Galaxy Digital scoops $306M in Solana after deal for crypto treasury

Digital assets investment firm Galaxy Digital has bought $306 million worth of Solana in a single day after teaming up with investment firm Multicoin Capital and trading firm Jump Crypto to create a so-called crypto treasury company.

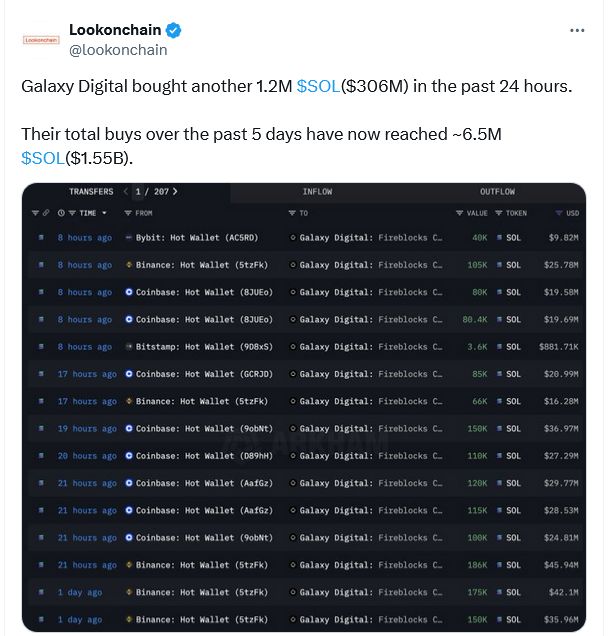

Galaxy scooped up 1.2 million Solana on Sunday from multiple exchanges and sent them to the crypto custody firm Fireblocks, according to blockchain data reported by Lookonchain.

It extends a Solana buying spree from Galaxy since Wednesday, which has seen it buy up over $1.5 billion worth of the token.

On Thursday, Galaxy said that it’s linking up with Multicoin Capital and Jump Crypto to join in a $1.65 billion private placement round in Forward Industries, a medical device company that recently pivoted to wanting to have the largest Solana holdings among public firms, joining a trend of similar so-called crypto treasury companies .

Source: Lookonchain

Source: Lookonchain

Galaxy buys up over 6.5 million SOL

Lookonchain said in the past five days, Galaxy has scooped up 6.5 million SOL, worth approximately $1.55 billion.

On-chain data shows the firm is buying tens to hundreds of thousands of SOL tokens at a time in rapid succession, each costing millions of dollars.

It’s unclear if Galaxy’s SOL purchases are linked to its involvement with Forward Industries. Galaxy Digital did not immediately respond to a request for comment.

Forward Industries stock rallies

Shares of Forward Industries (FORD) rallied last week on its Solana pivot announcement, with its stock up 16% over the last five trading days to Friday.

The firm’s stock price is up 620% year-to-date after closing trading on Friday at $36.10, which has reversed a multi-year slide.

As of the June quarter, the firm reported its revenue had declined 50% from the same period last year, while its net profit margin was down 329% during the same period.

Solana adoption on the rise

On Sept. 3, Galaxy Digital became the first Nasdaq-listed firm to be tokenized on the Solana blockchain.

Meanwhile, Solana treasury company DeFi Development Corp stated that its Solana treasury hit the 2 million milestone after buying $117M worth of SOL in eight days.

Mert Mumtaz, co-founder and CEO of Helius, has said that Solana treasury companies have cumulatively raised $3-$4 billion with more to follow.

The total value locked on Solana hit a record high of $12 billion earlier this month, and is second only to Ethereum when measured by TVL locked across its DeFi projects.

Solana is up 17.3% in the past seven days and has gained nearly 30% in the past 30 days, according to CoinGecko.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Fed rate cuts in conflict, but Bitcoin's "fragile zone" keeps BTC below $100,000

The Federal Reserve cut interest rates by 25 basis points, but the market interpreted the move as hawkish. Bitcoin is constrained by a structurally fragile range, making it difficult for the price to break through $100,000. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

The Federal Reserve cut interest rates by 25 basis points with a 9-3 vote. Two members supported keeping rates unchanged, while one supported a 50 basis point cut. In addition, the Federal Reserve has restarted bond purchases and will buy $40 billion in Treasury bills within 30 days to maintain adequate reserve supply.

HyENA officially launched: Perp DEX supported by Ethena and based on USDe collateral goes live on Hyperliquid

The launch of HyENA further expands the USDe ecosystem and brings institutional-grade margin efficiency to the on-chain perpetuals market.