Why Perpetual Contracts Must Belong to General-Purpose Blockchains?

Why does Hyperliquid, despite being a relatively successful application chain, still rely on the general-purpose chain HyperEVM?

As a relatively successful application chain, why does Hyperliquid still rely on the general-purpose chain HyperEVM?

Written by: World Capital Markets

Translated by: Saoirse, Foresight News

The debate between application chains (Appchains) and general-purpose chains (GP Chains) has never ceased. Both models have their own advantages, but when viewed from a historical and economic perspective, the rationale for building perpetual contracts on general-purpose chains becomes self-evident.

In fact, the idea that applications should build their own independent chains is completely putting the cart before the horse. Truly high-quality applications should support general-purpose chains, rather than splitting into isolated “information islands.”

The Essence of Finance Is Integration, Not Fragmentation

The development pattern of the financial industry has never been about decentralization, but about continuous integration.

In 1921, there were about 30,000 banks in the United States; today, that number has dropped to about 4,300, a decrease of 86%. Why did this change occur? The answer lies in shared infrastructure, unified standards, and efficient settlement mechanisms. The fewer the infrastructures, the stronger the liquidity and the more significant the scale effect.

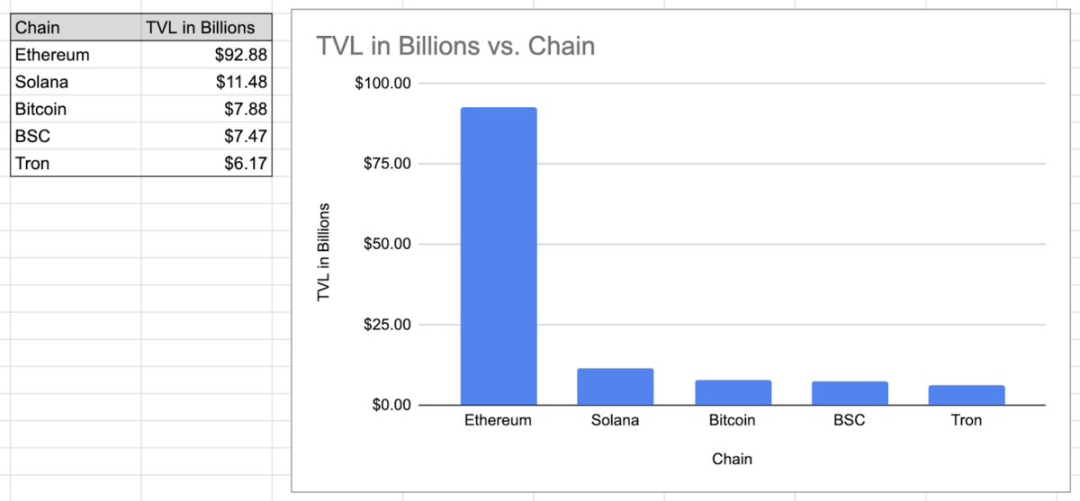

Although a batch of new blockchain projects emerges every year, and despite the “Cambrian explosion” of alternative solutions, Ethereum—a blockchain that is slow and costly—still firmly holds the top spot in total value locked (TVL) rankings, with a huge lead: its scale is almost 10 times that of Solana.

Below are the top five blockchains by total value locked as of August 31, 2025

Data source: https://defillama.com/chain/ethereum

After Ethereum, the rankings are still dominated by general-purpose chains. Ultimately, you will see HyperEVM—another general-purpose chain, which supports the operation of Hyperliquid; and Hyperliquid is so far the only truly successful application chain.

This shows that shared settlement is the ultimate direction for blockchain finance, not fragmented “application-specific islands.”

Distribution Is Core: The “Key to Victory” in Finance

There is a common saying that “general-purpose chains only solve the distribution problem.” “Only” solve it? That’s like saying “a drug only cures cancer.” In finance, distribution itself is the core competitive advantage.

How big are the differences between the financial products you use daily across different providers?

From checking accounts to comparing the New York Stock Exchange (NYSE) and Nasdaq, apart from “distribution capability” and “established network effects,” I find it hard to see any essential differences between these businesses. You should know, hardware costs like servers are cheap, but distribution capability is priceless.

Platform Economics: The Real Revelation

Platforms are extremely influential distribution carriers.

Looking back at the history of platforms—from operating systems, App Stores, Xbox game consoles, to the Internet, and more recently Telegram—the pattern is crystal clear: those breakthrough applications, whether by choice or by necessity, always support the platform rather than developing independently away from it.

Think about the importance of distribution for platforms: how many apps on your iPhone are not downloaded through the App Store? How many times have you accessed a website without using a browser? TikTok didn’t build a better operating system, Facebook didn’t develop a better browser, and Halo didn’t manufacture a better Xbox console.

In fact, contrary to some current opinions: high-quality applications are actually motivated to support the development of the platform.

Popular applications want the platform to succeed, which creates a “flywheel effect”: applications bring in traffic, traffic attracts more applications, which in turn brings more traffic.

Blockchain, through decentralized governance, solves the only core drawback of traditional platforms—“platform risk” (i.e., the platform may unilaterally change rules, restrict applications, etc.). On decentralized platforms, there will no longer be cases like FarmVille’s decline due to platform rule changes. You can enjoy all the advantages of the platform without bearing the risk of being “exploited by the platform.” Of course, it should be noted that due to the inherent trade-off between “performance” and “decentralization” in current technology, MegaETH still has some degree of centralization; but what matters is the ultimate goal, not the initial state.

Conclusion: Network Effects Drive “Winner Takes All”

The financial industry continues to integrate, platforms dominate distribution, and distribution capability is more important than product features.

The only difference between blockchain and historical patterns is that it will further amplify these effects.

The future trend is: perpetual contracts (and all “killer apps”) will make leading general-purpose chains even stronger. Because network effects do not fragment; they only stack and intensify.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Exodus: Bitcoin ETFs See $825 Million in Outflows Over Five Trading Days

Bitcoin Nears Record Stretch of 1079 Days Without Heavy Selling as Market Holds Steady at High Levels

Ethereum’s TVL Could Explode in 2026 as Stablecoins and RWAs Expand

10x Research Outlines Key Events That Could Move Crypto in 2026