Here’s Why the US Economy Looks Solid Despite Soft Labor Market, According to Former National Economic Council Director

The former National Economic Council director says US companies’ focus on rewarding shareholders has come at the expense of the labor market.

In a new CNBC Television interview, Gary Cohn says firms have found ways over the last decade or so to be efficient while driving down the cost of human capital.

According to Cohn, the end result is a solid economy underpinned by productivity gains on reduced labor requirements.

“You just have to understand when you’re running a company, your obligation is to your shareholders to create a return on capital. You have to be able to pay back your debt. If the cost of your inputs goes up, and you can’t charge more for your finished product, you have to figure out how to become more efficient…

In Q2, revenue as a whole for companies went up just over 6%… Earnings, EPS, went up by 11.8%. Now, you could say there’s some efficiency. As you get bigger, you get more efficient. So the last dollar in is more efficient than the first dollar in. But companies found ways to make themselves more efficient. They sold more product with less cost, and that cost wasn’t the cost of goods. The cost was labor…

You see it in unemployment rates…

When you squeeze the tube in one place, it’s got to come out somewhere else. And I think what we’re seeing, and a lot of people are scratching their heads going, ‘I don’t understand this. The economy is good. Earnings are good. Retail sales are OK. But the job market’s weak.’

Well, the job market’s weak because to make the equation work, companies are getting smaller.”

Last week, JPMorgan Chase CEO Jamie Dimon warned that the US economy is showing weakness. Dimon said that revised data from the U.S Bureau of Labor Statistics (BLS) – which showed that job hirings were overstated by 911,000 between March 2024 and 2025 – suggested the US economy is weakening.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin rebounds on Japan rate hike as Arthur Hayes sees dollar at 200 yen

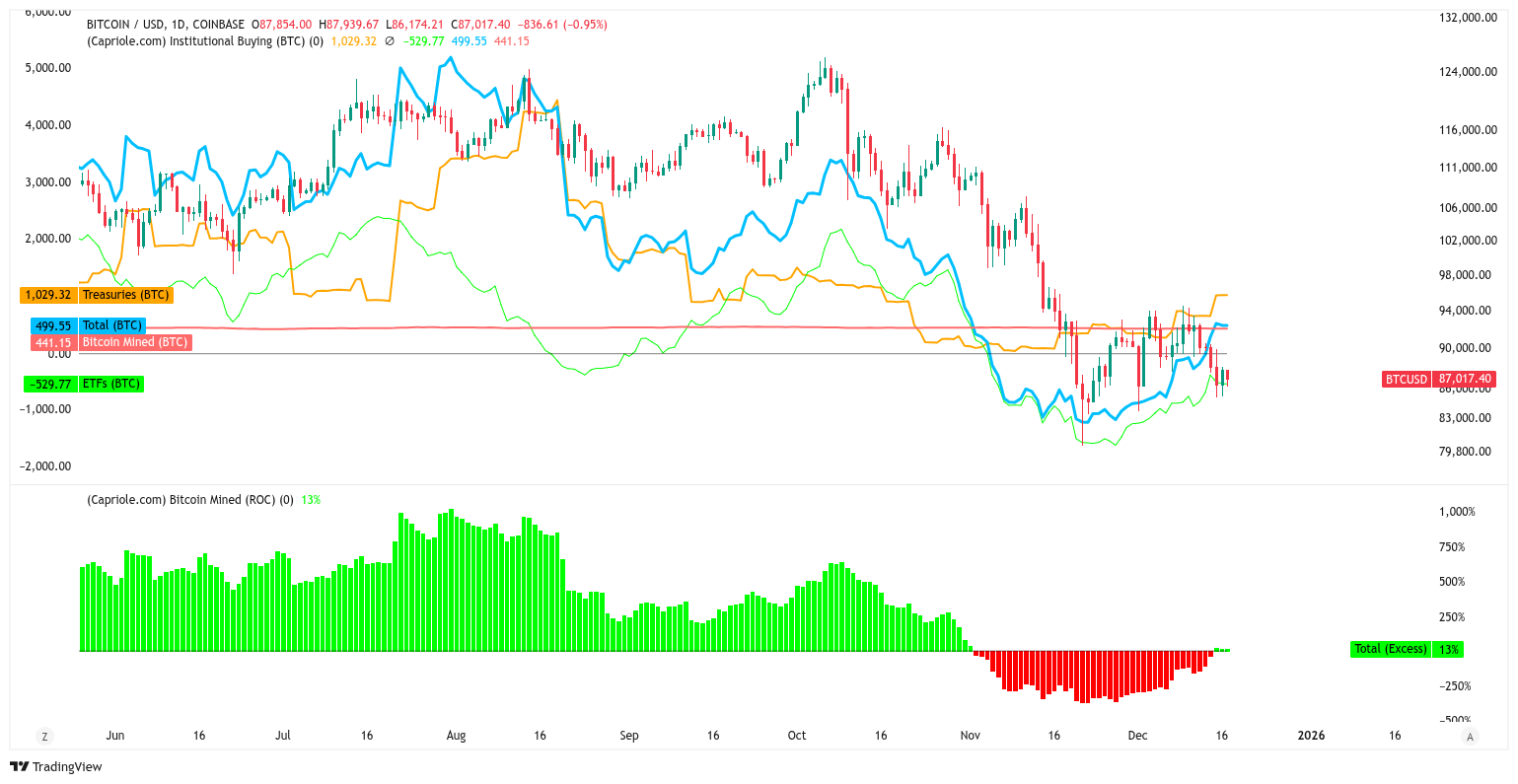

Bitcoin institutional buys flip new supply for the first time in 6 weeks

US Senate Confirms Michael Selig, Travis Hill to Lead CFTC and FDIC

Metaplanet ADR: A Strategic Gateway for US Investors to Access Bitcoin-Backed Assets