Will PayFi be the next narrative for RWA?

Can uncollateralized credit lending protocols work in the DeFi world?

Can unsecured credit lending protocols work in the DeFi world?

Written by: Sleeping in the Rain

The market's concerns about this type of protocol mainly focus on the borrower's ability to repay. In plain terms, the key is whether the project can recover the money it lends out—only then will users be more willing to deposit funds for wealth management, allowing the project to operate and earn fees.

Only by solving the above problem can such projects truly achieve sustainable development.

The solutions generally fall into the following two directions:

- Maximize the likelihood that borrowers can repay normally

- Provide corresponding guarantees/insurance for deposit users

Therefore, when we look at such projects, we need to focus on these two points. I have mentioned $MPL and $CPOOL in my outlooks for August and September, and next week I will write another article discussing these two projects.

Today, let's first talk about @humafinance, a project in the same sector that just announced a $38 million funding round, and take a look at its solutions and new product expansions.

1/ Recently Announced Funding Information ⬇️

Huma Finance recently completed a $38 million funding round, including $10 million in equity investment and $28 million in yield-bearing RWA. The round was led by Distributed Global, with participation from Hashkey Capital, Folius Ventures, Stellar Development Foundation, and TIBAS Ventures, the venture capital arm of Turkey's largest private bank İşbank, among others.

Huma Finance plans to use this funding to deploy its PayFi product on the Solana and Stellar chains.

Next, I will share my understanding of this project as concisely as possible.

2/ Huma Finance v1

Huma Finance v1 is an unsecured lending platform for businesses and individuals, focusing on the borrower's future potential income—that is, when a borrower takes a loan, the main consideration is the borrower's future income cash flow.

As stated in their official Mirror post: "Income and earnings are the most important factors in underwriting, as they are highly predictive of repayment ability."

To better advance its vertical business, Huma merged with Arf this year. Arf is a liquidity and settlement platform focused on cross-border payments, supported by Circle (and also collaborates with Solana and Stellar).

After the merger, Huma is responsible for the deposit side, while Arf handles lending to the Web2 world and collecting interest, forming a sustainable cycle. (As seen on their official website, the default rate so far is 0%)

3/ PayFi

Huma v2 is an expansion of v1. On top of lending, Huma aims to expand its business into the PayFi sector.

What is PayFi?

"PayFi" was proposed by Lily Liu, Chair of the Solana Foundation (and also an investor in Huma Finance). PayFi refers to new financial markets built around the Time Value of Money. The time value of money means that a certain amount of money held now is more valuable than the same amount received in the future, because this money can generate income, such as earning interest from lending, earning yields from US Treasuries, or completing transactions and transfers at lower costs in less time, etc.

Therefore, PayFi is also a sub-sector of RWA. (This is likely why Huma Finance is considering deployment on Solana.)

However, although it is RWA, PayFi is different from the RWA assets built on US Treasury yields that the market is familiar with. PayFi's yields often come from transaction fees, cross-border payments, and loan interest, etc. For example, Arf uses Web3 liquidity to provide cross-border transfer services for licensed financial institutions at T1 and T2 levels in developed countries (which can be understood as bridge funding).

After interest rate cuts in the US and with greater adoption, PayFi may become the mainstream sub-sector leading the development of RWA. Huma is one of the first projects to enter the PayFi space and has also attracted the favor of VCs and core circles supporting PayFi (just look at the list of investors).

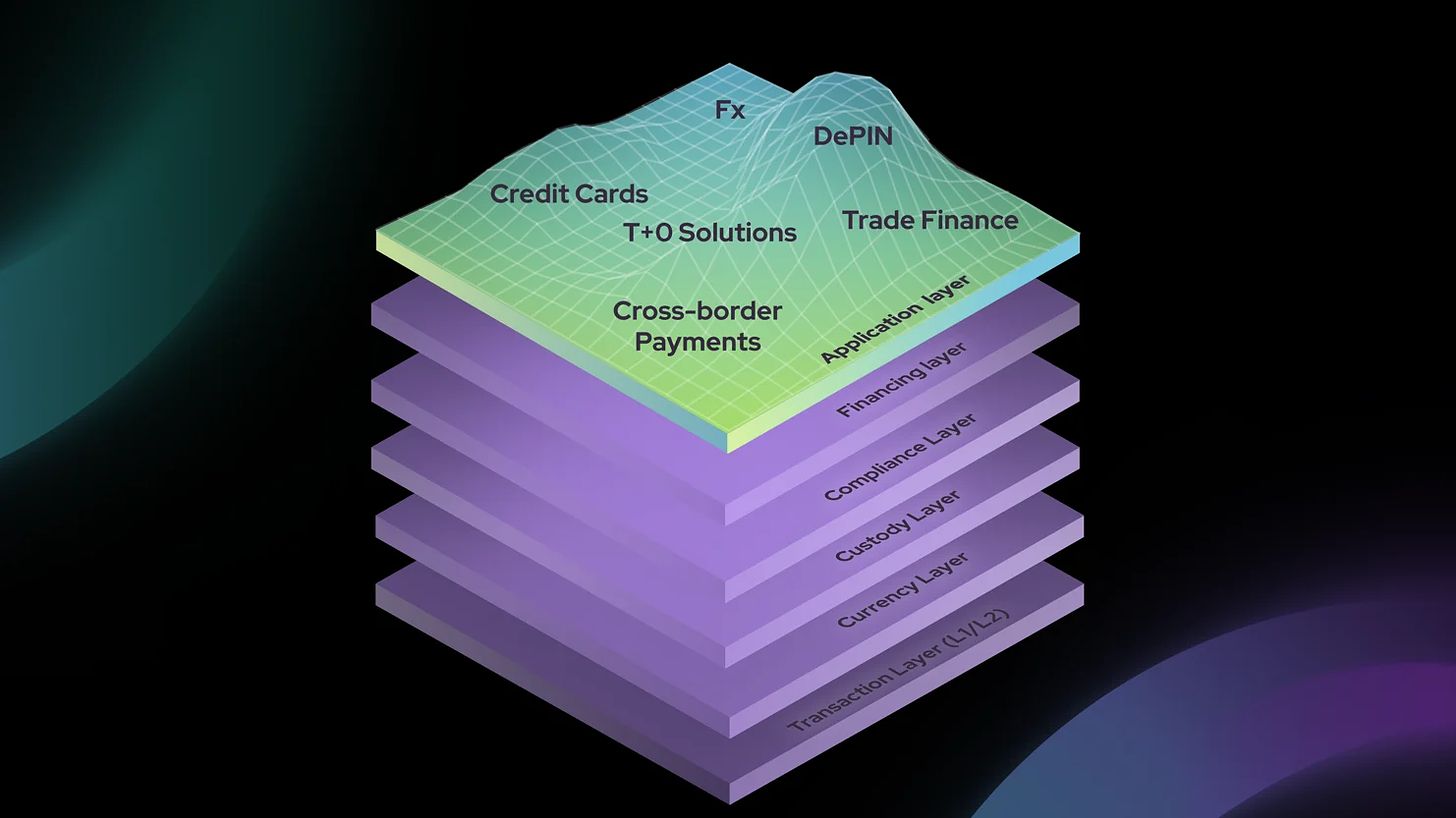

At the same time, to become the core infrastructure provider in the PayFi sector, Huma has launched the PayFi Stack to meet the needs of the PayFi sector in trading, currency, custody, financing, compliance, and application building.

4/ Huma Finance v2

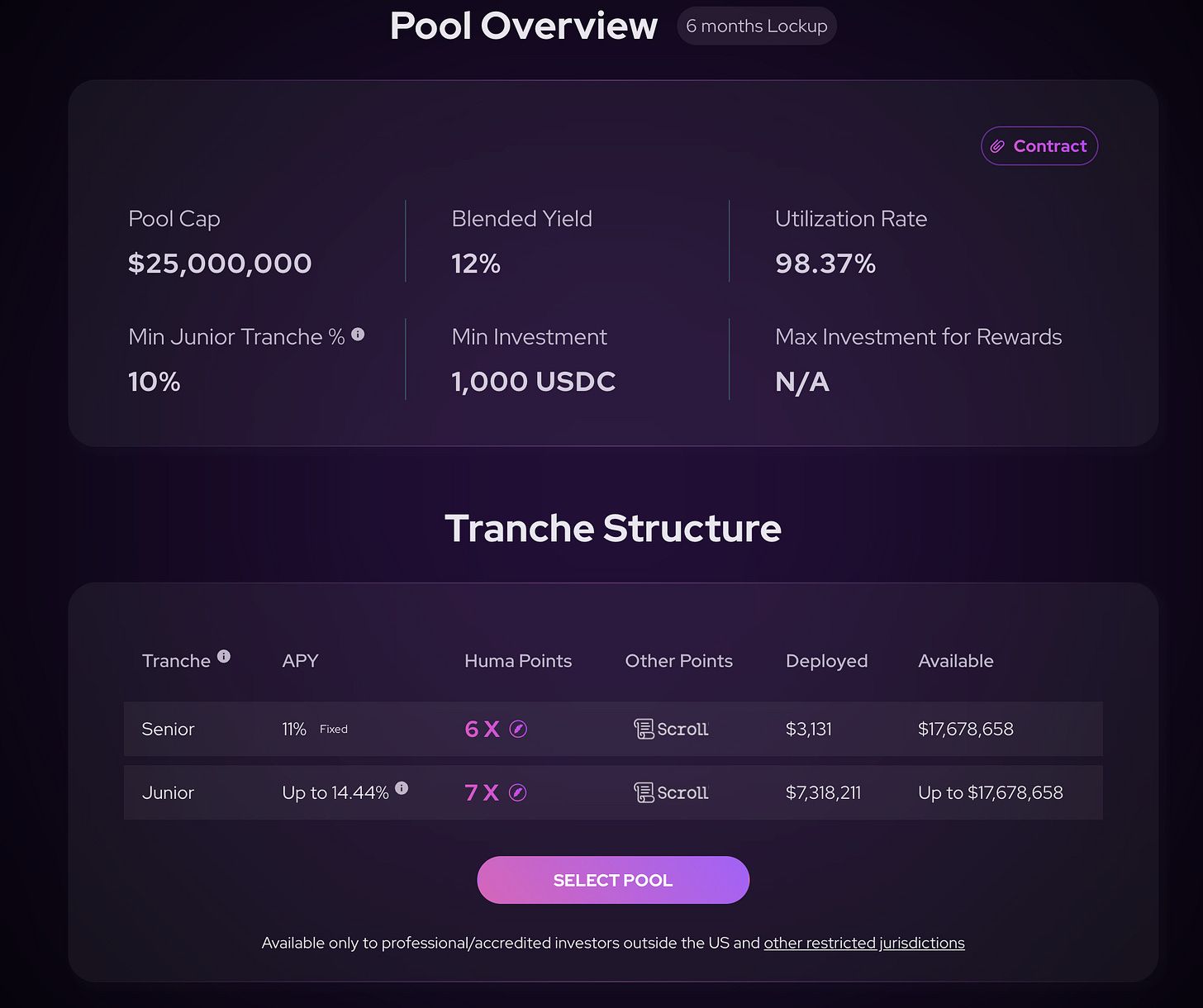

On the product side, v2 has achieved a more complex product structure, such as the addition of Senior Tranche, Junior Tranche, and First Loss Cover features mentioned below. Simply put, this upgrade subdivides functions to meet the needs of different users.

Huma v2's pools are divided into Senior and Junior Pools. The Senior Pool has a fixed yield, while the Junior Pool has a floating yield, which depends on the project's real-time income.

The cost of the higher floating yield in the Junior Pool is that it must bear corresponding losses in the event of bad debt. From a product perspective, I personally believe that in the future, the project may need to subsidize Junior Pool depositors through tokens or other incentives—after all, the Junior Pool is the product's safety module.

5/ How does Arf handle the liquidity provided by investors?

After we deposit funds into the Huma Finance Arf Pool, these assets are placed by Arf into a bankruptcy-remote SPV (Special Purpose Vehicle, a legal entity created for specific or temporary purposes, mainly for risk isolation).

Arf Financial GmbH, as the service provider, serves the SPV. Lending, cross-border payments, transaction settlement, and risk management are all conducted here. After a transaction is completed, the SPV returns the money and profits from the pool back on-chain. Arf Financial GmbH does not have control over the pool funds.

6/ Filling in the Gaps

Here I want to add two points:

Arf does a good job in risk control, but this also leads to some issues, such as requiring KYC before depositing, which is not very friendly to many DeFi users. Also, I personally think Huma Finance's UI/UX still has room for improvement.

2. Cooperation with Scroll

Currently, we can deposit USDC into Huma on Scroll and achieve triple benefits—over 10% wealth management income + Huma points + Scroll points.

7/ Finally

Why have I been looking at these types of wealth management products lately? It's because after liquidating my positions some time ago, most of my assets are in U, so I'm looking for a good place to manage these U.

From my personal perspective, before the market shows a potential upward trend, I won't go all in or use leverage, at most I'll do some short-term swing trading.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Despite institutional support, Bitcoin remains weak, testing investor confidence

Bank of Canada Sets Strict Rules for Stablecoins Ahead of 2026 Law

IoTeX Achieves Crucial Milestone with MiCA-Compliant White Paper

Revolutionary Blockchain-Based Insurance: Kyobo Life’s Bold Partnership with SuperWalk