MYX Correction Ahead? Smart Money Says It’s Just a Dip

MYX price surged 1,500% in a week before cooling at $17.60. Whales sold, exchanges filled, and RSI divergence flagged weakness. Still, rising Smart Money Index suggests the correction may be only a pullback.

MYX Finance (MYX) price exploded nearly 1,500% in the past week, even printing a fresh all-time high just hours ago. Trading around $17.60 at press time, the token has cooled slightly, slipping 1.5% on the daily chart and consolidating for the past three sessions.

After such a parabolic move, some profit booking was expected. But one “smart” cohort continues to add, suggesting this profit booking-led correction may be nothing more than a short dip before the MYX price pushes higher.

Selling Pressure And Technical Weakness Signal A Correction

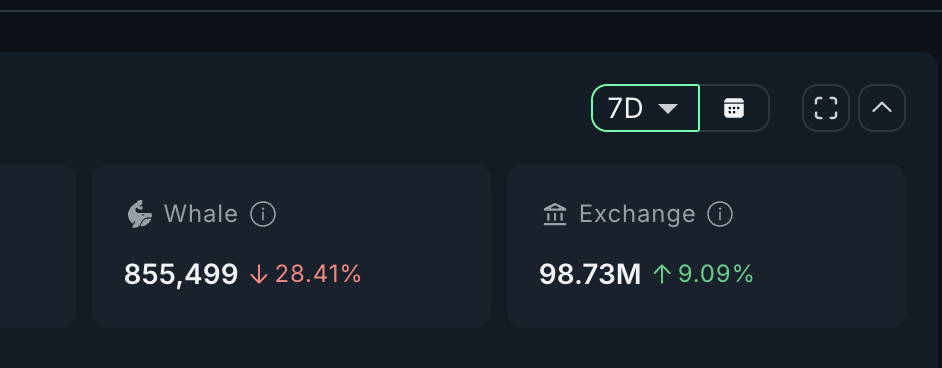

The first signs of strain have come from whales. Over the past seven days, whale wallets sold about 339,499 MYX, worth close to $5.9 million. Their total holdings now sit at 855,499 MYX.

MYX Experiences Selling Pressure:

MYX Experiences Selling Pressure:

Exchanges have also absorbed new supply, with balances climbing by 8.23 million MYX to a total of 98.73 million tokens — roughly $143.6 million at current prices. Rising exchange balances usually suggest holders are preparing to sell, adding more supply-side pressure.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

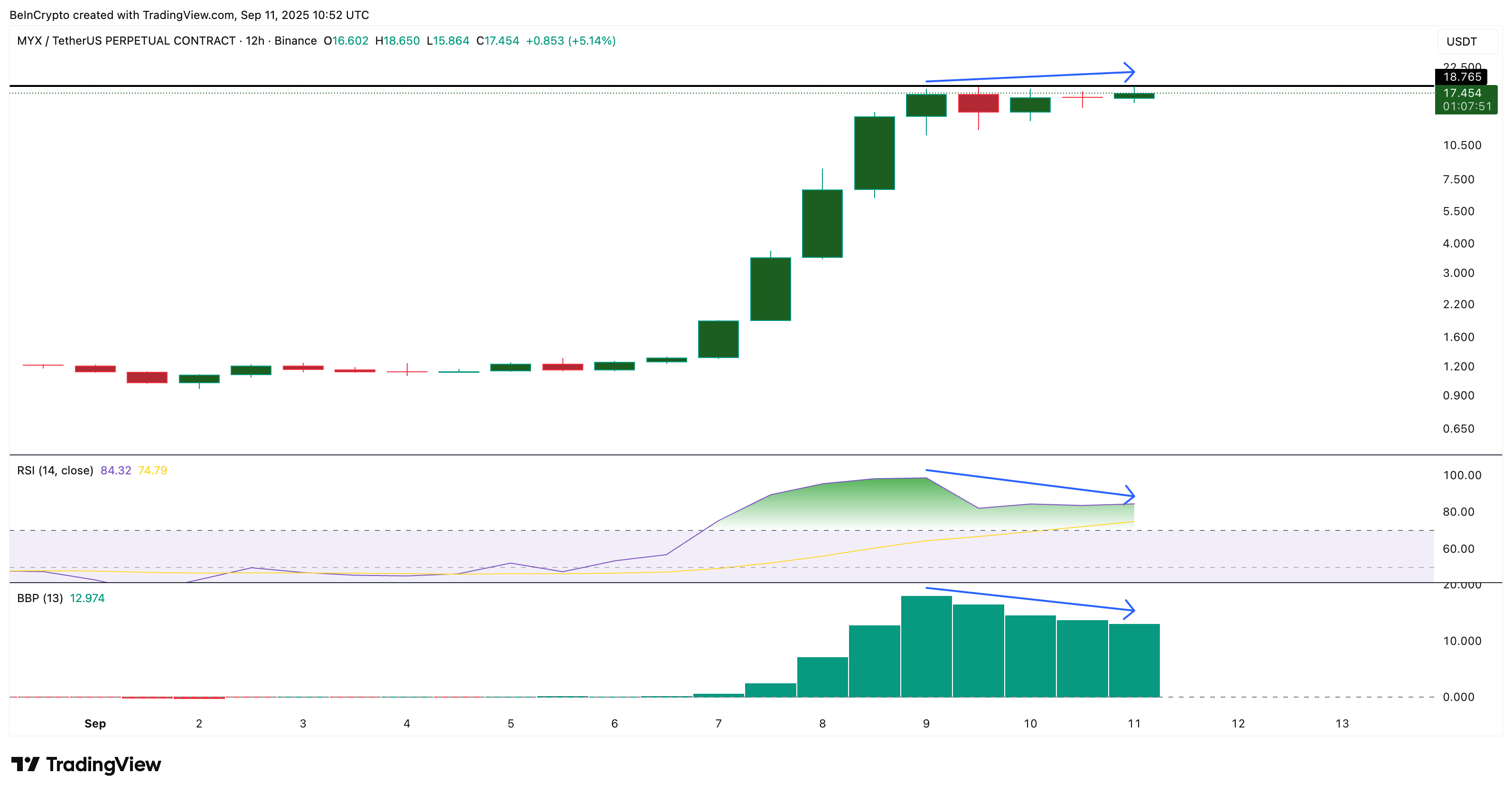

This selling has already shown up on the charts. On the 12-hour timeframe, MYX price made a higher high while the Relative Strength Index (RSI), which measures momentum, slipped to a lower high.

MYX 12-Hour Price Chart With Divergence:

MYX 12-Hour Price Chart With Divergence:

This “bearish divergence” is often a warning that buyers are losing strength even as the price climbs. Although on such a short time frame with only a few candles, this usually signals a pullback rather than a full reversal.

The Bull/Bear Power Index, which compares the force of buyers and sellers, tells a similar story. Bulls remain in control, but their dominance has weakened. Together, these factors indicate a fading of bullish momentum and make a pullback increasingly likely.

Why A MYX Price Pullback May Be Limited

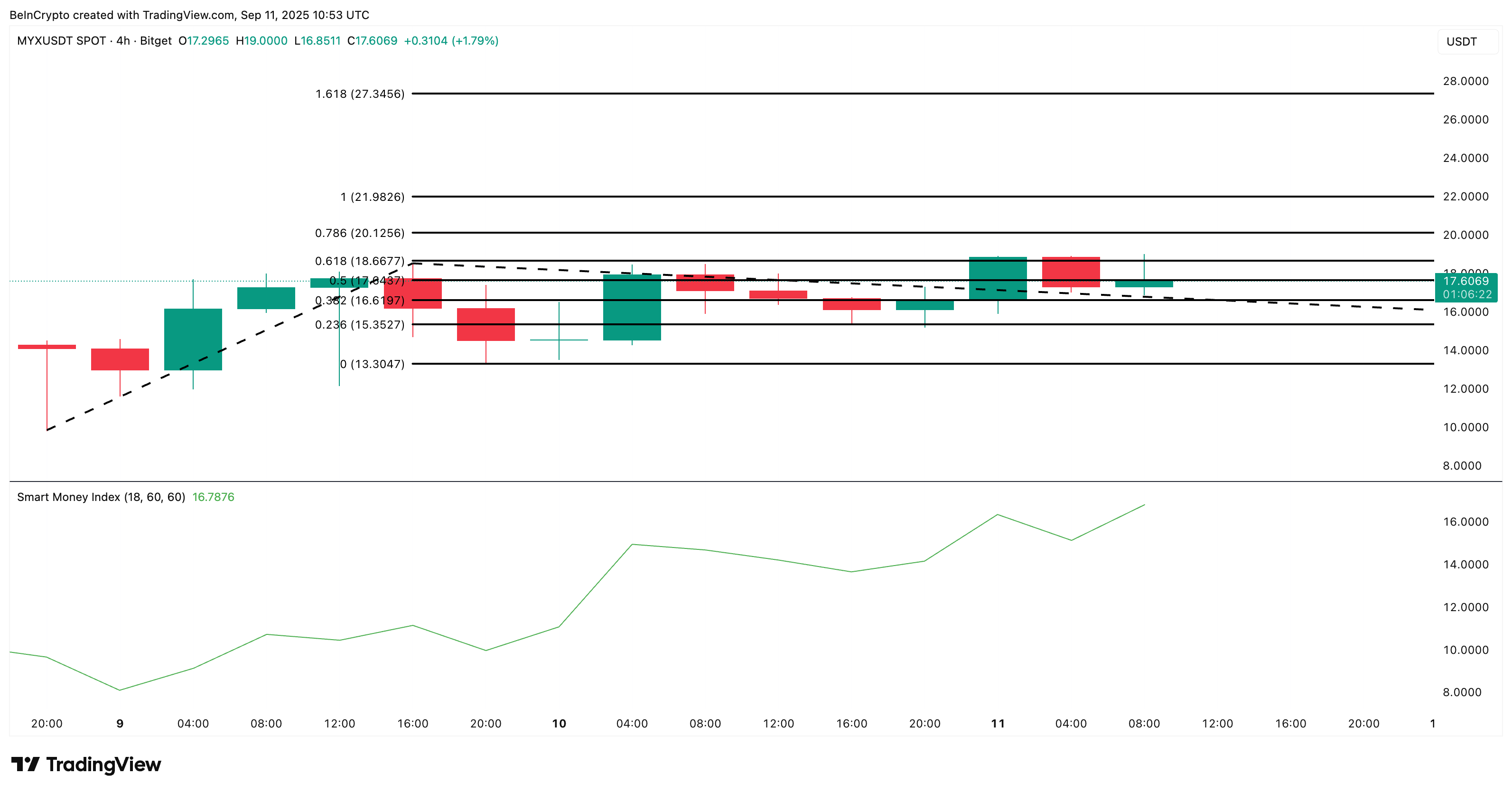

While momentum is cooling, the 4-hour chart shows the correction may not evolve into a collapse. The 12-hour chart gives a broad view, but the 4-hour view is valuable for tracking how dips unfold inside that larger trend.

MYX Finance has been range-bound since September 9, but the Smart Money Index (SMI) continues to climb. That means short-term capital — the kind looking for quick gains — is still being deployed into MYX Finance.

MYX Price Analysis:

MYX Price Analysis:

This rise in SMI aligns with the short-term bearish divergence. Sellers are adding pressure, but active buying shows dips are being absorbed. That suggests the correction is more likely a pullback inside an uptrend than the start of a reversal.

The Smart Money Index (SMI) tracks the activity of capital often considered more informed or tactical.

Key MYX price levels remain important. Support is visible at $16.61 and $15.35.

A MYX price drop below $13.30 would break the bullish setup, while a daily close above $18.66 could clear the path toward $20.12–$27.34.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

When being the "chief trader" is not enough, is Trump going to "run the show" himself?

As Wall Street's "mainstream players" rush to enter the market, Trump—who naturally attracts attention and controversy—clearly does not want to miss out on this grand feast.

The mysterious team that dominated Solana for three months is about to launch a token on Jupiter?

With no marketing and no reliance on VC, how did HumidiFi win the Solana on-chain proprietary market maker war in just 90 days?

USDD completes fifth security audit report, ChainSecurity confirms high-level security

Web3 security auditing firm ChainSecurity has released the fifth security audit report for USDD 2.0, confirming its high level of security in token integration and application mechanisms, as well as improved reliability in multi-chain deployment. Summary generated by Mars AI This summary is generated by the Mars AI model, and the accuracy and completeness of the generated content are still being iteratively updated.