Ethereum price stalled near $4.5K after a failed breakout at $4,763; fading perpetual demand and rising exchange inflows left ETH vulnerable to consolidation between $4.47K and $4.6K, despite positive funding rates indicating lingering bullish bias.

-

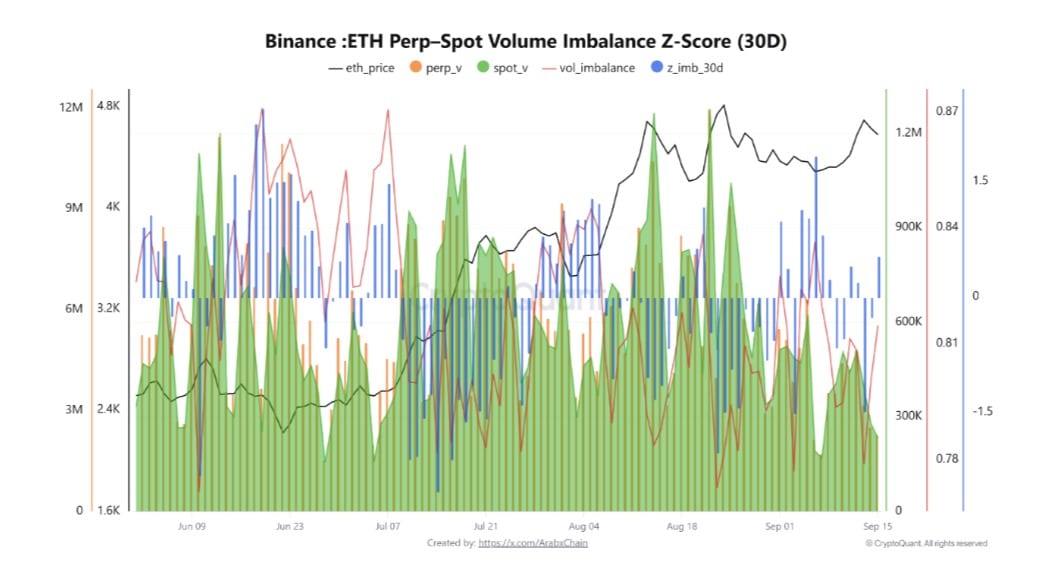

Perpetual demand weakened: imbalance between perps and spot volumes declined, signaling exits by leveraged traders.

-

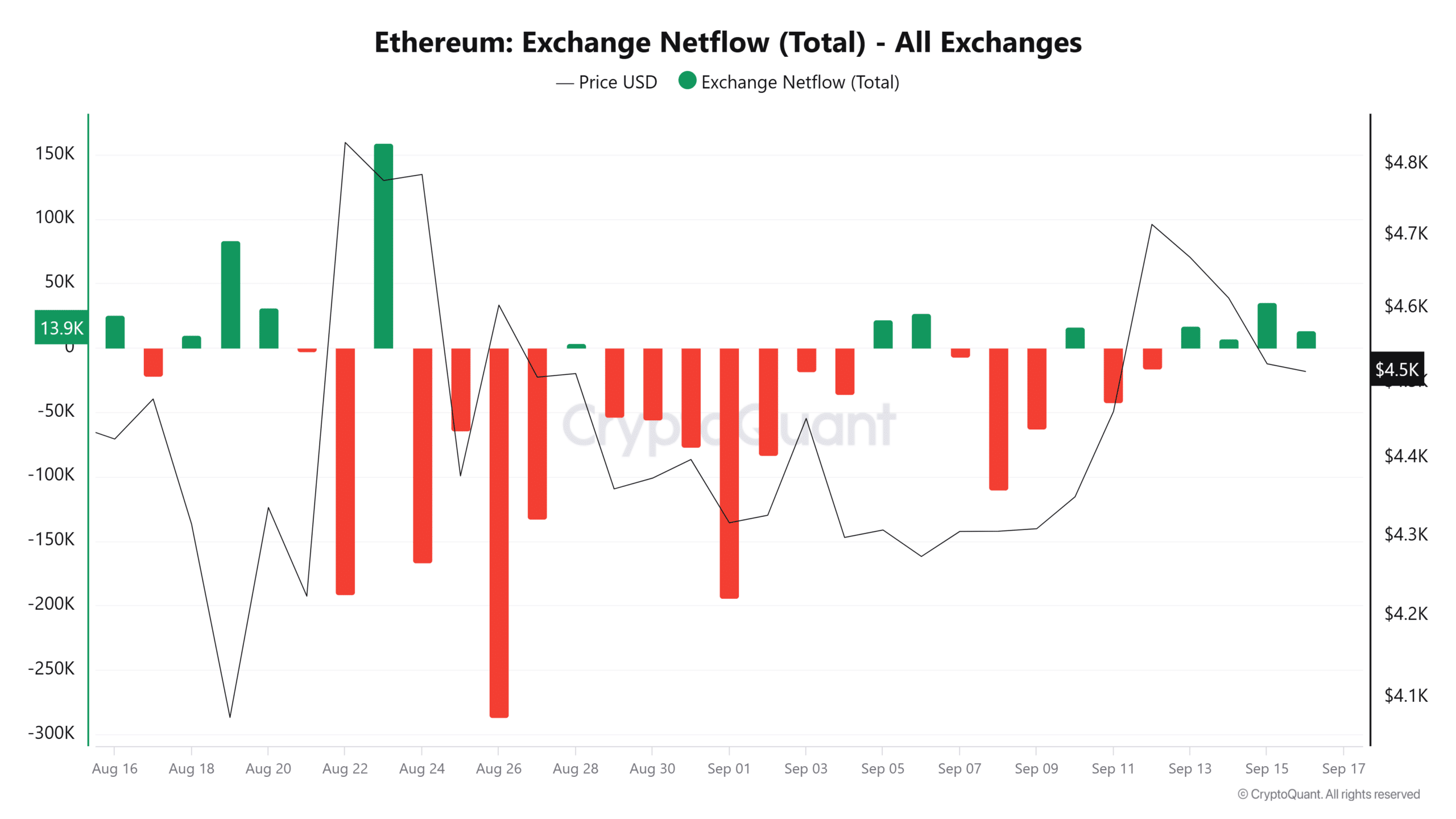

Spot selling rose: Exchange Netflow hit ~13.9K, indicating net inflows and spot-side pressure.

-

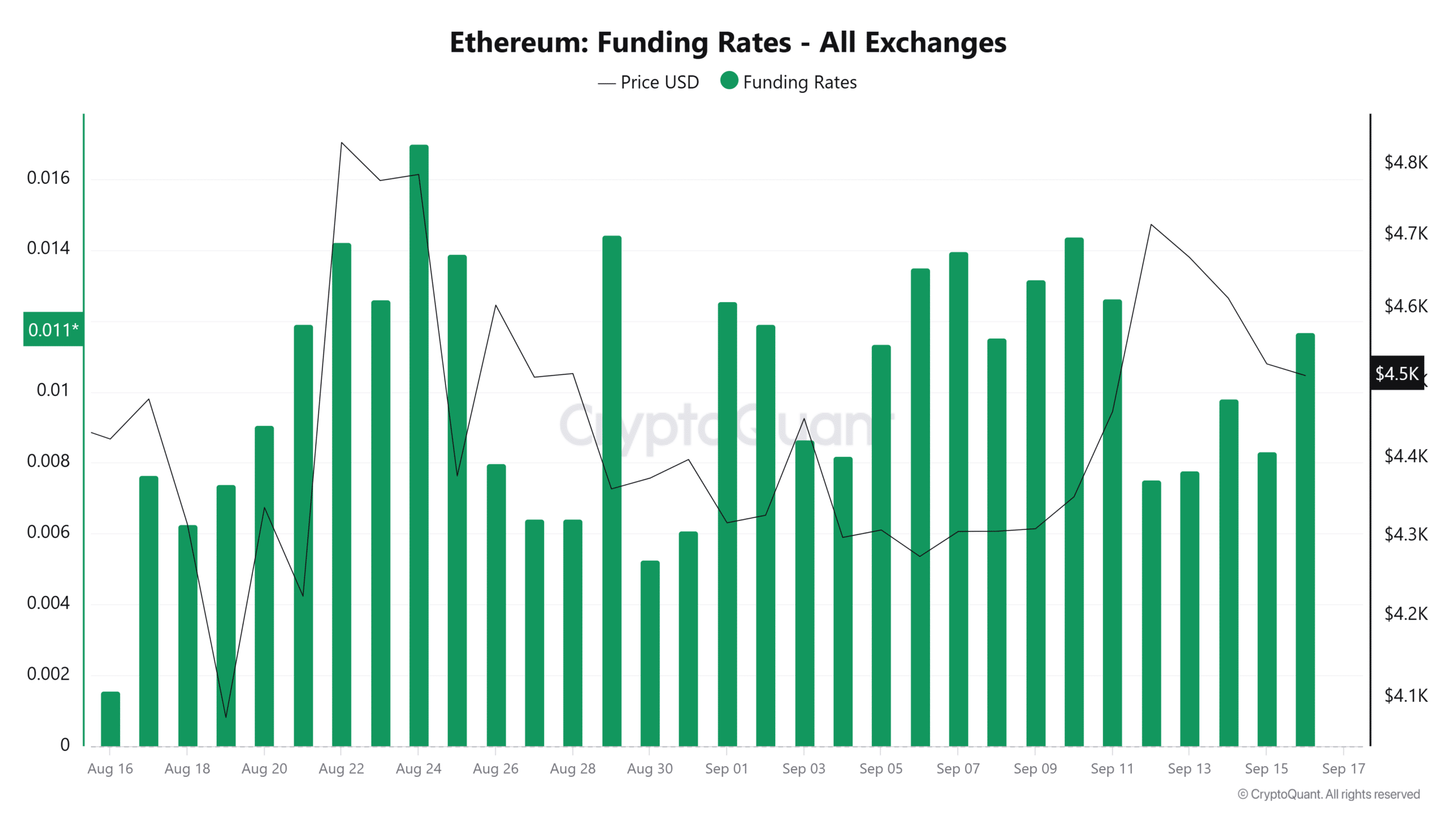

Funding remains positive: Funding Rate at ~0.011, but low spot volume suggests limited conviction.

Meta description: Ethereum price shows stalled breakout at $4.76K; fading perpetual demand and rising exchange inflows may cap ETH near $4.5K — read the latest market metrics.

Why did Ethereum’s price stall near $4.5k?

Ethereum price stalled after rejection at $4,763 as leverage appetite dropped and exchange inflows increased. Immediate balance-sheet metrics — weak perpetual dominance, spot volumes under 1M, and positive but fragile funding rates — point to short-term consolidation rather than a fresh uptrend.

How did perpetual and spot volumes shift recently?

Perpetual demand faded notably over the prior two weeks. CryptoQuant analyst Arab Chain reported the Z-Score oscillated between 0.0 and -1.0, indicating perps lost dominance. This shift implies many speculators reduced leverage exposure, lowering the probability of a sustained volatility-driven rally.

Source: CryptoQuant

What do funding rates and leverage metrics indicate?

Funding rates stayed positive for 30 days, peaking around 0.011 at press time. Positive funding shows remaining bullish bias, but the persistence of positive funding with falling perps volume suggests fewer new longs are being opened. That dynamic increases vulnerability to a long squeeze if selling accelerates.

Source: CryptoQuant

How are spot inflows affecting short-term price action?

Spot Volume remained muted in the 500k–1M band, well below summer highs. CryptoQuant data showed Exchange Netflow at approximately 13.9K, a clear sign of spot-side selling pressure over the recent four-day stretch. Higher inflows to exchanges typically correlate with increased selling and supply pressure on price.

Source: CryptoQuant

Summary metrics (recent)| Peak rejection level | $4,763 | Failed breakout |

| Current price (press time) | $4,499 | Down ~0.7% daily |

| Funding rate | ~0.011 | Buy-side bias but thin |

| Exchange Netflow | ~13.9K inflows | Spot selling pressure |

Stagnation or dip for ETH?

COINOTAG analysis and on-chain metrics together point to a likely consolidation phase. If leverage continues to shrink while spot inflows persist, ETH may remain confined between $4.47K and $4.6K in the near term.

For traders, the combination of low spot volume and positive funding rates implies caution: bullish bias exists but lacks depth, raising the odds of sideways movement or a sharp corrective move on renewed selling.

Frequently Asked Questions

Why did ETH drop to $4,469 on Sep 15, 2025?

ETH fell after a rejected breakout at $4,763 and reduced perpetual volume. Profit-taking and increased exchange inflows pushed the price down to $4,469 as leverage participants exited positions.

Is a long squeeze likely for Ethereum soon?

Possibility exists: funding rates are positive (~0.011) but market depth is thin. A sudden spike in selling could trigger a fast long squeeze due to fewer leveraged longs sustaining upward moves.

Key Takeaways

- Perpetual demand faded: Z-Score drifted toward negative readings, signaling less leverage dominance.

- Spot selling increased: Exchange Netflow ~13.9K shows net inflows and seller activity.

- Short-term range likely: ETH may consolidate between $4.47K–$4.6K absent stronger flows.

Conclusion

Front-loaded metrics show the Ethereum price is under pressure despite a still-positive funding rate. On-chain indicators from CryptoQuant and market reporting from CoinMarketCap and COINOTAG suggest limited buying conviction. Watch perpetual vs. spot flows and exchange netflows for the next directional clue; risk management is essential for near-term trades.

Published: 2025-09-15 | Updated: 2025-09-15 | Author: COINOTAG