is he betting on?

He made it clear: neither of these two applications is perfect, and there is still a long way to go to achieve true user experience and security.