Bitget Daily Digest(September 17)|Fed may announce 25 basis point rate cut at FOMC meeting; ZKsync to unlock 173 million tokens today; US and UK to deepen cooperation on crypto regulation

Today's Preview

1. The US Federal Reserve FOMC will announce its interest rate decision and economic outlook at 02:00, September 18, 2025(UTC+8). The market is paying close attention to policy trends.

2. ZKsync (ZK) will unlock approximately 173 million tokens (worth about $10.7 million) at 16:00, September 17, 2025(UTC+8).

3. The US Department of Labor will release initial jobless claims for the week ending September 13 at 20:30, September 18, 2025(UTC+8), which may impact market risk appetite.

Macro & Hot Topics

1. The Federal Reserve will hold its rate-setting meeting this week, and the market generally expects a 25 basis point rate cut to be announced on September 17. Crypto-friendly official Stephen Miran has officially joined the Fed’s Board of Governors and will participate in this vote.

2. Malta opposes further centralization of EU crypto regulatory powers under ESMA, stressing the need to maintain regulatory convergence while avoiding excessive concentration of authority.

3. Japanese fashion retail chain Mac House will begin purchasing Bitcoin as a company reserve via regular investments starting September 17, with an initial investment of approximately $11 million.

Market Updates

1. BTC and ETH have shown narrow-range volatility over the past 4 hours. Market sentiment remains neutral. The total liquidation amount surged significantly in the past 24 hours, with most liquidations on short positions.

2. Influenced by hawkish Fed comments, the three major US stock indices closed lower last night: Dow Jones down 0.27%, Nasdaq down 0.07%, and S&P 500 down 0.13%, reflecting cautious market sentiment.

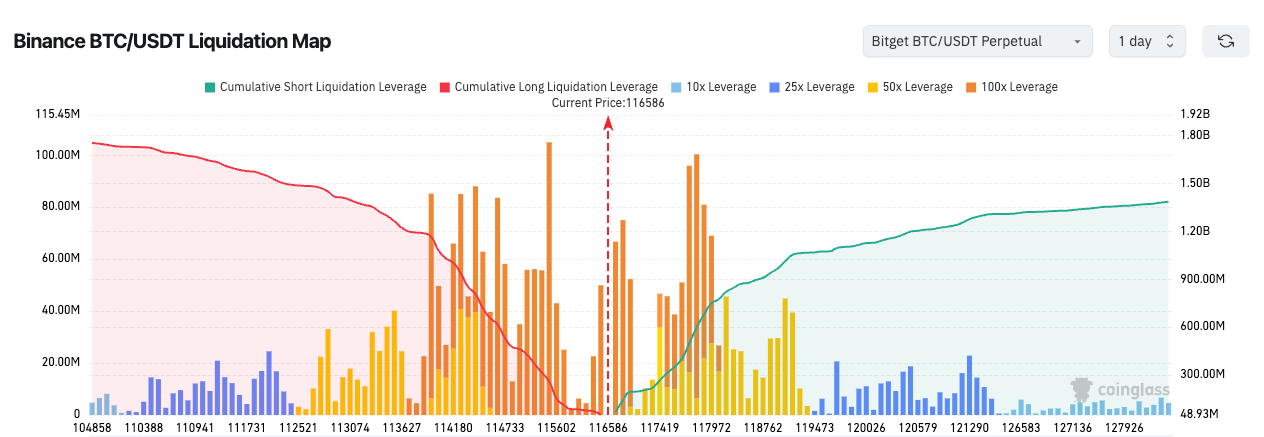

3. According to Bitget’s liquidation map, BTC is currently priced at 116,617 USDT. Both long and short liquidations are highly concentrated in the 115,000-117,000 range, indicating heightened risk of sharp volatility.

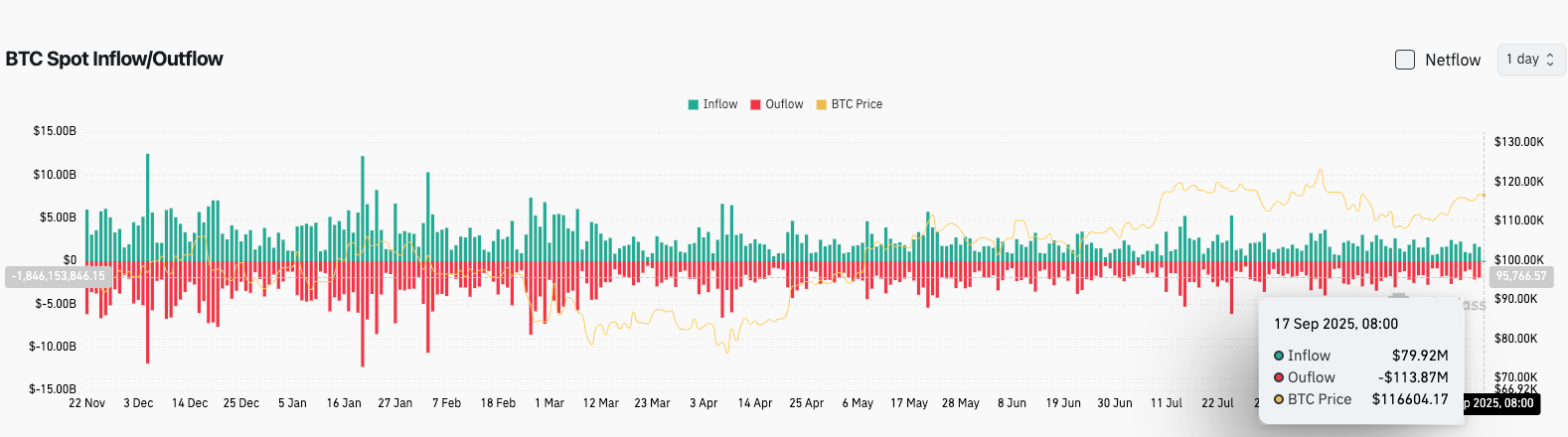

4. In the past 24 hours, BTC spot inflows totaled $79 million, outflows $112 million, for a net outflow of $33 million.

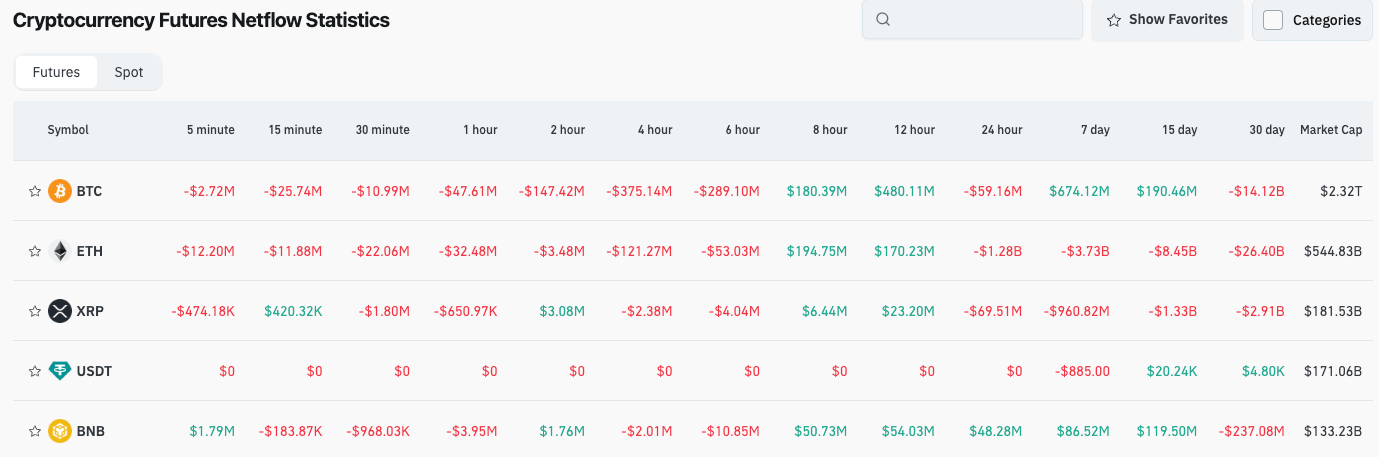

5. Over the past 24 hours, contract trading for BTC, ETH, XRP, USDT, BNB, and other major tokens saw leading net outflows, potentially signaling trading opportunities.

News Updates

1. The US and UK will deepen regulatory cooperation on cryptocurrencies, with plans to establish a “cross-border sandbox”.

2. France warns it may block other EU-licensed crypto companies from operating in France as a response to MiCA’s “passporting” risk.

3. The US SEC and Gemini have reached a preliminary settlement regarding the lawsuit over the “Earn” lending product.

Project Developments

1. REX-Osprey: XRP and Dogecoin ETFs have received approval from the US SEC and will be officially listed this week.

2. Openbank: Launches crypto trading services in Germany, supporting BTC, ETH, LTC, MATIC, ADA, and more.

3. COTI: Mainnet V2 will be upgraded on September 17, introducing new protocol improvements.

4. Zircuit: Announces a $495,000 developer grant program to support Web3 ecosystem growth.

5. Hyperion DeFi: Partners with Credo Cayman; Credo will adopt HYPE tokens to reduce transaction fees.

6. WConnect: Teams up with Mantle Network to launch the “WConnect|Mantle Season” series of events.

7. Aster: Hosts its Token Generation Event (TGE) on September 17, unlocking 704 million ASTER tokens for airdrop.

8. Circle: Announces investment in the Hyperliquid ecosystem, launching native USDC to drive DeFi application expansion.

9. Swiss banks UBS, PostFinance, and Sygnum have successfully completed an interbank deposit token payment test on Ethereum.

Disclaimer: This report was generated by AI and human-verified for accuracy. It is not intended as investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Espresso co-founder’s decade in crypto: I wanted to disrupt Wall Street’s flaws, but witnessed a transformation into a casino instead

Everything you've been hoping for may have already arrived; it just looks different from what you expected.

Solana Foundation Steps In as Kamino and Jupiter Lend Dispute Intensifies

Bitcoin Firms Confront the Boomerang Effect of Excessive Leverage

Ethereum Burns $18B, Yet Its Supply Keeps Growing