Solana DeFi TVL Hits $13,38 Billion as Users Surge

- Solana DeFi TVL Surpasses $13 Billion

- Solana Network Sees Increase in Transactions and Users

- SOL cryptocurrency accumulates an increase of almost 25% in the week

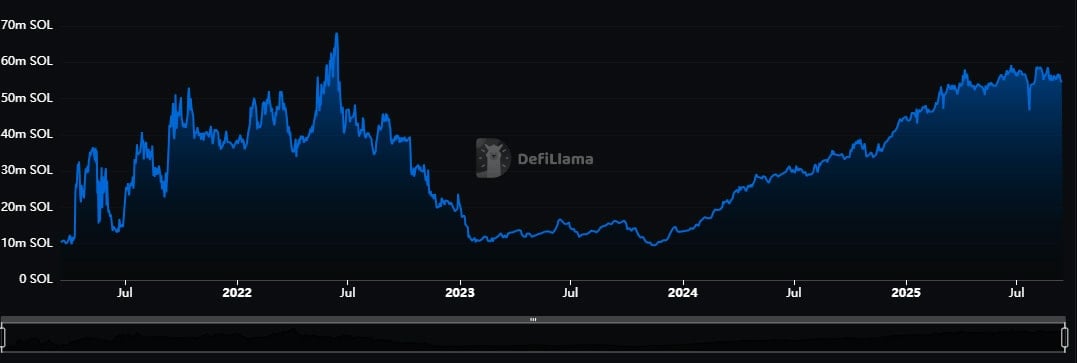

The Solana network has reached a significant new milestone in the decentralized finance (DeFi) sector, with its total value locked (TVL) surpassing $13,38 billion. This growth represents an 18% increase in the last week, according to data from DeFiLlama, reflecting the consistent increase in capital inflows into the Solana ecosystem's leading protocols.

This growth is primarily driven by increased user demand, accompanied by increased network activity. Data from Artemis indicates that the number of daily active addresses, which participated in at least one transaction involving SOL, increased 37% in seven days. At the same time, the daily transaction count increased 17%, demonstrating increased network utilization.

The recent performance of the SOL cryptocurrency reflects this positive movement in the ecosystem. The digital asset has accumulated a nearly 25% appreciation in the last seven days, solidifying its position among the market's highlights.

The expansion of DeFi's TVL, coupled with the growth of on-chain interactions, signals user and developer confidence in Solana's solutions. These factors tend to favor both protocol liquidity and the network's attractiveness to new projects.

The combination of a high locked value, a significant increase in the user base, and strong appreciation of the cryptocurrency reinforces the positive momentum of blockchain, which continues to gain ground among the main competitors in the cryptocurrency market.

SOL's recent performance has caught the attention of analysts, who are monitoring whether this momentum could lead the asset to retest its all-time highs. The current pace of ecosystem expansion is one of the key indicators investors monitor to gauge the network's potential appreciation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is the moat of public blockchains only 3 points? Alliance DAO founder's remarks spark heated debate in the crypto community

Instead of worrying about "moats," perhaps we should focus more on how cryptocurrencies can meet the real needs of more market users faster, at lower cost, and with greater convenience.

Digital Finance Game: Unveiling the US Cryptocurrency Strategy

Glassnode: Bitcoin weakly fluctuates, is major volatility coming?

If signs of seller exhaustion begin to appear, it is still possible in the short term for bitcoin to move towards the $95,000 level and the short-term holder cost basis.

Axe Compute (NASDAQ: AGPU) completes corporate restructuring (formerly POAI), enterprise-level decentralized GPU computing power Aethir officially enters the mainstream market

Predictive Oncology officially announced today that it has changed its name to Axe Compute and will trade on Nasdaq under the ticker symbol AGPU. This rebranding marks Axe Compute's transition into an enterprise-level operator, officially commercializing Aethir's decentralized GPU network to provide robust, enterprise-grade computing power services for AI companies worldwide.