Bitcoin illiquid supply is the portion of BTC unlikely to trade publicly; Fidelity estimates this could top six million BTC by end‑2025 and reach about 8.3 million BTC (≈42% of circulating supply) by 2032, tightening available market supply and potentially supporting price appreciation.

-

Fidelity projects over 6 million BTC illiquid by end of 2025

-

Publicly traded treasury companies and seven‑year holders drive the trend; 105 public firms currently hold ~969,000 BTC (Bitbo data)

-

Combined holdings equal roughly $628 billion at an average price of $107,700, raising sell‑off risk if whales move to market

Meta description: Bitcoin illiquid supply projected to exceed 6M BTC by 2025, per Fidelity. Learn what this means for price, whales, and investors — read the report highlights.

Asset management firm Fidelity expects Bitcoin’s illiquid supply to exceed 6 million BTC by the end of 2025 amid sustained buying by Bitcoin treasury companies and growing long‑term holder balances.

Around 42% of Bitcoin’s current circulating supply — or roughly 8.3 million BTC — could be considered illiquid by Q2 2032 if present trends continue, Fidelity finds. The firm defines illiquid supply as cohorts whose balances have increased each quarter or at least 90% of the time over the past four years.

Fidelity identifies two primary cohorts as illiquid: long‑term holders (wallets inactive for seven+ years) and publicly traded companies holding at least 1,000 BTC. Both groups have generally increased or held steady in supply, tightening the volume available to regular market participants.

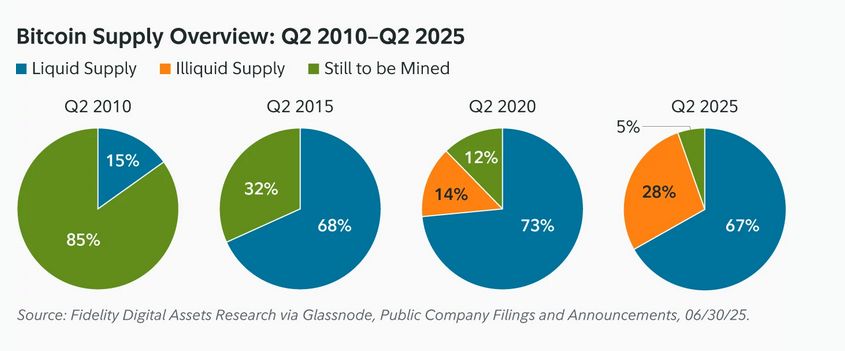

Bitcoin’s supply has changed drastically in the past 15 years. Source: Fidelity

What is Bitcoin’s illiquid supply?

Bitcoin illiquid supply is the share of outstanding BTC that is unlikely to be offered for sale on open markets due to long‑term holding behavior or corporate treasuries. Fidelity estimates this group will hold over six million BTC by end‑2025, reducing immediate market liquidity and potentially supporting price if demand persists.

How does Fidelity calculate the illiquid Bitcoin supply?

Fidelity uses on‑chain wallet behavior and corporate disclosures to identify cohorts whose balances have increased each quarter or at least 90% of the time over four years. The firm projects cohort trends forward using the past ten years’ growth rate for long‑term holders and observed corporate accumulation patterns for publicly traded firms.

Why does illiquid supply matter for Bitcoin prices?

Illiquid supply reduces the float available for trading, which can amplify price moves when demand rises. At the end of Q2 2025, Fidelity calculated combined holdings of the two cohorts equal to roughly $628 billion at an average BTC price of $107,700. Fewer BTC on the open market can mean sharper price responses to inflows or sell‑offs.

How big is the corporate BTC treasury cohort?

There are currently 105 publicly traded companies holding Bitcoin, and together they own more than 969,000 BTC — about 4.61% of total supply, per Bitbo data. This cohort has mostly maintained or increased holdings, with only one quarterly decrease noted in Q2 2022.

What are the risks if whales sell?

Large holders (whales and corporate treasuries) represent concentrated supply. In the past 30 days, whales have reportedly sold nearly $12.7 billion in BTC — the largest short‑term sell‑off since mid‑2022 — while the BTC price dipped roughly 2% in the same period, according to CoinGecko. A coordinated or sustained sell‑off from illiquid cohorts would press prices downward before liquidity providers can absorb the flow.

Frequently Asked Questions

How much of Bitcoin’s circulating supply could become illiquid by 2032?

Fidelity projects nearly 42% of the circulating supply — about 8.3 million BTC — could be illiquid by Q2 2032 if current accumulation trends among long‑term holders and corporate treasuries continue.

What would trigger a major price move despite high illiquid supply?

A sudden, concentrated sell‑off by large holders or increased exchange inflows would create supply pressure. With a smaller float, even modest selling can move prices sharply if buyer demand does not match the outflow.

Key Takeaways

- Illiquid supply is rising: Fidelity expects >6M BTC illiquid by end‑2025, tightening the available float.

- Corporate treasuries matter: 105 public companies hold ~969,000 BTC (Bitbo data), boosting institutional concentration.

- Price sensitivity increases: Large holdings equal ~$628B at recent average prices; whale sell‑offs could amplify volatility.

Conclusion

Fidelity’s analysis highlights a structural shift: a growing share of Bitcoin may become effectively off‑market as long‑term holders and public treasuries accumulate. This reduced float can support prices in the face of demand but also raises the stakes for market moves if large holders liquidate. Investors should monitor on‑chain flows, corporate disclosures, and market depth to assess risk and opportunity.