Ethereum’s Path to $5,000 Clears, as Exchange Supply Hits YTD Low, ETF Flows Rebound

Ethereum’s rally gains strength as exchange supply dwindles and ETF inflows surge, setting the stage for a $5,000 breakout.

Ethereum (ETH) has climbed by nearly 10% over the past week, driven by improving market sentiment and renewed investor demand.

The price surge comes as broader risk appetite returns to the crypto market, raising hopes that ETH could be gearing up for a breakout toward the $5,000 mark.

Ethereum Supply Tightens, ETF Inflows Surge — Is $5,000 Next?

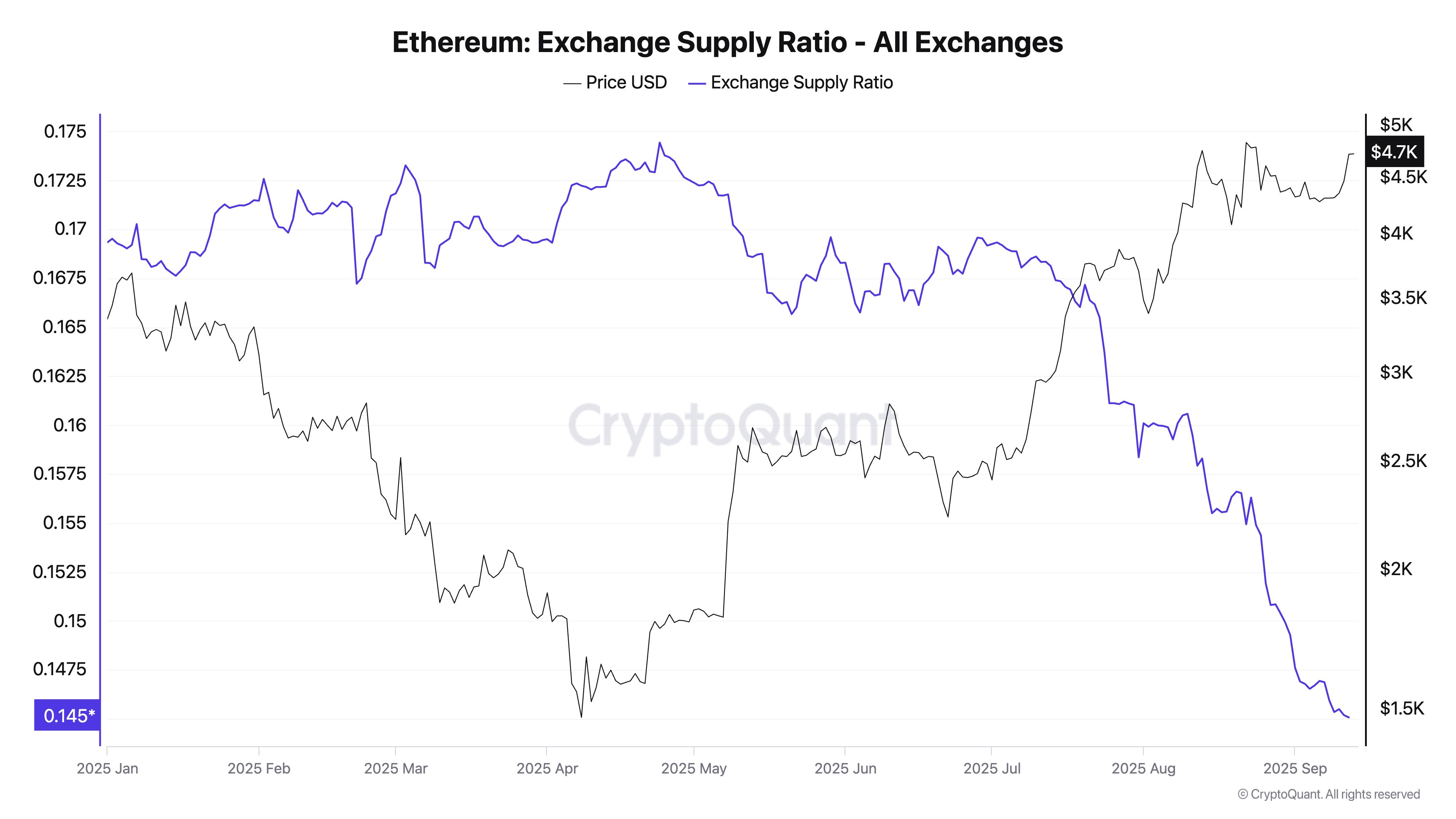

Ethereum’s Exchange Supply Ratio (ESR) has plunged to its lowest level this year, indicating that fewer coins are being held on centralized exchanges. As of this writing, the metric is at 0.14, falling steadily since July 20, per CryptoQuant.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Ethereum Exchange Supply Ratio. Source:

CryptoQuant

Ethereum Exchange Supply Ratio. Source:

CryptoQuant

The ESR measures the share of ETH’s circulating supply on centralized exchanges. A higher ESR signals that more ETH is sitting on exchanges, increasing the risk of near-term selling pressure.

Conversely, when the ESR declines, as it has now, it indicates that holders are moving coins off exchanges, often into private wallets or custodial solutions. This reduces the immediate availability of ETH for sale.

Historically, such declines in exchange balances have often preceded extended rallies, raising the likelihood of a rally toward $5,000 in the near term.

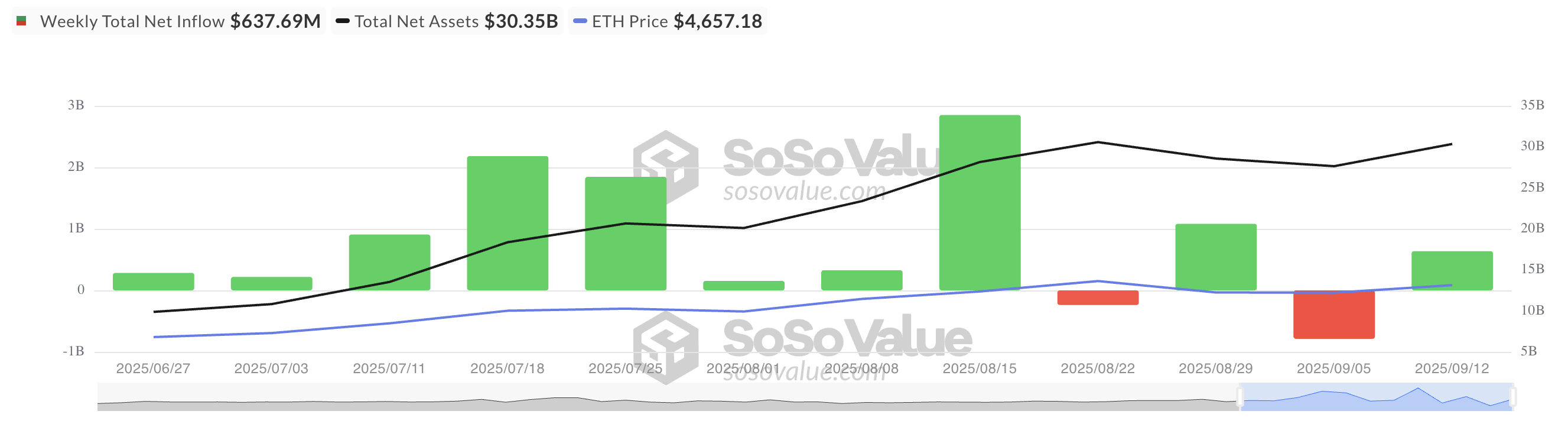

Furthermore, institutional confidence is showing signs of revival. Spot Ethereum exchange-traded funds (ETFs), which saw capital outflows last week, have recorded a rebound in inflows in the past few days.

Total Ethereum Spot ETF Net Inflow. Source:

SosoValue

Total Ethereum Spot ETF Net Inflow. Source:

SosoValue

According to SosoValue, between September 8 and 12, spot Ethereum investment funds recorded $638 million in capital inflows, a sharp reversal from the $788 million in outflows the previous week.

This turnaround reflects a decisive shift in sentiment, with key investors rotating back into ETH and strengthening the case for a sustained push toward the $5,000 level.

Ethereum Holds $4,664 Support as $5,000 Rally Comes Into Focus

On the daily chart, ETH holds above the new support floor formed at $4,664. Sustained strength at this zone could pave the way for a retest of its all-time high at $4,957.

A successful breakout above this level could trigger a rally toward the much-anticipated $5,000 milestone.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

However, this bullish outlook hinges on defending the $4,664 floor. Failure to hold this level could expose ETH to renewed downside pressure, with the next key support sitting around $4,211.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.