Fidelity and Canary Crypto ETFs Reach DTCC Pre-Launch Stage

- The Fidelity Solana ETF and the Canary XRP and HBAR ETFs are now listed on DTCC records.

- Analysts give Solana and XRP ETFs 95 percent approval odds, while Hedera has 90%.

- Analysts confirm DTCC listing is only a step, and SEC approval is required for launch.

Fidelity’s proposed Solana ETF and Canary Capital’s planned HBAR and XRP ETFs have appeared on the Depository Trust & Clearing Corporation (DTCC) website, marking an important procedural step toward potential market entry. The listings do not indicate regulatory approval. Instead, they reflect preparation for trading, clearing, and settlement. The Securities and Exchange Commission (SEC) must still approve the products, and issuers must secure the effectiveness of their S-1 filings before launch.

DTCC Listings Spark Market Attention

Three ETFs are now visible on DTCC records, which are Fidelity’s Solana ETF under ticker FSOL, Canary’s XRP ETF listed as XRPC, and Canary’s Hedera ETF labeled HBR. Their appearance immediately stirred attention across crypto circles, since Bitcoin and Ethereum ETFs also surfaced on DTCC systems before official trading.

Bloomberg data places the odds of approval for Solana and XRP ETFs at 95 percent, with Hedera’s HBAR ETF given a 90 percent probability. Bloomberg also notes that the final deadline for SEC decisions on Solana and XRP is October, with the commission choosing to delay all altcoin ETF applications until that date.

While investors read the DTCC listings as encouraging, analysts caution against equating them with imminent trading. Both Bloomberg’s senior ETF analyst Eric Balchunas and ETF Store President Nate Geraci confirmed the administrative nature of the update. Balchunas remarked, “Agree, nothing to see here. That said, how many tickers are added that never launched, probably almost none.”

The DTCC adds securities to its NSCC security eligibility list to prepare the market infrastructure for a new ETF’s debut. This procedure ensures that trading desks, custodians, and clearing systems will be ready following the SEC’s authorization.

SEC Reviews and Regulatory Delays

The SEC has shown caution in its approach to crypto ETFs, extending the review period for proposed Ethereum ETFs, allowing staking, filed by BlackRock, Fidelity, and Franklin Templeton. The agency also postponed Franklin Templeton’s Solana and XRP ETF applications, demonstrating its deliberate pace with altcoin exposure.

The reasons behind this caution are due to the SEC standards of spot crypto products. Regulators review underlying markets, liquidity is deemed adequate, custody facilities are found to have high security, and risks of manipulation are kept minimum. Although spot ETFs are approved for Bitcoin and Ethereum, altcoins like Solana, XRP, and Hedera face regulatory uncertainties. This raises concern whether altcoin ETFs would clear the SEC’s grasp like Ethereum and Bitcoin or slow their debut?

Related: Fidelity FDIT Hits $200M, Rival BlackRock BUIDL Fund

Altcoin ETFs Represent a New Phase

Although the focus of the trio (SOL, HBAR, and XRP) is to get approval from teh SEC, each has its own characteristics that have helped gain investor interest. Solana, a powerful competitor among smart contract platforms, as high throughput and low transaction costs, while Hedera provides enterprise-level performance and dApps with its hashgraph consensus. XRP stands as an international payment offering low costs and rapid transactions despite the regulatory warfare.

To issuers, ETFs based on these tokens would offer a controlled avenue of exposure to traditional investors, whereas for investors, the DTCC listing is a sign of progress. However, there is no guarantee, as trading can commence after the SEC approves and the S-1 filings are effective. Until this point, the issuers and market makers have kept on developing operational systems in anticipation of being officially launched and await the final decision of the regulator.

The post Fidelity and Canary Crypto ETFs Reach DTCC Pre-Launch Stage appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

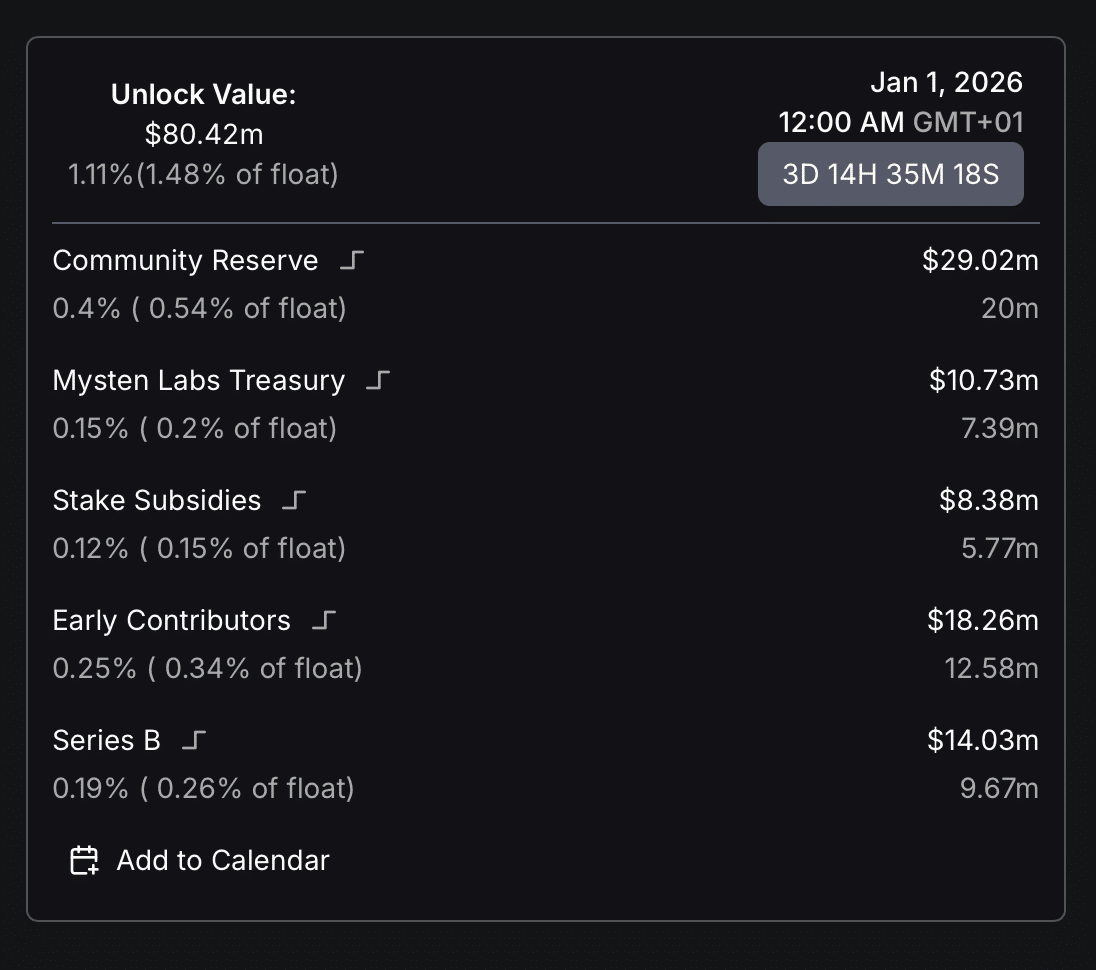

SUI faces $80 mln unlock as sellers step in: Can bulls defend key resistance?

Bitcoin Navigates Turbulent Waters with Record Highs and Market Corrections in 2025

2025's Memecoin&AI Hype Train Derailed in Epic Fashion – Kriptoworld.com

XRP: ETF ‘green days’ fade as leverage hits $450mln – This hints at…

BREAKING: DTCC has listed Fidelity’s Solana ETF and Canary’s #XRP ETF!

BREAKING: DTCC has listed Fidelity’s Solana ETF and Canary’s #XRP ETF!