Altcoin Market Hits 2025 Highs, BTC Dominance Dips Below Key Trendline

- Altcoin market cap hit $1.12 trillion, its highest daily close of 2025 since January.

- Bitcoin dominance dropped to 57.9%, signaling altcoins gaining share as BTC weakens.

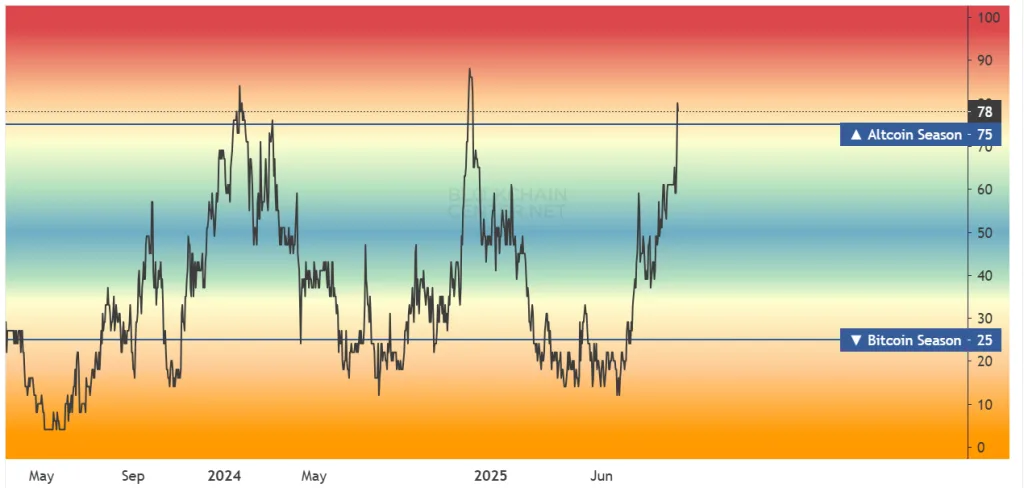

- Altseason indicators surged, with Blockchain Center’s index hitting 78, the year’s high.

The altcoin market has reached its highest daily close of 2025, a level last seen in January. The surge comes as Bitcoin dominance falls below 58%, a steep drop from its June peak of nearly 66%. Analysts say this shift may mark the beginning of “Phase 3 Altseason,” a stage where altcoins gain momentum against Bitcoin.

Altcoin Market Cap Breaks Through Resistance

The total altcoin market cap (TOTAL3) closed at about $1.12 trillion. The chart shows higher highs and higher lows since mid-July. Traders highlight that the market recently cleared congestion near $1.04–$1.08 trillion. That breakout signals stronger demand for tokens outside Bitcoin.

Daily candles confirm steady buying pressure instead of single-day spikes. This indicates broad inflows rather than short-term speculative jumps. The next key resistance level is close to $1.16 trillion. A close above that would confirm a breakout to new multi-month highs.

Source:

Tradingview

Source:

Tradingview

On the downside, immediate support now sits near $1.08 trillion. A further cushion lies around $1.00 trillion. If the market fails to hold $1.08 trillion, analysts expect a retest closer to $1.00 trillion. For now, the structure still favors continuation while candles close above the rising pattern.

Bitcoin Dominance Slides to Key Levels

Bitcoin dominance has declined continuously since peaking at around 66% earlier this year. The current level is approximately 57.9%. The chart pattern shows lower highs and lower lows, demonstrating a weakening trend. This attests to the fact that Bitcoin is losing market share to altcoins.

Source:

Tradingview

Source:

Tradingview

Key support now sits near 57%, while a stronger floor lies around 54.5%. On the upside, resistance is found near 60%. If dominance climbs above 60%, Bitcoin may regain its leadership. However, a continued decline below 57% would likely expand inflows toward altcoins.

The interaction between the two charts highlights the shift. A rising total market cap alongside falling dominance indicates clear altcoin strength. Traders view this as a rotation toward mid-cap and small-cap tokens.

Altseason Indicators Reach Year Highs

Excitement about a potential altcoin season is also rising across social media. Fresh data shows multiple altseason indicators hitting their strongest levels of 2025. The Blockchain Center’s Altcoin Season Index now reads 78 out of 100.

Source:

Blockchaincenter

Source:

Blockchaincenter

The Blockchain Center defines altseason as when 75% of the top 50 crypto assets outperform Bitcoin over 90 days. Based on the latest numbers, that threshold has now been reached. Analysts suggest this creates ideal conditions for altcoins to extend gains.

In just one day, more than $130 billion has entered the crypto market. The surge has driven a strong green wave across assets. Ethereum, Solana, Ripple, and other major tokens posted significant returns during the rally.

Related: Altcoin Momentum Builds as BTC Dominance Continues to Drop

Macroeconomic Conditions Add Fuel

Macroeconomic factors have added momentum to the crypto rally. Investors are looking forward to the interest rate cut by the Federal Reserve in September. Such a prospect has increased the sentiment towards risky investments such as cryptocurrencies. A positive outlook may lead to additional institutional capital flows into altcoins following months of Bitcoin-led flows.

The combination of rising altcoin market cap, declining Bitcoin dominance, and favorable macro conditions is reinforcing the argument in favor of an altcoin breakout. The market players are now observing whether TOTAL3 will surpass the level of $1.16 trillion. If it does, analysts say a broad altcoin rally could accelerate into the final quarter of the year.

The post Altcoin Market Hits 2025 Highs, BTC Dominance Dips Below Key Trendline appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin – Is it a case of ‘pain today, gains tomorrow’ for BTC’s price?

Are XRP and Cardano Losing Relevance? Mike Novogratz Explains Key Indicators as Crypto Investors Move Beyond Hype, Seek Real Utility

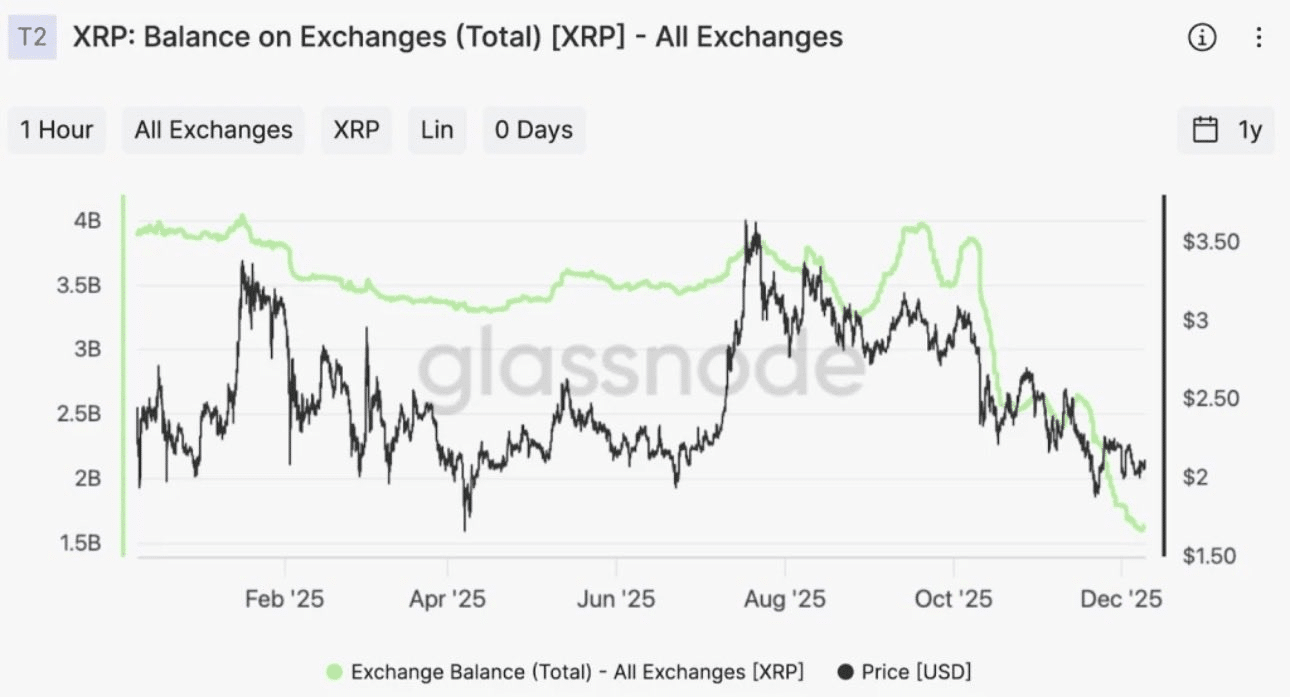

Reasons why XRP is poised to lead 2026 DESPITE drop below $2

BTC Exodus: Bitcoin ETFs See $825 Million in Outflows Over Five Trading Days