Crypto Majors Trade Sideways amid Geopolitical Tension

Major digital assets were flat or slightly up on Tuesday, Sept. 16, following geopolitical tensions, and just ahead of the Federal Reserve’s policy meeting on Wednesday.

Bitcoin (BTC) is trading at $115,287, after failing to break through $116,000 earlier today, but is up 3.2% over the past week. Ethereum (ETH) is trading around $4,450, showing similar dynamics to BTC on the daily and weekly timeframes.

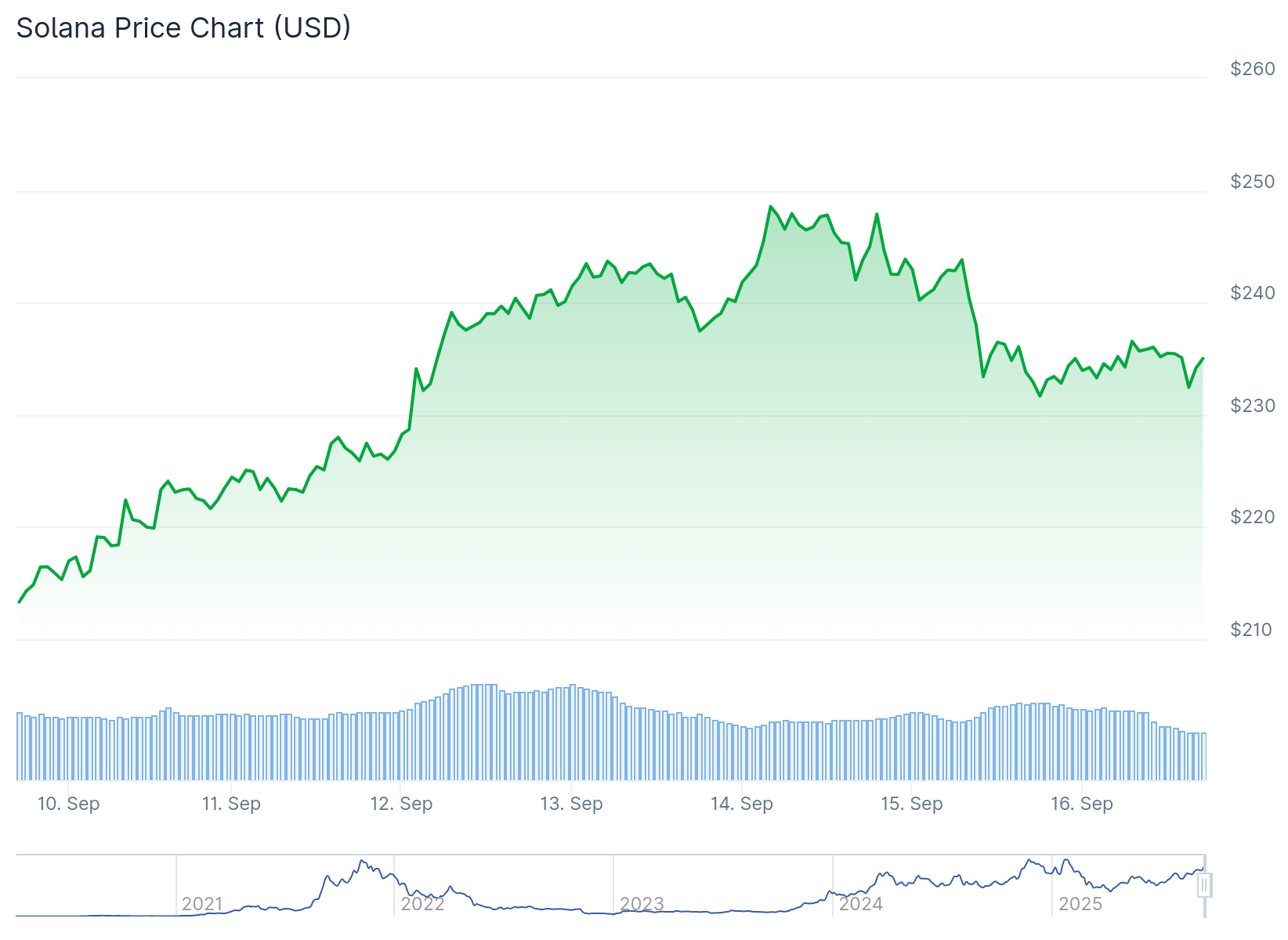

Among other large-cap crypto assets, most are flat or slightly up today, with XRP holding out just over $3, and Solana (SOL) still above $230, up just 1.5% today, but 9% over the past week.

Hyperliquid (HYPE), Sui (SUI), and Avalanche (AVAX) saw more notable gains between 3-5% over the past 24 hours. Hyperliquid validators recently chose Native Markets as the issuer for its native stablecoin, USDH, over established stablecoin issuers like Paxos and Ethena.

As The Defiant recently reported, AVAX’s rally is likely driven by institutional inflows, gaming adoption, and other activations across the ecosystem, including Ethena’s deployment on Avalanche this week.

The broader total cryptocurrency market capitalization remained flat over the past 24 hours at $4.1 trillion, with Bitcoin dominance at 56% and Ethereum at 13.1%, according to CoinGecko.

Liquidations and ETFs

Over the past 24 hours, nearly $205 million in crypto positions were liquidated, including $156 million in long positions and $48 million in shorts, per Coinglass. Ethereum led with over $67 million in liquidations, followed by assorted altcoin at $29 million, and BTC at $15 million.

On Monday, Sept. 15, investors continued to show strong demand for crypto ETFs, injecting $260 million in net inflows into spot Bitcoin ETFs, marking the sixth consecutive day of inflows, according to SoSoValue.

Spot Ethereum ETFs also recorded robust activity, attracting even more than BTC products, with nearly $360 million in net inflows, representing the fifth straight day of positive flows.

Geopolitical Tensions and Fed Meeting

Tuesday’s volatility is being driven partly by geopolitical uncertainty, experts said. On Monday, Sept. 15, President Donald Trump announced that U.S. forces had struck a second boat suspected of carrying drugs from Venezuela.

According to Trump, three people described as “narcoterrorists” were killed in the latest strike, after an earlier attack that killed 11. The Venezuelan government criticized the action, calling it a “heinous crime,” the New York Times reported.

The operation quickly raised tensions in Latin America, with both international and U.S. observers questioning whether the strike was justified.

“Unexpected geopolitical events raise uncertainty and act as short-term bearish volatility drivers,” Bitunix analysts said in comments shared with The Defiant. “However, unless the conflict escalates into a regional war, the impact is likely to remain liquidity-driven rather than fundamentally sustained.”

The market swings also come as investors brace for the Federal Reserve’s rate decision on Wednesday, Sept. 17, with the central bank widely expected to cut interest rates.

“The market currently expects the Fed to decide at least a 25bps rate cut in its FOMC meeting on September 16-17, as labor market risks increasingly overshadow inflation risks,” said Fabian Dori, head of investments at Sygnum Bank, in comments shared with The Defiant.

Dori explained that while a 25 bps cut is the clear expectation, the underlying dynamics are complex. “U.S. labor market figures have weakened, with rising unemployment and downward payroll revisions,” he said. “Yet significant data revisions, questions about measurement quality, and structural changes – including immigration shifts and tariff-induced reshoring – make interpretation difficult.”

He also noted that inflation remains sticky, “while the latest PMI readings suggest a re-acceleration in U.S. business activity.” In turn, he expects the Fed to move ahead with caution.

“It will be interesting to observe any deviation from this practice as the composition of the FOMC is about to change,” Dori concluded.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DOJ Exposes $7.8M Crypto Scam Tied To Bitcoin Rodney

Grayscale Signals Bitcoin Could Hit New Highs in 2026 Despite Recent Dip

Will the Bitcoin Cycle Survive American Monetary Policy?