Kalshi exec submits Hyperliquid improvement proposal to solve prediction market deployment challenges

Four authors submitted Hyperliquid Improvement Proposal 4 (HIP-4) introducing “Event Perpetuals” to enable prediction markets on the platform’s order book infrastructure.

The proposal lists Kalshi’s head of crypto, John Wang, among its four co-authors. The text addresses limitations in Hyperliquid’s existing HIP-3 builder-deployed perpetuals for prediction market use cases.

The current infrastructure requires continuous oracle updates and limits price changes to 1% per tick, making binary event resolution impractical.

Event Perpetuals’ goal is to eliminate continuous oracle feeds and funding payments, with prices determined entirely by trading activity. The contracts settle with binary payoffs reflecting market-implied probabilities between 0 and 1, resolving instantly to either outcome upon event conclusion.

The proposal demonstrates current limitations through NFL betting scenarios, where sportsbook odds update as step functions during games.

Under HIP-3 constraints, settling a market from neutral (0.5) to zero probability would require 50 minutes due to tick limitations, creating arbitrage opportunities for informed traders.

The attached oracle settling chart illustrates the asymmetric resolution problem, showing rapid settlement toward 1.0 but gradual decay toward 0, highlighting infrastructure challenges that motivated the new proposal.

Auction mechanism for fair price discovery

Event Perpetuals launch through single-price clearing auctions lasting approximately 15 minutes.

The system evaluates all candidate prices to maximize matched volume, with tie-breaking favoring minimal imbalance and prices closest to 50%.

The clearing mechanism diagram shows bid and ask distributions across price levels, with the system calculating optimal clearing prices that balance supply and demand.

Orders execute uniformly at the determined opening price before continuous trading begins.

Builders deploy markets by staking 1 million HYPE tokens and can charge up to 50% additional fees above base rates.

The infrastructure supports market recycling, allowing new events to replace resolved markets within existing slots.

Event Perpetuals operate with 1x isolated margin only, requiring buyers to deposit collateral equal to their maximum potential loss.

The proposal concludes that trading occurs within price bands of 0.001 to 0.999, with resolution oracles posting final values during specified challenge windows for dispute resolution.

The post Kalshi exec submits Hyperliquid improvement proposal to solve prediction market deployment challenges appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

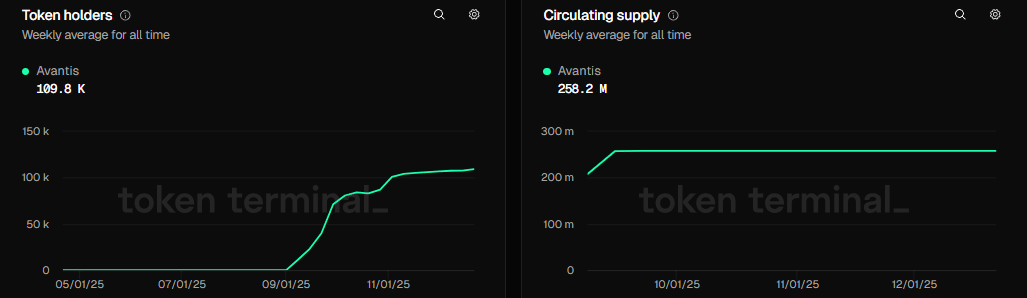

Avantis – Assessing key drivers of AVNT’s 62% weekly rally

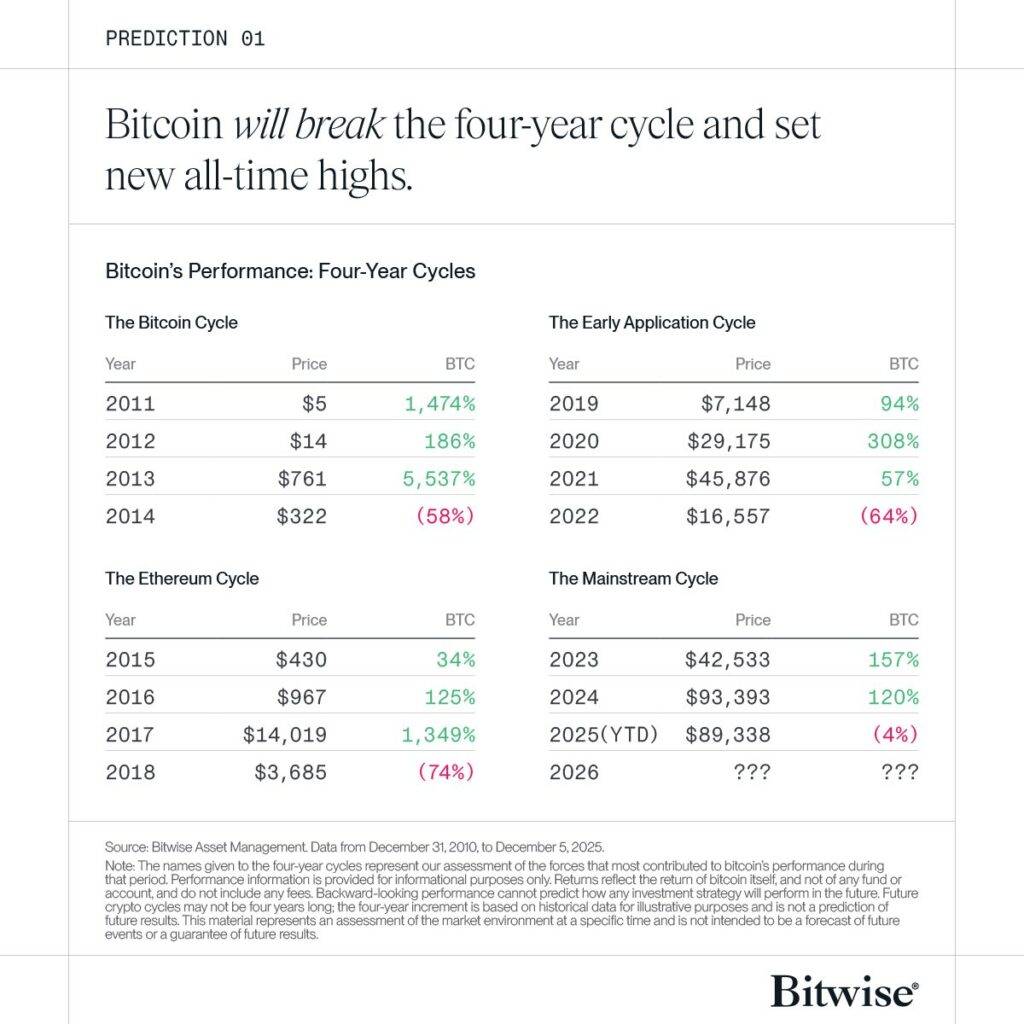

Bitcoin – Is it a case of ‘pain today, gains tomorrow’ for BTC’s price?

Are XRP and Cardano Losing Relevance? Mike Novogratz Explains Key Indicators as Crypto Investors Move Beyond Hype, Seek Real Utility

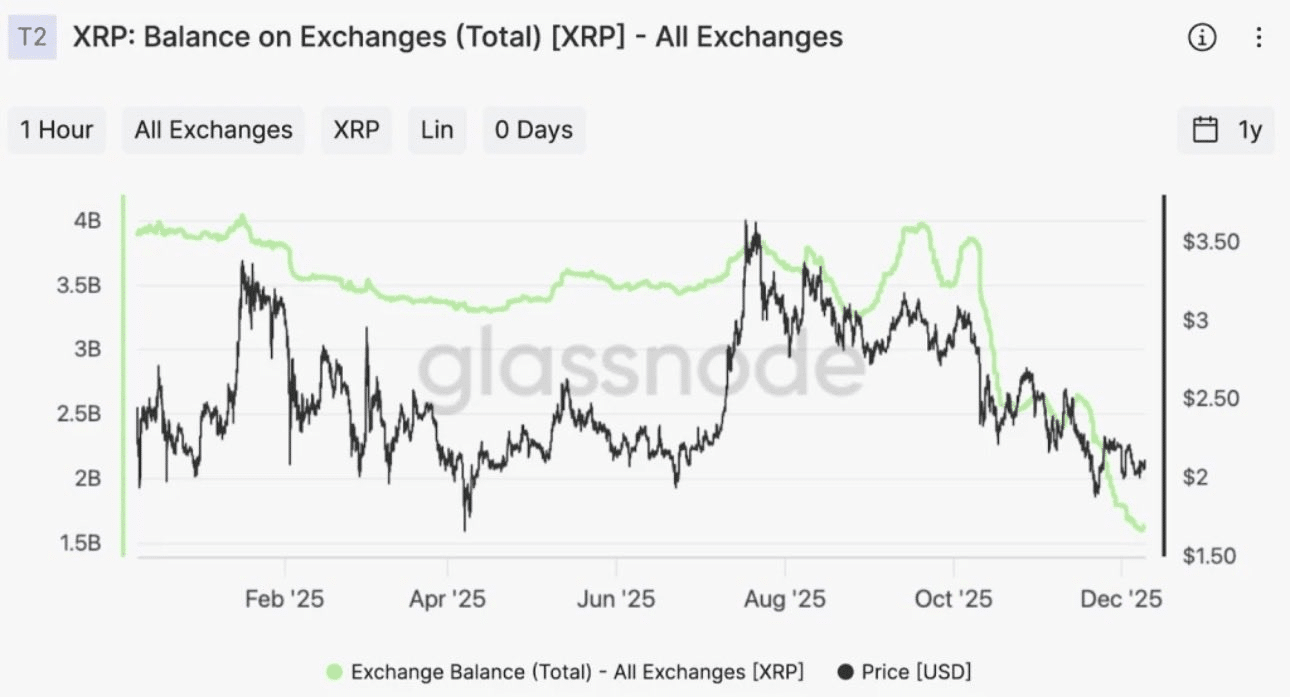

Reasons why XRP is poised to lead 2026 DESPITE drop below $2