Get Your Bitcoin and Ethereum via PayPal: P2P Payments Have Just Entered the Cryptocurrency Space

PayPal has launched peer-to-peer payments for Bitcoin and Ethereum, allowing users to send and receive cryptocurrencies directly through its platform more easily than before.

PayPal Introduces Bitcoin and Ethereum to Peer-to-Peer Payments

PayPal is further deepening its involvement in the cryptocurrency sector. The payments giant has confirmed that Bitcoin (BTC) and Ethereum (ETH) are now part of its peer-to-peer (P2P) payment system. This means that millions of users will soon be able to send and receive cryptocurrencies directly via PayPal and Venmo, with plans already in place to expand to global markets.

This upgrade demonstrates PayPal’s ambition to go beyond traditional finance, positioning itself as a global digital wallet that seamlessly connects fiat and cryptocurrencies.

Update Details

- Cryptocurrency Support: Bitcoin (BTC), Ethereum (ETH), and PayPal’s PYUSD stablecoin.

- Platforms: Available on PayPal and Venmo, and supports other compatible digital wallets.

- Launch: Initially launching in the United States, with subsequent expansion to countries such as the United Kingdom and Italy.

- Tax Clarity: Personal transfers between friends and family remain exempt from IRS 1099-K reporting, meaning gifts or reimbursements will not be considered taxable income.

Why This Matters for Cryptocurrency Adoption

PayPal’s move could accelerate the mass adoption of digital assets:

- Mainstream Access: Millions of users can instantly access cryptocurrencies without external exchanges or wallets.

- Payment Convenience: Cryptocurrencies can now be sent as easily as fiat, reducing transfer friction.

- Merchant Potential: Combined with PayPal’s “Pay with Crypto” feature, merchants can accept payments in BTC, ETH, or PYUSD, reducing fees and delays.

- Network Effect: Everyday use of cryptocurrencies for payments strengthens the role of Bitcoin and Ethereum in global finance.

Impact on Bitcoin, Ethereum, and PYUSD

Bitcoin will gain new momentum as a borderless asset transfer, while Ethereum reinforces its image as a mainstream financial platform. PayPal’s PYUSD stablecoin will also benefit, positioning itself as the default stablecoin within the PayPal ecosystem.

This development may put competitive pressure on other fintech companies and even traditional banks, prompting them to integrate cryptocurrencies more rapidly.

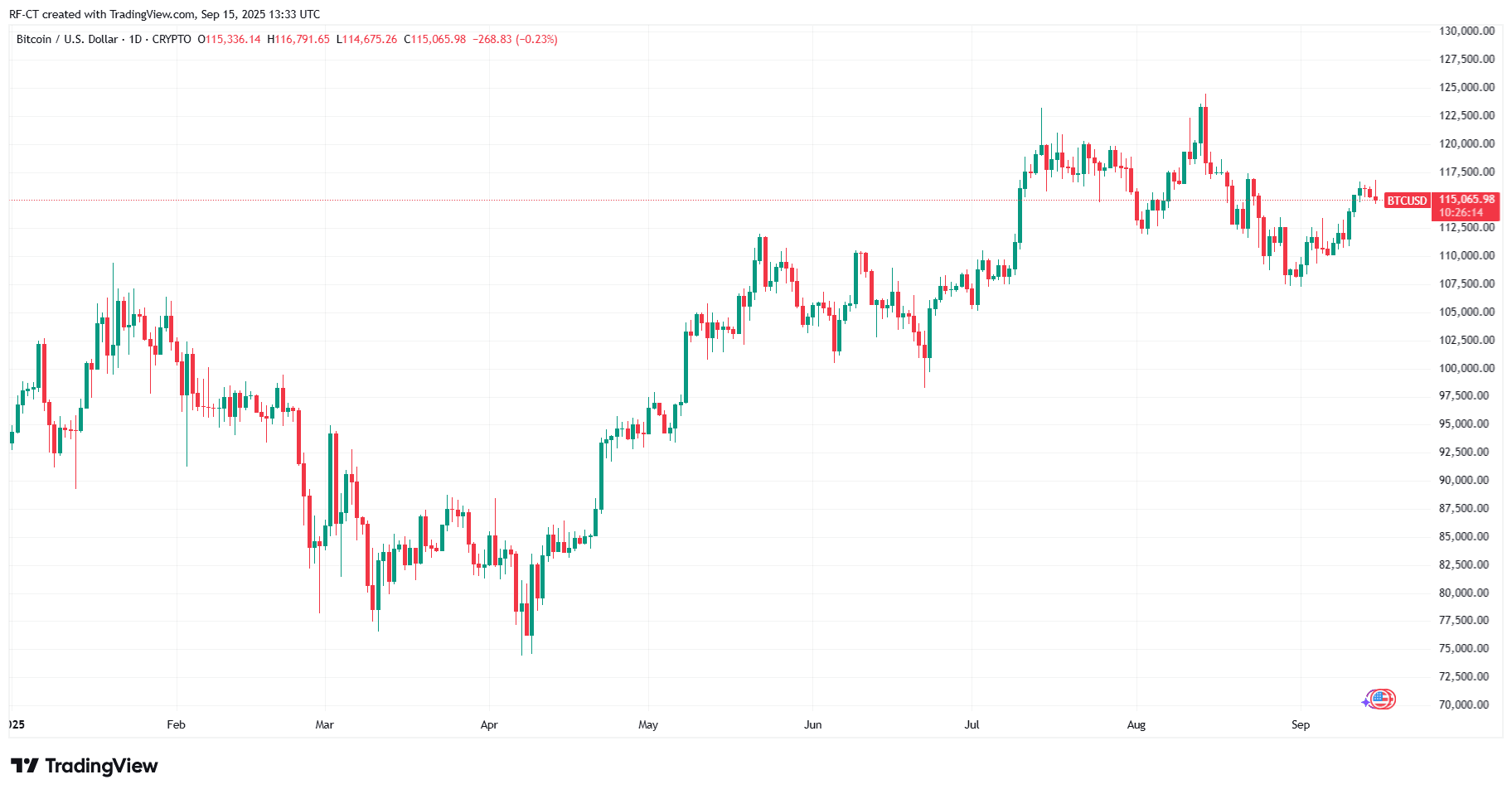

By TradingView - BTCUSD_2025-09-15 (YTD)

By TradingView - BTCUSD_2025-09-15 (YTD) Outlook

Integrating Bitcoin and Ethereum into PayPal’s P2P payments is more than just another update—it is a milestone in global cryptocurrency adoption. By bringing digital assets into everyday money transfers, PayPal is solidifying its role as a bridge between the old financial system and the new era of blockchain-powered payments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

As economic cracks deepen, bitcoin may become the next liquidity "release valve"

The US economy is showing a divided state, with financial markets booming while the real economy is declining. The manufacturing PMI continues to contract, yet the stock market is rising due to concentrated profits in technology and financial companies, resulting in balance sheet inflation. Monetary policy struggles to benefit the real economy, and fiscal policy faces difficulties. The market structure leads to low capital efficiency, widening the gap between rich and poor and increasing social discontent. Cryptocurrency is seen as a relief valve, offering open financial opportunities. The economic cycle oscillates between policy adjustments and market reactions, lacking substantial recovery. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

The wave of cryptocurrency liquidations continues! US Bitcoin ETF sees second highest single-day outflow in history

Due to the reassessment of Federal Reserve rate cut expectations and the fading rebound of the U.S. stock market, the crypto market continues to experience liquidations, with significant ETF capital outflows and options traders increasing bets on volatility. Institutions warn that technical support for bitcoin above $90,000 is weak.

When traditional financial markets fail, will the crypto industry become a "pressure relief valve" for liquidity?

As long as the system continues to recycle debt into asset bubbles, we will not see a true recovery—only a slow stagnation masked by rising nominal figures.

A Quiet End to 2025 Could Prime Crypto for a 2026 Breakout, Analysts Say