Shibarium bridge exploit: Shiba Inu’s DeFi team offered a 5 ETH (≈$23,000) bounty to the attacker after a $2.4M bridge drain, urging the return of funds and beginning a coordinated forensic response with security firms to recover assets and restore network integrity.

-

5 ETH bounty offered to attacker to return stolen funds

-

The exploit drained ~ $2.4 million after validator keys were compromised via a flash-loan enabled takeover.

-

Shibarium paused stake functions, moved funds to a multisig hardware wallet; teams like Hexens, Seal 911 and PeckShield are investigating.

Shibarium bridge exploit: Shiba Inu offers 5 ETH bounty after $2.4M exploit — read mitigation steps and market impact. Claim bounty details and update timeline.

Shiba Inu’s DeFi team offers a $23,000 bounty to the Shibarium bridge attacker after a $2.4 million exploit, urging the return of stolen funds.

Shiba Inu’s decentralized finance platform on its Shibarium layer-2 network has offered a 5 Ether (≈$23,000) bounty to the attacker behind a recent bridge exploit, urging the return of stolen assets.

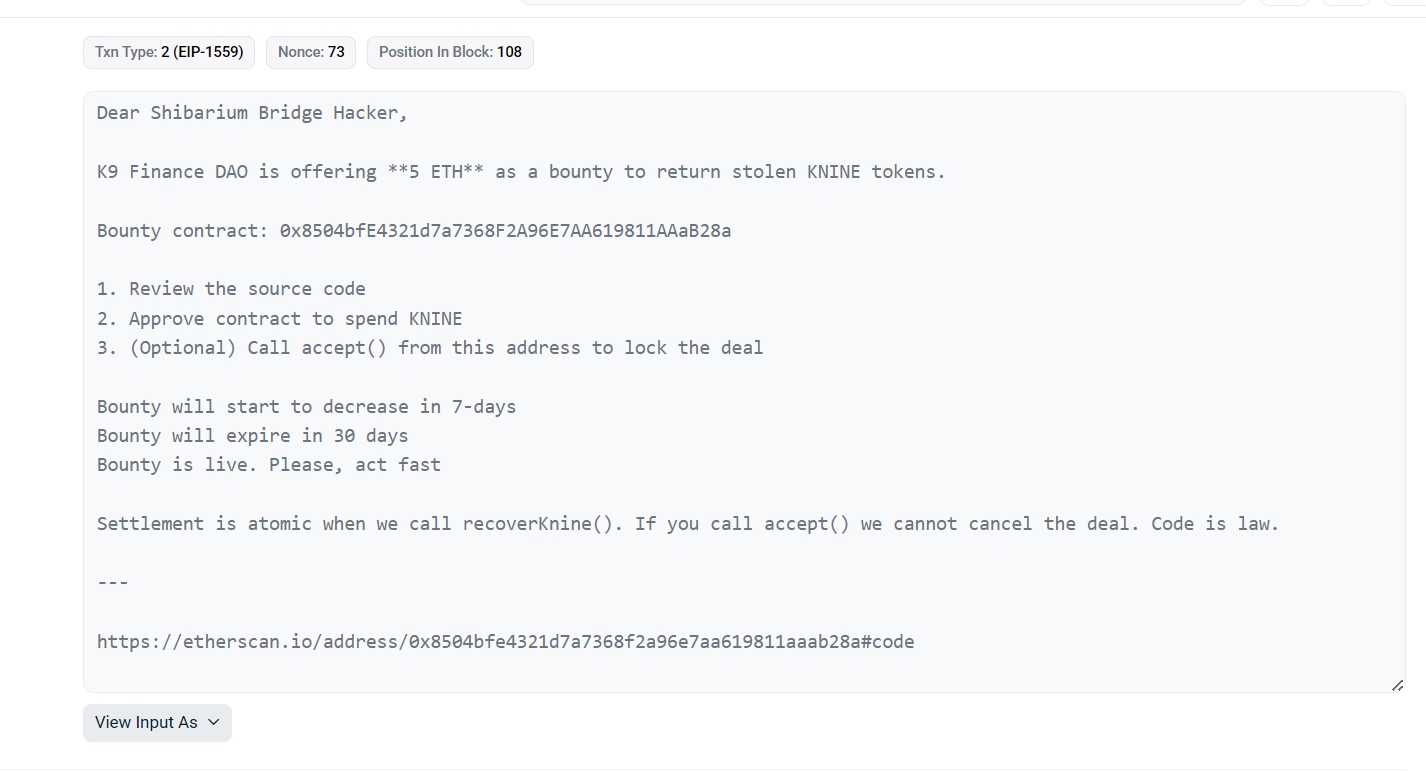

On Monday, the DeFi platform sent an onchain message to the attacker saying that the bounty offer will remain open for 30 days. The protocol added a deadline and a condition where the bounty amount will start to decrease in seven days.

“Settlement is atomic when we call recoverKnine(). If you call accept() we cannot cancel the deal. Code is law,” K9 Finance wrote. “Bounty is live. Please, act fast.”

In an X post on Saturday, Shiba Inu developer Kaal Dhairya said that while they have already contacted the authorities, the team is open to negotiating with the attacker.

K9 Finance’s message to the Shibarium attacker. Source: Etherscan

What happened in the Shibarium bridge exploit?

The Shibarium bridge exploit occurred when malicious actors gained access to validator signing keys and used a flash loan to buy 4.6 million BONE tokens, achieving majority validator power and executing a transaction that moved ≈$2.4 million out of the bridge. Shibarium bridge exploit is the core incident affecting validator security and cross-chain liquidity.

How did Shibarium respond and who’s investigating?

Shibarium developers paused stake and unstake functions and moved stake manager funds into a multisig-controlled hardware wallet. The team is working with security firms Hexens, Seal 911 and PeckShield and has contacted authorities while offering a time-limited bounty to encourage restitution.

Restoring network security and safeguarding user assets remain the team’s stated priorities. Public onchain messages and investigator updates from onchain analyst ZachXBT and transaction records on Etherscan are guiding the response.

Shiba Inu’s 24-hour price chart. Source: CoinGecko

Why did token prices fall after the exploit?

Market reaction was immediate: SHIB fell ~7% from $0.0000145 to $0.0000131, KNINE dropped ~10%, and BONE plunged about 38% from $0.31 to $0.19. Price declines reflect short-term sell pressure, liquidity disruption, and investor concern over validator key integrity.

What are the immediate mitigation and recovery steps?

Shibarium’s team implemented the following technical measures to limit further damage and begin recovery:

- Paused stake/unstake functions and critical bridge operations.

- Moved protocol-controlled funds into a multisig hardware wallet.

- Engaged forensic security firms and notified law enforcement.

- Offered a 5 ETH bounty to incentivize voluntary return of funds.

Frequently Asked Questions

How long is the bounty available to the attacker?

The bounty is available for 30 days from issuance, with the offer set to decrease after seven days. The protocol signaled the deal is atomic, meaning acceptance triggers the recovery flow.

Can users still access funds on Shibarium?

Users may face limited access: stake and unstake functions were paused to prevent further compromise. Protocol teams recommend monitoring official onchain notices and wallet security alerts.

Key Takeaways

- Bounty offered: 5 ETH (~$23,000) to incentivize return of stolen funds.

- Attack vector: Compromised validator keys + flash loan enabled majority signing power.

- Mitigation: Paused staking, moved funds to a multisig hardware wallet, engaged forensic teams.

Conclusion

The Shibarium bridge exploit underscores the critical need for validator key security and rapid incident response. COINOTAG will monitor forensic findings from Hexens, Seal 911, PeckShield and onchain investigators; users should follow official protocol updates and secure private keys. Expect coordinated recovery efforts and further updates as investigations progress.

Related: Dogecoin price rises despite latest delay of US DOGE ETF launch

Magazine: Can Robinhood or Kraken’s tokenized stocks ever be truly decentralized?